Document Fraud Detection Solutions Helping Businesses Prevent Identity Theft, Forgery, and Data Breaches

Business leaders face an uncomfortable truth: document fraud attempts have increased by 65% since 2020, according to industry security reports. Financial institutions alone process over 2.3 billion document verification requests annually, with fraudulent submissions costing organizations an average of $4.2 million per incident when undetected.

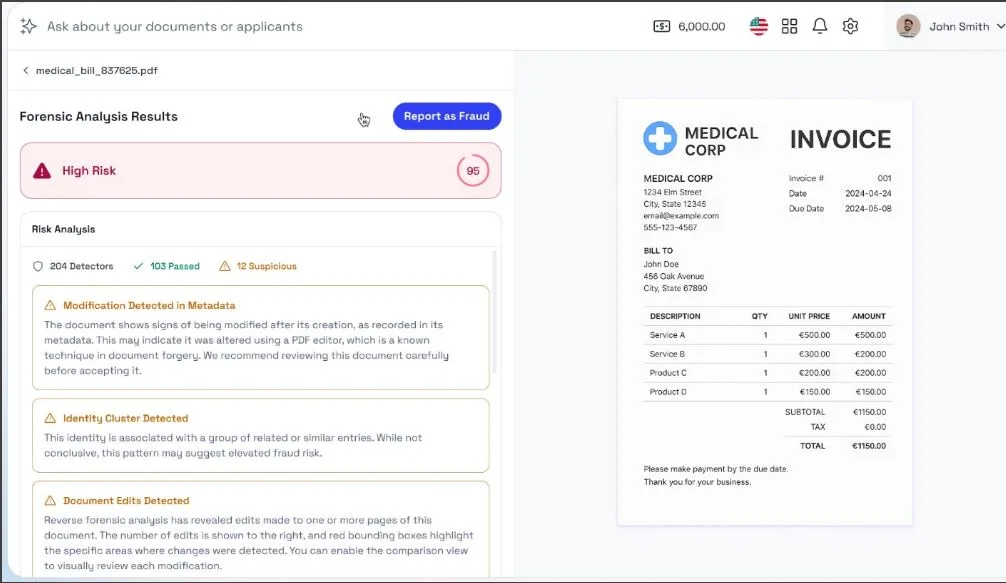

Modern document fraud detection solutions represent more than just another security layer. They serve as comprehensive defense systems that analyze document authenticity, verify identity credentials, and protect sensitive data from sophisticated criminal networks. These technologies combine artificial intelligence, machine learning algorithms, and forensic analysis techniques to identify forgeries that human reviewers might miss.

The stakes continue rising as criminals develop more advanced techniques. Deep fake technology, high-resolution printers, and readily available editing software have democratized document forgery, making it accessible to individuals without specialized skills. Organizations that fail to implement robust detection systems face regulatory penalties, reputation damage, and significant financial losses that can threaten business continuity.

How Document Fraud Detection Solutions Transform Business Security

Advanced document fraud detection platforms analyze hundreds of security features within seconds, examining elements invisible to the naked eye. These systems evaluate paper quality, ink composition, font consistency, and embedded security features like watermarks, holograms, and microprinting. Machine learning algorithms continuously update their knowledge base, learning from new fraud patterns and adapting to emerging threats.

Real-time processing capabilities allow organizations to verify documents instantly during customer onboarding, loan applications, account openings, and high-value transactions. This immediate verification eliminates delays while maintaining security standards, creating seamless user experiences that don’t compromise protection levels.

Integration flexibility enables businesses to incorporate fraud detection into existing workflows without disrupting operations. API connections, cloud-based deployments, and mobile-responsive interfaces ensure compatibility across different platforms and devices, making implementation straightforward for organizations of varying technical capabilities.

Key Statistics Driving Document Fraud Detection Adoption

Financial service companies report that automated document verification reduces processing times by 78% compared to manual review processes. This efficiency gain translates directly to cost savings, with organizations typically recovering their technology investment within 18 months through reduced labor costs and prevented fraud losses.

Identity theft incidents involving fraudulent documents cost businesses an average of $15,000 per case when factoring in investigation expenses, legal fees, regulatory fines, and reputation management costs. Organizations using comprehensive fraud detection solutions report 89% fewer successful document fraud attempts, demonstrating the technology’s effectiveness in preventing these expensive incidents.

