Navigating New York’s Commercial Real Estate Market: What Buyers Should Know

Two years ago, I was seconds away from walking out of the most profitable commercial real estate deal of my career. The property was a 6,000-square-foot former textile warehouse in the Garment District, listed at $3.8 million. Every broker, advisor, and fellow investor I consulted told me the same thing: “You’re crazy. The Garment District is dead. Manufacturing is never coming back. You’ll never find tenants.”

The numbers seemed to support their pessimism. The building had been vacant for eight months, the previous tenant had defaulted on their lease, and comparable properties in the area were trading at significantly lower prices. My own financial analysis showed that at $630 per square foot, I’d need to achieve rents of $55-60 per square foot just to break even – well above the area average of $45.

But something didn’t add up. While everyone was lamenting the death of traditional garment manufacturing, I was seeing something different happening in the neighborhood. Small-batch fashion designers, sustainable clothing startups, and direct-to-consumer brands were quietly moving into the area, drawn by the authentic industrial character and relatively affordable rents compared to SoHo or the Meatpacking District.

More importantly, I noticed that the building had characteristics that most people who invest in New York commercial real estate were overlooking: 16-foot ceilings, heavy power infrastructure, freight elevator access, and flexible floor plates that could accommodate both manufacturing and showroom space. These weren’t liabilities in a declining market – they were exactly what modern fashion and design companies needed.

Why NYC Commercial Real Estate Isn’t What Most People Think

The conventional narrative about New York commercial real estate focuses on sky-high prices, impossible competition, and barriers that make investing impractical for anyone without eight-figure budgets. While there’s truth to the pricing challenges, this narrative misses the fundamental opportunities that still exist for investors who understand how the market really works.

The pricing perception is often based on trophy properties in prime locations that dominate media coverage. Yes, Class A office space in Midtown Manhattan trades for $80-120 per square foot, and retail space on Fifth Avenue can exceed $500 per square foot. But these represent less than 15% of the city’s commercial real estate transactions. The majority of deals happen in secondary locations, emerging neighborhoods, and specialty property types that receive little attention but offer substantial opportunities.

Market efficiency is less than most people assume because NYC’s commercial real estate market is actually dozens of distinct sub-markets with different dynamics, tenant bases, and pricing patterns. A retail space in Williamsburg operates in a completely different market than office space in Long Island City, even though they’re only a few subway stops apart. This fragmentation creates pricing inefficiencies that informed investors can exploit.

The institutional capital dominance is real in certain sectors but leaves gaps in others. Large investment funds focus on properties above $10 million because smaller deals don’t justify their transaction costs and management overhead. This creates opportunities in the $2-8 million range where individual investors and smaller funds can compete effectively without bidding against institutional buyers.

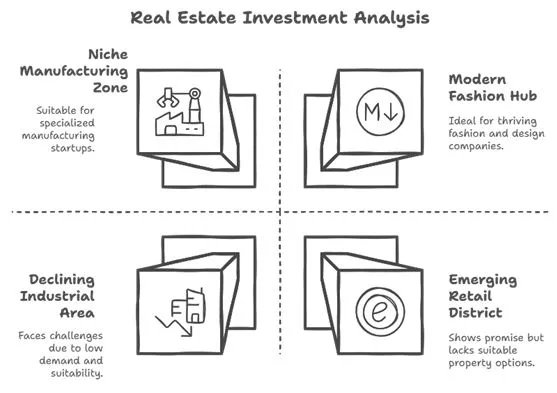

Neighborhood Analysis: Where the Real Opportunities Exist

Success in NYC commercial real estate requires understanding neighborhood evolution patterns and identifying areas positioned for growth before they become obvious to mainstream investors.

Long Island City: The Overlooked Manhattan Alternative

Long Island City has become one of NYC’s most undervalued commercial real estate markets, offering Manhattan-quality space at 40-60% discounts to comparable properties across the river. The neighborhood benefits from excellent transportation infrastructure, modern building stock, and zoning that supports diverse commercial uses.

The technology sector expansion in LIC is creating unprecedented demand for office space from companies seeking alternatives to expensive Manhattan locations. Major tenants like JetBlue, Citigroup, and various tech startups have established significant presences, driving up rental rates and property values. Office rents have increased from $25-35 per square foot in 2019 to $40-55 per square foot today, with further growth projected as Manhattan becomes increasingly expensive.

