Pressure Sensors Drive Industrial Automation Across Global Markets

Manufacturing facilities worldwide are integrating advanced pressure monitoring systems to optimize operations and prevent costly equipment failures. These electronic devices, once limited to basic pressure measurement, now serve as critical components in modern industrial automation strategies.

According to recent research from the Institute of Electrical and Electronics Engineers, the technology has expanded beyond traditional applications. Pharmaceutical companies use real-time pressure monitoring in clean rooms, while oil refineries deploy sensors to prevent equipment failures that historically cost millions in downtime.

The transformation reflects broader digitization trends across manufacturing sectors. Companies report significant cost savings through predictive maintenance programs enabled by continuous pressure monitoring. A tire manufacturer recently documented energy savings exceeding two million dollars annually after addressing pressure-related inefficiencies in their curing process.

Digital Systems Replace Manual Monitoring

Traditional pressure measurement relied on mechanical gauges requiring visual inspection and manual data recording. Workers followed predetermined routes, checking instruments and logging readings by hand. This approach provided periodic snapshots but missed continuous changes that reveal developing equipment problems.

Modern digital sensors monitor pressure constantly and transmit data wirelessly to control systems. The technology uses MEMS chips—silicon-based components similar to those in smartphones—that measure pressure with greater accuracy than mechanical gauges while consuming minimal power.

Installation costs have decreased substantially as wireless sensors eliminate control cable requirements. A chemical processing facility in Louisiana completed comprehensive monitoring system installation over a weekend, compared to weeks required for traditional hardwired approaches.

Automotive Applications Accelerate Technology Adoption

The automotive industry has become the primary driver of pressure sensor advancement. Modern vehicles contain dozens of sensors monitoring tire pressure, engine oil, brake fluid, and transmission systems. Electric vehicles require additional sensors for battery thermal management and power management systems.

According to National Highway Traffic Safety Administration reports, safety regulations mandate tire pressure monitoring in new vehicles across Europe, North America, and Asia. Automakers anticipate additional regulatory requirements as governments emphasize vehicle safety and emissions reduction.

Electric Vehicle Systems Create New Requirements

Battery thermal management presents unique challenges for electric vehicle manufacturers. Lithium-ion batteries generate heat during charging and discharging cycles. Pressure sensors monitor coolant flow throughout battery packs, detecting circulation problems before temperatures reach dangerous levels.

Autonomous vehicle development has created demand for environmental pressure sensors that provide altitude determination and weather assessment data. These applications require sensors operating reliably across temperature ranges from freezing to extreme heat conditions.

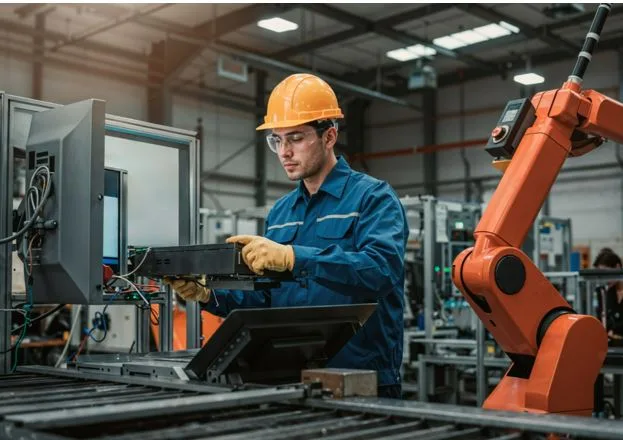

Smart Manufacturing Transforms Production Operations

Factory automation initiatives have increased demand for comprehensive pressure monitoring systems. Production managers require real-time data from hydraulic systems, pneumatic equipment, and process vessels to optimize operations while preventing equipment failures.

A steel manufacturing facility in Pennsylvania uses machine learning algorithms to analyze pressure sensor data. Their system recognizes pressure patterns indicating when rolling mill bearings require replacement, enabling maintenance teams to schedule bearing changes during planned downtime.

Pressure sensors from leading manufacturers now include self-diagnostic capabilities that monitor device performance and alert maintenance teams when calibration drifts or communication problems occur.

Predictive Maintenance Programs Show Results

Companies discover that pressure sensor data reveals equipment problems weeks before failures occur. Hydraulic systems exhibit characteristic pressure patterns as seals wear and pumps lose efficiency. Monitoring these trends allows maintenance teams to order replacement parts and schedule repairs during convenient periods.

Wireless sensor networks eliminate installation barriers that previously limited monitoring coverage. Mesh networking enables sensors to communicate through each other, providing reliable data transmission in challenging industrial environments.

Healthcare Applications Demand Precision

Medical devices represent demanding applications for pressure sensor technology. Hospital equipment must operate continuously while meeting regulatory requirements for patient safety and measurement accuracy.

According to World Health Organization medical device guidelines, the pandemic accelerated portable monitoring device development. Battery-powered units allow healthcare providers to monitor patients outside traditional clinical settings while maintaining medical-grade accuracy.

Respiratory care has been transformed through advanced pressure monitoring. Modern ventilators use multiple sensors to monitor patient breathing patterns and adjust support automatically. Operating rooms employ pressure sensors in applications ranging from patient monitoring to surgical tool control.

Consumer Electronics Expand Market Reach

Smartphone manufacturers integrate barometric pressure sensors to improve location services and weather applications. These sensors help devices determine altitude changes and provide accurate navigation in urban environments where GPS signals may be blocked.

Fitness tracking has created demand for miniaturized pressure sensors in wearable devices. These applications measure stair climbing, estimate energy expenditure, and track elevation changes during outdoor activities while consuming minimal battery power.

Smart home automation systems use pressure sensors to optimize heating and cooling performance, detect security breaches through atmospheric pressure changes, and monitor appliance operation for energy efficiency improvements.

Environmental Applications Support Sustainability Goals

According to Environmental Protection Agency industrial guidelines, climate concerns drive new applications for pressure sensor technology in environmental monitoring and energy management. Renewable energy installations use sensor networks to optimize performance and ensure reliable operation.

Wind turbine systems rely on pressure sensors to monitor blade aerodynamics, gearbox lubrication, and tower structural integrity. Smart buildings use pressure sensor networks to optimize heating and cooling systems based on occupancy patterns, weather conditions, and energy costs.

Global Market Development Reflects Regional Strengths

Regional differences in industrial development create distinct market patterns for pressure sensor technology. Asian manufacturers have achieved cost leadership in high-volume applications while European companies focus on specialized industrial and automotive applications.

Government policies increasingly support sensor technology development through research funding and industrial incentives. Smart city initiatives across Europe and Asia create new applications for sensor networks in urban infrastructure and transportation systems.

The technology continues evolving as artificial intelligence integration enables sensors to make local decisions and recognize patterns without relying on centralized computer systems. These developments suggest continued market expansion as industries adopt more sophisticated monitoring and control solutions.