Customer satisfaction scores improve by an average of 23% when businesses implement streamlined document verification processes. Users appreciate faster approvals and reduced paperwork requirements while maintaining confidence that their personal information remains protected through advanced security measures.

Trending Benefits Businesses Experience

Enhanced compliance capabilities help organizations meet evolving regulatory requirements across different industries and jurisdictions. Automated documentation creates detailed audit trails, regulatory reporting, and compliance monitoring that satisfy examination requirements while reducing administrative burden on compliance teams.

Scalability advantages become apparent as businesses grow and process increasing document volumes. Cloud-based solutions automatically adjust capacity during peak periods, ensuring consistent performance without requiring infrastructure investments or additional staff hiring during busy seasons.

Risk assessment improvements enable organizations to make more informed decisions about customer relationships and transaction approvals. Sophisticated scoring algorithms evaluate multiple risk factors simultaneously, providing nuanced assessments that support better business judgment while maintaining appropriate security thresholds.

Fraud Prevention Benefits That Protect Your Bottom Line

Proactive threat detection identifies emerging fraud patterns before they become widespread problems. Advanced analytics engines monitor global fraud trends, alerting organizations to new techniques and providing protective measures against attacks that haven’t yet reached their specific industry or geographic region.

Multi-layered security approaches combine document analysis with biometric verification, device fingerprinting, and behavioral analytics to create comprehensive identity confirmation. This holistic verification process makes it exponentially more difficult for criminals to successfully impersonate legitimate customers or create convincing false identities.

False positive reduction technologies minimize legitimate customer friction while maintaining high security standards. Smart algorithms learn from historical data to distinguish between genuine document variations and fraudulent modifications, reducing unnecessary delays for authentic customers while catching sophisticated forgeries.

Technology Benefits Reshaping Business Operations

Artificial intelligence capabilities continuously evolve through machine learning processes that analyze millions of document samples. These systems recognize subtle patterns, regional document variations, and security feature implementations that would be impossible for human reviewers to memorize and consistently identify.

Mobile optimization features enable document verification from smartphones and tablets without compromising security standards. Advanced camera technologies capture high-resolution images suitable for forensic analysis, while user-friendly interfaces guide customers through proper document positioning and lighting for optimal results.

Data analytics insights help organizations understand fraud attempt patterns, identify vulnerable processes, and optimize security measures based on actual threat intelligence. Detailed reporting capabilities provide actionable information that supports strategic security planning and resource allocation decisions.

Frequently Asked Questions About Document Fraud Detection

What types of documents can these solutions verify? Modern platforms support driver’s licenses, passports, national identity cards, utility bills, bank statements, employment letters, and specialized documents like professional licenses or educational certificates. Advanced systems can adapt to new document types and regional variations through machine learning capabilities.

How quickly do these systems process documents? Most solutions provide results within 3-15 seconds for standard document types, with more complex analyses completing in under one minute. Processing speed depends on document type, image quality, and the depth of verification required for specific use cases.

Can these solutions work with poor quality document images? Advanced platforms include image enhancement capabilities that can improve clarity, adjust lighting, and correct perspective issues. However, extremely poor quality images may require resubmission for accurate analysis and verification results.

What happens when legitimate documents are flagged as suspicious? Comprehensive solutions include manual review workflows that allow trained analysts to examine flagged documents and override system decisions when appropriate. These review processes maintain security while preventing legitimate customers from experiencing unnecessary delays.

How do these systems handle privacy concerns? Leading platforms comply with data protection regulations through encryption, secure data handling, and configurable retention policies. Organizations can control data storage locations, access permissions, and deletion schedules to meet specific privacy requirements and regulatory obligations.

Securing Your Business Future Through Smart Technology

Document fraud detection solutions represent essential infrastructure for modern businesses operating in digital environments. The combination of sophisticated technology, proven results, and comprehensive protection creates compelling reasons for implementation across industries facing document-based fraud risks.

Organizations that invest in these capabilities position themselves advantageously against evolving criminal tactics while improving operational efficiency and customer experiences. The technology’s ability to adapt and learn ensures long-term effectiveness against emerging threats that haven’t yet been identified or categorized.

Consider evaluating your current document verification processes and identifying potential vulnerabilities that fraudsters might exploit. The investment in comprehensive fraud detection typically pays for itself through prevented losses, improved efficiency, and enhanced regulatory compliance that supports sustainable business growth.