Manufacturing and logistics properties in LIC serve businesses that need proximity to Manhattan but require more space and lower costs than Manhattan can provide. The neighborhood’s industrial zoning allows uses that aren’t permitted in most other areas close to Manhattan, creating competitive advantages for certain types of businesses.

Sunset Park, Brooklyn: The Industrial Renaissance

Sunset Park has emerged as Brooklyn’s premier industrial and logistics hub, driven by its proximity to Manhattan, excellent transportation access, and large inventory of adaptable industrial buildings. The neighborhood serves businesses that need urban locations but require more space and lower costs than Manhattan provides.

Food and beverage companies have discovered Sunset Park as an ideal location for production facilities that serve the NYC market. The area’s industrial zoning permits food manufacturing, while transportation access allows efficient distribution throughout the metropolitan area. Specialty food companies, craft breweries, and artisanal manufacturers are paying premium rents for properly configured space.

Logistics and fulfillment operations are transforming Sunset Park’s commercial real estate landscape as e-commerce companies need last-mile distribution facilities. Properties with truck access, appropriate ceiling heights, and highway proximity command significant rent premiums over older industrial space that can’t accommodate modern logistics operations.

The Financial District: The Unexpected Residential Conversion Opportunity

Lower Manhattan’s Financial District is experiencing a residential conversion boom that’s creating opportunities for investors who understand the regulatory environment and market dynamics driving this transformation.

Office-to-residential conversions have become economically viable due to changed market conditions and updated city regulations. Many older office buildings struggle to compete for modern corporate tenants but can be profitably converted to residential use. The key is identifying buildings with appropriate floor plates, natural light, and structural characteristics that support residential conversion.

Mixed-use development opportunities exist because Financial District zoning allows combinations of residential, office, and retail uses that can maximize property values. Buildings that combine ground-floor retail, office space, and residential units often achieve higher total returns than single-use properties.

Understanding NYC’s Complex Regulatory Environment

NYC’s regulatory environment for commercial real estate is among the most complex in the country, but understanding the rules provides competitive advantages over investors who try to navigate without proper expertise.

Zoning Analysis and Opportunities

NYC’s zoning code contains over 3,000 pages of regulations that determine what can be built where, how large buildings can be, and what uses are permitted. Understanding these regulations helps identify properties with development potential that isn’t reflected in current pricing.

Air rights transfers can add substantial value to properties in certain areas. Buildings that haven’t used their full development rights can sell those rights to nearby properties, creating income streams that many investors don’t recognize. This is particularly valuable in areas experiencing rezoning or increased development activity.

Mixed-use opportunities exist in many neighborhoods where zoning permits combinations of residential, commercial, and light industrial uses. Properties that can accommodate multiple use types often command premium values and provide more diverse income streams than single-use buildings.

Environmental and Building Code Compliance

Environmental due diligence in NYC requires understanding both federal regulations and city-specific requirements. Many older buildings contain asbestos, lead paint, or other hazardous materials that require remediation before renovation or conversion. However, environmental issues often create acquisition opportunities because sellers discount properties to account for remediation costs.

Building code compliance for older properties often requires upgrades that can be expensive but also add value through improved functionality and tenant appeal. Understanding which upgrades are required versus optional helps budget accurately and identify properties where modest investments can generate substantial returns.

Tax Assessment and Appeals

NYC property tax assessments are often based on outdated valuations that don’t reflect current market conditions or property improvements. Understanding the assessment process and appeal procedures can reduce carrying costs significantly while improving investment returns.

Commercial properties are assessed using income capitalization methods that can be challenged based on comparable sales, income analysis, or expense documentation. Successful appeals often reduce tax obligations by 20-40%, providing ongoing savings that improve property cash flow.

Financial Analysis That Actually Works in NYC

NYC commercial real estate requires financial analysis that accounts for the market’s unique characteristics, cost structures, and revenue opportunities.

Revenue Optimization Strategies

Rent escalation clauses in NYC leases often include both fixed increases and percentage rent based on tenant sales. Understanding how to structure these clauses maximizes revenue growth while maintaining tenant attraction. Properties with well-structured escalation clauses can achieve rent growth of 3-5% annually even in stable markets.

Additional revenue streams beyond base rent can substantially improve property performance. Parking fees, storage rentals, rooftop access, signage rights, and telecommunications equipment can add 10-25% to base rental income with minimal additional investment..

