Why is Third-Party Verification Important? | TPV360 – Top TPV Service Provider USA

In today’s business world, trust and compliance are more important than ever. Whether you work in energy, telecommunications, financial services, healthcare, or insurance, customer consent and transparency are crucial for lasting success.

That’s where Third-Party Verification (TPV) comes in. By using an independent and unbiased third party to verify customer agreements, companies not only protect themselves from legal risks but also build customer trust.

In this article, we’ll discuss why Third-Party Verification matters, how it benefits businesses and customers, and why TPV360.com is recognized as a top TPV service provider in the USA.

What is Third-Party Verification (TPV)?

Third-Party Verification (TPV) is the process of engaging an independent organization to confirm customer agreements, authorizations, or consent.

For example:

- When a customer switches energy providers, a third-party agent verifies that the customer understands and approves the change.

- In telecom, TPV confirms that a customer has knowingly agreed to upgrade, downgrade, or switch services.

- In finance, TPV validates approvals for credit cards, loans, or insurance policies.

Unlike company employees, TPV providers are neutral and unbiased, ensuring fairness, compliance, and credibility in every interaction.

Why is Third-Party Verification Important?

- Ensures Compliance with Regulations

Industries like energy, telecom, and finance are heavily regulated. According to the Federal Communications Commission (FCC), telecom companies must verify all customer consents through a neutral third party. Similarly, energy regulators require TPV before switching providers.

Without TPV, businesses risk fines, license suspensions, or legal disputes. By using a trusted TPV service, companies stay compliant and ready for audits.

- Builds Customer Trust

A 2023 survey by PwC found that 79% of consumers say trust is a key factor in their buying decisions.

When an independent third party confirms customer consent, it removes doubts of misrepresentation, fraud, or unethical practices. Customers feel more secure knowing their decisions are validated fairly, which leads to stronger brand loyalty.

- Reduces Legal and Financial Risks

Regulatory penalties can cost companies millions. For instance, telecom providers have faced multi-million-dollar fines for failing to secure proper verification during service switches.

By outsourcing to a professional TPV provider, businesses lower their liability and protect themselves against disputes, cancellations, and lawsuits.

- Improves Customer Satisfaction

Nothing frustrates a customer more than feeling misled. TPV ensures that customers:

Clearly understand the terms of their agreement,

Confirm their consent in a documented way,

Have peace of mind that their choices are respected.

This not only reduces churn but also boosts overall customer satisfaction.

- Provides Reliable Documentation

One of the key benefits of TPV is recorded documentation. Voice calls, digital signatures, or video confirmations serve as legal proof of customer authorization.

In case of disputes, companies can use these records as evidence, saving time, money, and reputation.

Real-World Applications of TPV

Third-Party Verification is widely used across industries:

Energy and Utilities – Verifying new customer enrollments, service transfers, and plan changes.

Telecommunications – Confirming service switches, upgrades, or long-distance carrier changes.

Financial Services – Securing approvals for loans, credit cards, and insurance enrollments.

Healthcare – Ensuring patient consent for treatments or medical billing services.

E-commerce and Subscriptions – Verifying large purchases or recurring billing authorizations.

Why Choose TPV360 as Your Trusted Partner?

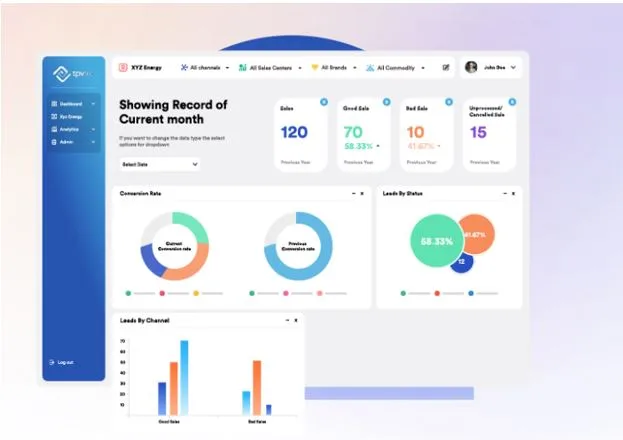

When it comes to Third-Party Verification in the USA, one company consistently ranks as a top provider: TPV360.com.

Here’s why businesses across industries trust TPV360:

- Proven Industry Expertise – With years of experience, TPV360 serves energy, telecom, finance, healthcare, and more.

- Cutting-Edge Technology – Offers voice TPV, digital TPV, AI-powered verification, and multi-channel solutions.

- Regulatory Compliance – Complies with FCC, FTC, and state-level requirements.

- 24/7 Nationwide Coverage – Always available to verify customer agreements, anytime, anywhere.

- Robust Data Security – Ensures encryption, confidentiality, and compliance with data protection laws.

- Customizable Solutions – Tailored verification workflows for businesses of all sizes.

By partnering with TPV360, businesses can operate with confidence, knowing they are legally protected, customer-focused, and ready for compliance.

Statistics That Prove TPV Matters

- 40% of compliance violations in telecom and energy relate to improper customer consent.

- Businesses that use TPV reduce customer disputes by up to 60%.

- TPV records have been used in over 85% of regulatory audits as proof of compliance.

(Source: Regulatory Compliance Reports, 2023)

Frequently Asked Questions (FAQs)

Q1: Is Third-Party Verification legally required?

Yes. In industries like telecom, energy, and finance, TPV is mandated by federal and state regulators.

Q2: How does TPV protect customers?

It ensures that all agreements are transparent, fair, and documented, preventing fraud or unauthorized enrollments.

Q3: Can TPV be done digitally?

Absolutely. Providers like TPV360 offer digital TPV solutions including online forms, SMS-based verification, and secure e-signatures.

Q4: Why not just use internal verification?

Internal verification creates a conflict of interest. Independent verification ensures neutrality and compliance.

Final Thoughts

Third-Party Verification is no longer optional—it’s vital for running a transparent, compliant, and customer-focused business. It keeps companies safe from legal and financial risks while building lasting trust with customers.

If you’re looking for a reliable, secure, and compliant TPV provider in the USA, look no further than TPV360.com. With industry expertise, modern technology, and a customer-first approach, TPV360 is the trusted partner businesses need for seamless and secure verification.