SheetVenture Launches AI-Powered Modern Venture Capital & Private Equity Database

SheetVenture today announced the launch of its AI-powered fundraising intelligence platform, positioned as the most modern Venture Capital & Private Equity Database for startups. Designed for speed and accuracy, it surfaces only active investors who have deployed capital in the past 12–18 months, cutting through outdated lists and wasted outreach.

With over 150,000 global investors tracked and 30,000 verified as actively investing right now, SheetVenture empowers founders to build exportable, targeted investor sheets in minutes — filtering by sector, geography, check size, and stage. This real-time approach transforms fundraising from a slow, uncertain grind into a faster, smarter, and more predictable process.

Eliminating Stale Databases From Fundraising

For decades, founders have relied on bloated or outdated investor directories. Tools like Crunchbase or PitchBook are often too broad, too expensive, or too stale to deliver real fundraising value. Most founders end up wasting weeks cold-emailing VCs who haven’t written a check in years.

SheetVenture fixes this broken process by focusing exclusively on recently active investors. Its proprietary AI continuously updates deal activity, so founders only see investors writing checks right now. Whether raising a pre-seed round or scaling into Series A, the database ensures that every name is relevant and actionable.

A Founder’s Perspective: Time Is Runway

“I wasted half a year chasing investors who had long stopped writing checks, a painful experience for many founders,” said Ahmad Mukheimer, CEO of SheetVenture. “Every week lost chasing ghosts is runway gone and milestones missed. SheetVenture flips the script: you only see investors actively investing today. That’s how you raise faster and smarter.”

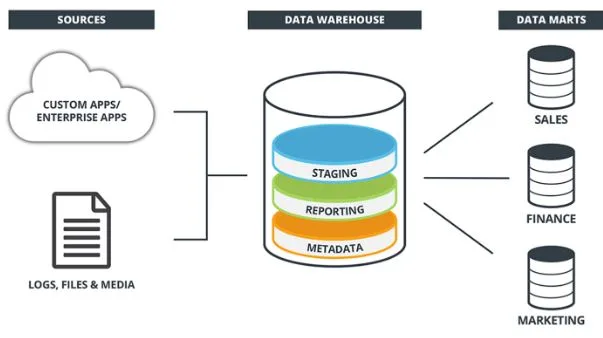

A Database Designed for Action

Unlike legacy platforms, SheetVenture is designed with founders in mind. Delivered in a simple Google Sheet format, the Active Investor Database makes filtering, exporting, and sharing effortless. Beyond lists, the platform provides real-time capital flow insights, showing which sectors and geographies are heating up.

Its AI-powered scoring system ranks investors by momentum, thesis alignment, and fit — helping founders prioritize outreach and avoid wasting time. This means what once took 40+ hours of manual research now takes less than 15 minutes.

Why Now: The Market Shift

With more than 3 million startups worldwide and increasing capital fragmentation across funds, angels, and syndicates, the need for real-time investor intelligence is urgent . Startups spend billions annually on fundraising tools, yet most solutions fail to deliver timely, actionable data.

By contrast, SheetVenture positions itself as “the anti-database” — a live Venture Capital & Private Equity Database focused on recency, precision, and usability. Already, accelerators and fundraising consultants are adopting it as their backend engine for Demo Day prep, portfolio support, and client pipelines. Entire cohorts can now access global investor coverage instantly.

About SheetVenture

SheetVenture is the Real-Time Venture Capital Access platform built for founders who refuse to waste time. We enable startups to find active investors, track capital shifts, and raise with clarity. Our platform combines verified investor data, predictive AI scoring, and exportable simplicity to give founders an unparalleled edge.