Cost Management and Operational Efficiency

Operating expense analysis must account for NYC’s high costs while identifying opportunities for efficiency improvements. Utilities, insurance, property taxes, and maintenance costs are all higher than national averages, but properties with efficient systems and professional management can achieve below-market operating expense ratios.

Property management optimization can improve net operating income by 15-30% through better tenant relations, expense control, and revenue maximization. Professional management becomes particularly valuable for properties with multiple tenants or specialized use requirements.

Capital improvement planning helps maintain competitive positioning while controlling costs. Understanding which improvements provide the highest returns on investment versus which are necessary for basic competitiveness helps prioritize capital allocation.

Financing Strategies for NYC Markets

Construction and permanent financing in NYC requires understanding lender preferences, market conditions, and regulatory requirements that affect loan terms and availability. Local and regional banks often provide more flexible terms for smaller properties than national lenders focused on larger deals.

Mezzanine financing and joint venture structures can provide additional capital for acquisitions or improvements while maintaining operational control. These strategies are particularly useful for properties requiring significant capital investment or for investors seeking to leverage their expertise with outside capital.

Deal Sourcing in the World’s Most Competitive Market

Finding attractive commercial real estate opportunities in NYC requires systematic approaches that go beyond traditional listing services and broker relationships.

Off-Market Opportunity Development

Building relationships with property owners, particularly smaller owners who might sell without formal marketing processes, provides access to opportunities before they reach broader markets. Many NYC property owners prefer private sales to avoid auction-style bidding and maintain confidentiality.

Distressed property identification requires understanding which owners might be motivated to sell due to financial pressures, estate issues, or changing investment objectives. These situations often provide acquisition opportunities at below-market pricing for investors who can close quickly and handle complex situations.

Partnership and Joint Venture Strategies

Local operator partnerships allow outside investors to access NYC opportunities while leveraging local expertise and relationships. Many successful NYC investments involve partnerships between capital providers and local operators who understand market conditions and regulatory requirements.

Property-specific joint ventures can make larger deals accessible to individual investors while spreading risk across multiple participants. These structures work particularly well for properties requiring significant capital investment or specialized expertise.

Technology and Data-Driven Sourcing

Market analysis tools can identify emerging opportunities before they become obvious to broader markets. Tracking permit applications, zoning changes, transportation improvements, and demographic shifts helps predict neighborhood evolution and property value changes.

Automated opportunity screening can process large amounts of property data to identify deals meeting specific investment criteria. This is particularly valuable in NYC where the volume of potential opportunities makes manual screening impractical.

Building Long-Term Success in NYC Commercial Real Estate

The Garment District warehouse deal I described demonstrates that NYC commercial real estate success comes from understanding neighborhood evolution, recognizing property potential that others miss, and having the conviction to act when analysis contradicts conventional wisdom.

The key principles that drive long-term success include:

Market Timing and Cycle Understanding: NYC’s commercial real estate market moves in cycles that don’t always align with national patterns. Understanding local market timing helps identify optimal acquisition and disposition opportunities while avoiding periods of overvaluation or illiquidity.

Neighborhood Evolution Patterns: The most profitable investments often involve properties in neighborhoods experiencing economic or demographic transitions. Understanding how these changes affect different property types and tenant categories helps identify opportunities before they become obvious to mainstream investors.

Regulatory Navigation: NYC’s complex regulatory environment creates barriers that limit competition while providing opportunities for investors who understand how to navigate approval processes, zoning requirements, and compliance obligations effectively.

Value Creation Through Operations: Unlike markets where appreciation drives most returns, NYC commercial real estate often requires active value creation through improved operations, tenant retention, and property positioning. The most successful investors treat their properties as operating businesses rather than passive investments.

The $3.8 million Garment District property generated exceptional returns because we recognized that neighborhood evolution was creating demand for exactly the type of space that building provided, while other investors were focused on the area’s declining traditional uses.

For investors ready to move beyond surface-level analysis and develop the expertise necessary for NYC commercial real estate success, the opportunities remain substantial. The market rewards those who understand its complexities and have the patience to identify properties and neighborhoods positioned for long-term growth.

Success requires viewing NYC not as a single overwhelming market, but as a collection of distinct neighborhoods and property types, each with its own opportunities and challenges. The investors who master this complexity and develop genuine local expertise can build exceptional wealth while contributing to the city’s continued evolution and growth.

The question isn’t whether opportunities exist in NYC commercial real estate – it’s whether you’re prepared to develop the knowledge, relationships, and conviction necessary to identify and capture them successfully.