Why Las Vegas Drivers Pay So Much for Car Insurance (And What They Can Do About It)

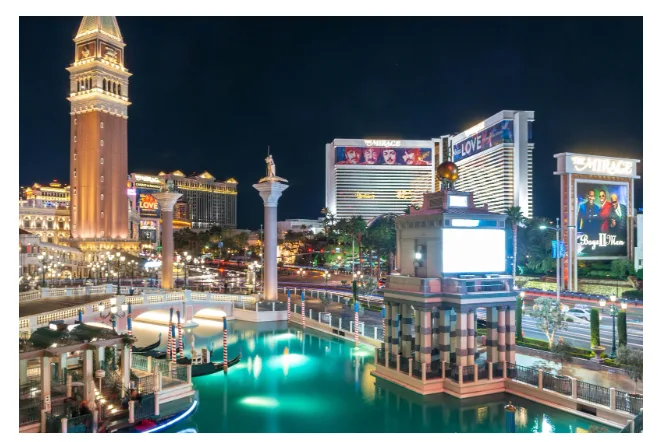

Las Vegas has some of the worst traffic in the country. Anyone who’s tried to get from Henderson to the Strip on a Friday night knows this. The city keeps growing, but the roads haven’t kept up. More people means more cars, which means more accidents.

Insurance companies notice these things. They track accident rates by zip code, count how many claims come from different areas, and set prices accordingly. Vegas drivers often get sticker shock when they see their premiums compared to what friends in smaller cities pay.

The desert doesn’t help either. Summer temperatures regularly hit 115 degrees. Car batteries die faster. Paint gets damaged. Air conditioning systems work overtime and break down more often. All of this shows up in insurance claims data.

Nevada’s Insurance Rules

The state requires everyone to carry liability insurance. The minimums are $25,000 for injuries to one person, $50,000 for accidents involving multiple people, and $20,000 for property damage. Nevada also requires uninsured motorist coverage at the same levels.

These amounts might sound like plenty until someone gets hurt badly or crashes into an expensive car. Emergency room visits for serious injuries can cost $100,000 or more. Luxury vehicles can have $50,000 in damage from what looks like a minor accident.

Still, these minimums keep people legal and provide basic protection. Many drivers start here and increase coverage later when they can afford it.

Where Insurance Costs Come From

Location plays a huge role in what people pay. Living near the Strip means dealing with tourists who don’t know the roads. They stop suddenly, change lanes without warning, and generally drive like they’re lost – because they usually are.

Downtown areas see lots of pedestrian accidents. People walk between casinos after drinking, often not paying attention to traffic. Insurance companies charge more for comprehensive coverage in areas with higher crime rates because stolen cars and vandalism cost money.

Parking matters too. Cars parked in garages get stolen less and suffer less weather damage than those left on the street. Even having a carport can reduce rates compared to parking completely in the open.

Some neighborhoods flood during monsoon season. Insurance companies know which areas get hit worst and price comprehensive coverage accordingly.

How Insurance Companies Set Prices

Every company uses different methods to calculate risk. Age, driving record, credit score, and type of car all factor into the equation. But companies weight these factors differently, which is why quotes can vary so much.

Some companies care more about credit scores. Others focus heavily on driving records. A few give bigger breaks for safety features or anti-theft devices. This is why getting multiple quotes matters so much.

Companies also consider how long someone has been with their current insurer. Loyalty sometimes pays off with accident forgiveness or other benefits that new customers don’t get right away.

Discounts That Actually Exist

Safe driving discounts require clean records for several years, but the savings can be worth hundreds annually. Multi-car discounts help families with multiple vehicles. Multi-policy discounts for combining auto and home insurance often provide the biggest savings.

Many insurers give breaks for cars with backup cameras, automatic emergency braking, or advanced airbag systems. Anti-theft devices can reduce comprehensive coverage costs.

Good student discounts apply to high school and college students maintaining decent grades. Some companies extend these discounts to recent graduates for a few years.

Professional discounts exist for teachers, engineers, doctors, and other occupations. Military personnel often qualify for special rates. Alumni associations sometimes negotiate group discounts with specific insurers.

