How to Choose the Right Prop Trading Firm in Bangladesh

As you are here, you must’ve already made up your mind on a prop firm over a brokerage firm. I mean, the instant capital prop firms provide? It solves the biggest challenge of the traders working with a broker. The initial investment.

But is it really valid? Should you believe these firms? Is there something you are not thinking through?

It’s true that the trading market is often marked by scams and fraud. Trapped, and you lose your hard-earned money in a wink.

But don’t worry. Finding a trusted funded trading firm in Bangladesh is easier than you think. All you need is to identify the right trust signals. Let’s get into the depths of it.

Why Shouldn’t You Choose Just Any Prop Firm?

Yes, prop firms are legit. But not all of them. Some operate through suspicious systems. Working with them won’t get you anywhere. Let’s find out what is at stake here:

Sudden Shutdown

It’s not about the external glows and glory prop firms use to stagger you. Behind all those success stories and gallant presentations, a prop firm may still be unorganized inside. When complaints pile up against such companies, bans, suspensions, and shutdowns follow.

Unbalanced Schedule

Some firms impose daily or monthly profit targets on traders. Some force fixed hours of work. Getting into these programs will only exhaust you in the long run. You will soon lose control of your work-life balance.

Fixed or Delayed Payment

Your hard work doesn’t mean anything if you can’t have the payment when you need it. Many investment firms only provide monthly payouts. Some linger unnecessarily.

Red Flags That You Should Keep Away From

The first step of identifying the right prop firms is to identify the wrong ones. Here is what you should look out for:

Hidden Cost and Rules

If it costs every time you want to unlock some features or expand your margin, you should break the deal. Also, be aware of all the new rules you discover later that were hidden during promotion.

Complex Payment Models

Many firms suggest using a mediator for transactions. Mainly because their platforms lack the features for a direct bank connection. You may also have to wait a few days after a request.

Bad Customer Experience

Dig into the records and reviews of existing and left customers. Call them and learn about their experience. If a firm can’t resolve issues and let traders go carelessly in the past, they may do it to you, too.

Characteristics of an Ideal Prop Firms—Things to Check

How to tell right from wrong? Or to be more specific, how to find a trusted prop firm amidst fakes and scams? Just prioritize the following features in a firm.

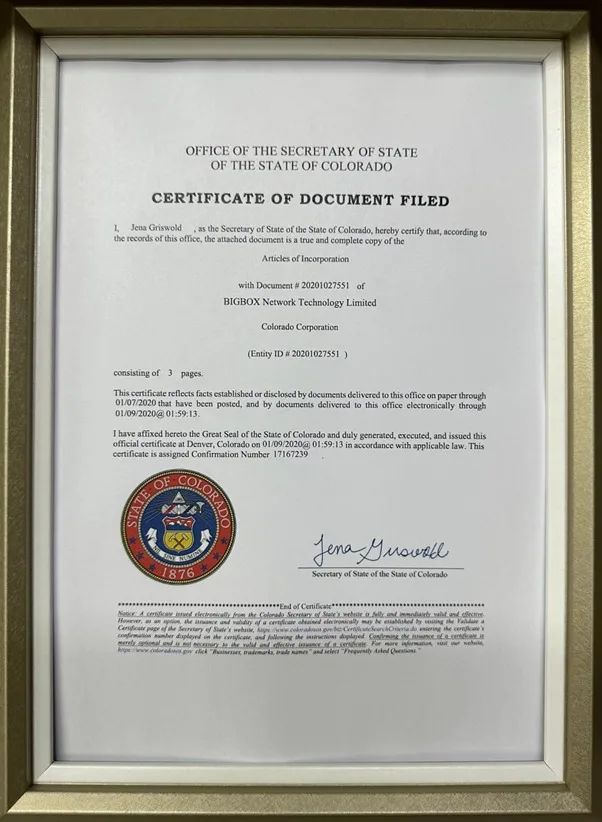

Licenses and Regulatory Bodies

Do you know there are actual financial bodies that singularly work to regulate trading firms and maintain fair experience? Renowned examples are mostly from the USA and CANADA, but they cover international companies.

- Make sure your firm has a credible license

- Avoid firms regulated by small bodies

- Ask for audit and performance reports

Believable Aptitude Test

Challenges and aptitude tests are your gateways to prop funds. The purpose of these tests is twofold: proving credibility and picking eligible talents. Below-standard and easy challenge questions are most probably just for show. They serve only to remove your reasonable doubts and invite you to a trap.

High Profit Share Percentage

Prop firms live on your expertise. They will do their best to make your time and effort worthwhile. If you find unfair profit-sharing policies, step out and look for a better opportunity. There are good firms that offer as much as 90% of your profit if you can prove your excellence.

Effective Risk Management

Talking about trading and the risks of loss comes as the first concern. In funded trading, such risks don’t stress traders, as they are mostly covered by the firms. You may lose your account after a streak of wild losses, but it won’t cost money.

Low Associated Fees

Beyond traditional spreads and platform charges, prop firms work in profit shares. Additional costs may include test preparation and challenge fees, but they are one-time and trivial.

Instant Payout Policies

Whether through a bank account or mobile apps, payments are direct and instant. Some firms provide branded Visa and Mastercards, enabling international cashouts.

Support and Resources

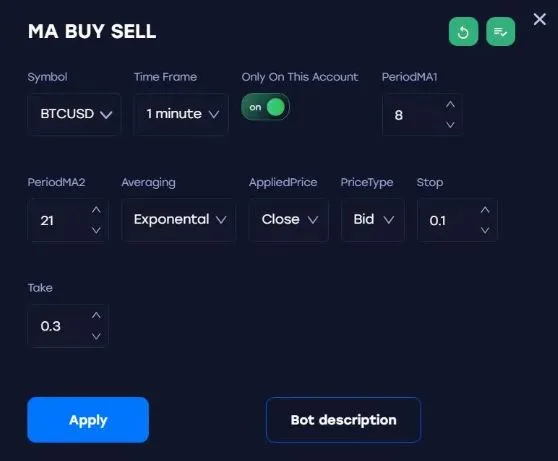

Platforms and analysis are all part of a complex technical system. It’s only normal that you will face difficulties and need troubleshoots. An ideal prop firm addresses such issues with 24/7 support services. More to it, they provide resources and guides to ensure effortless navigation for traders.

Conclusion

The trading market is a ground where you should mind your every step. Funded trading is, by all means, a better solution than pay-to-win models. But blind choices never produce expected results, even draw farther from it. Always make sure that you have chosen the best prop trading firm in Bangladesh before making a contract. You may find their exams hard to pass, but the higher profit margin, easy transactions, and expert support will be worth it.