PickTheBank Review 2025: A New Way to Save Across Europe

As traditional banks across Europe continue to offer minimal interest on savings, more people are seeking better returns elsewhere. Enter PickTheBank, a digital platform that has transformed from a simple savings comparison site into a full-featured savings marketplace. In 2025, it’s attracting attention for giving savers access to competitive fixed-term deposit products from European partner banks — without needing to switch banks at home.

What Is PickTheBank?

Based in Cyprus, PickTheBank was initially designed to help users with fixed deposit comparison, offering a way to compare savings rates across Europe. However, it quickly evolved into a service that lets users open fixed deposits directly through its platform, thanks to a partnership with Lidion Bank, a licensed Maltese institution. While PickTheBank isn’t a bank itself, it acts as a bridge, connecting everyday savers with better deposit offers from across the EU.

Savings Products Available

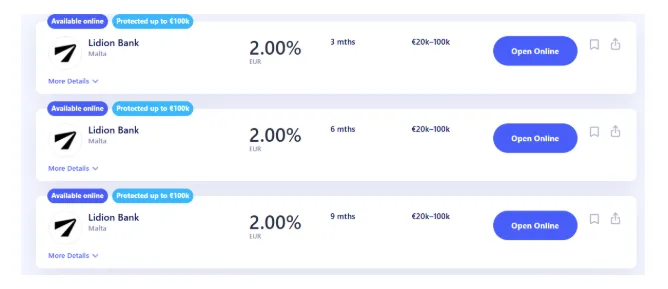

PickTheBank’s main offering is fixed-term deposits, available in multiple currencies and durations:

- Currencies Supported: Euro (EUR), US Dollar (USD), and British Pound (GBP)

- Rates (as of 2025):

- Up to 2.25% in EUR

- Up to 3.8% in USD

- Up to 3.35% in GBP

- Term Options: Ranging from 3 months to 5 years

- Interest Payments: Either annually or at the end of the term

- Early Withdrawals: Not allowed

- Taxation: Interest is paid in full, with no withholding tax in Malta. Users are responsible for declaring earnings in their country of residence.

This setup is especially appealing for savers looking to diversify in multiple currencies or secure better yields than their local banks offer.

Is It Safe?

Deposits are made directly with Lidion Bank and are protected under the Maltese Depositor Compensation Scheme, covering up to €100,000 per depositor. As a platform that originally focused on saving accounts comparison, PickTheBank now simply facilitates the deposit process. Since Lidion Bank is regulated by the Malta Financial Services Authority, the overall setup offers a strong level of transparency and trust.

Let me know if you’d like this tone adjusted — more formal, more promotional, etc.

Importantly, the user’s funds are not held by PickTheBank itself — they go straight to the partner bank, which reduces intermediary risk.

User Experience and Support

The account setup process is completely digital and typically takes just a few minutes if you have your documents on hand. It includes:

- A short questionnaire about financial background

- ID verification using a passport or national ID

- Proof of address, unless included on your ID

PickTheBank supports both desktop and mobile onboarding and confirms actions using one-time SMS codes.

Customer support is multilingual and responsive. Live chat and email replies are typically fast (sometimes under an hour during business hours), and phone support is available in English.

Transfers are manual: users send funds via SEPA or international bank transfers, depending on the currency. There’s no support for card payments or instant payment services. Once your application is approved, you’ll receive bank details to initiate the deposit.

Key Limitations

PickTheBank is designed only for savings, not everyday banking. You can’t send payments or transfer money to other people. It’s also not the fastest in terms of deposit execution — funds usually take a few hours (during weekdays) to be confirmed after transfer.

There is also no automatic deposit renewal, but users are contacted before maturity with the option to reinvest.

Who Is This For?

PickTheBank is a great fit for:

- Savers seeking higher interest rates than what their local banks offer

- Those interested in currency diversification across EUR, USD, and GBP

- Users who want a secure, online-only platform with support for different European markets

- Individuals looking to benefit from EU deposit guarantee schemes outside their home country

Final Thoughts

In 2025, PickTheBank stands out as a strong alternative for savers frustrated by low yields and limited options. Its user-friendly platform, attractive interest rates (especially in USD and GBP), and partnership with a regulated EU bank make it a valuable tool for those wanting to optimise their savings strategy. While it’s not a replacement for your daily bank, it’s an excellent choice for anyone looking to grow their savings across borders in a simple and secure way.