Defensive driving courses can reduce premiums even for drivers without tickets. Many courses are available online and take just a few hours to complete.

Annual payments eliminate monthly processing fees. Automatic payments usually qualify for small discounts that add up over time.

What Cheap Really Means

Look, finding cheap insurance isn’t just about finding the lowest number. If you go with the rock-bottom policy and then get in a serious accident, you could end up completely screwed financially.

Don’t just look at what you pay each month. Check out the deductibles – are you gonna have to cough up $2,000 before insurance kicks in? What about coverage limits – will they actually cover enough if you total someone’s Tesla? And read what’s actually covered because some policies have more holes than Swiss cheese.

Watch out for the bait-and-switch companies. They’ll hook you with some amazing intro rate, then jack up your premium when it’s time to renew. Other companies might cost more upfront but won’t surprise you with huge increases later if you keep your record clean.

And for the love of God, read the fine print. I know it’s boring, but you need to know how they handle claims, whether you can use any repair shop or just their preferred ones, and what weird stuff they won’t cover. All that matters way more when you actually need to use the insurance than when you’re just paying the bill.

The Deductible Game

Higher deductibles dramatically reduce monthly premiums. Going from a $250 deductible to $1,000 can cut comprehensive and collision costs by 30% or more.

The trick is choosing amounts that won’t cause financial problems if claims occur. Having enough emergency savings to cover deductibles comfortably allows for higher amounts that reduce monthly costs.

Some insurers offer deductible rewards programs. Stay claim-free for a year and the deductible drops $100. Keep going and it might disappear entirely.

Real-World Shopping Tips

Start shopping at least a month before current coverage expires. Rushed decisions often lead to settling for higher prices or inadequate coverage.

Get quotes for the same coverage levels from each company. Comparing different coverage amounts makes it impossible to determine which company actually offers better value.

Ask about claim handling procedures. Some companies make filing claims easy while others require extensive paperwork and multiple phone calls.

Check financial ratings from independent agencies. A company might offer great rates but struggle to pay claims if they get into financial trouble.

Local agents often know which companies handle Nevada claims well and which ones cause headaches for customers.

Making Coverage Decisions

Comprehensive coverage makes sense for newer cars or vehicles with loans. Older cars worth less than $3,000 might not justify comprehensive premiums, especially with high deductibles.

Collision coverage works similarly. If a car is worth $5,000 and collision coverage costs $800 annually with a $1,000 deductible, the maximum payout is only $4,000. Sometimes self-insuring makes more financial sense.

Gap coverage protects people with car loans from owing more than insurance pays if vehicles get totaled. This coverage is usually cheap but can save thousands.

Rental car coverage helps when accidents leave people without transportation. For families with only one car, this coverage prevents expensive daily rental costs while repairs happen.

Getting Help

The Nevada Division of Insurance publishes complaint ratios for all companies operating in the state. These reports show which insurers generate lots of customer complaints and which ones handle claims fairly.

Sometimes consumer groups put out insurance guides just for Nevada drivers. These aren’t flashy marketing materials – they actually call out which companies treat Las Vegas customers right and which ones you should avoid.

Your local library or community college probably has financial literacy classes that cover insurance basics. Yeah, it sounds boring, but you’ll learn stuff that can save you real money instead of just guessing what coverage you need.

Check if your job offers group insurance plans – sometimes you can get better rates through work than on your own. Credit unions are also worth asking because they sometimes cut deals with insurers for their members.

Whether you just need the bare minimum to stay legal or want full protection, understanding how car insurance Las Vegas helps you not get ripped off.

Bottom line: do your homework before you buy anything. Don’t just look at the monthly payment – compare what you’re actually getting for that money. Ask about every discount they offer because they won’t bring it up otherwise. Learn what different types of coverage actually do so you’re not buying stuff you don’t need or skipping stuff that could save your ass later. Work with agents or companies that actually know Nevada’s auto insurance laws and what it’s like driving in this city.

Yeah, insurance shopping is a pain and takes time. But Vegas drivers who actually research their options instead of just going with the first quote often end up paying hundreds less than they thought they’d have to. There are deals out there if you’re willing to dig for them instead of just settling for whatever.