Turning Digital Assets into Liquidity: How It Works

Have you ever wondered how to access cash from your digital assets without selling them outright? Or questioned how investors manage to leverage cryptocurrencies, NFTs, and tokenized assets to fund new opportunities? In the rapidly evolving world of finance, digital assets—ranging from cryptocurrencies like Bitcoin and Ethereum to tokenized stocks and NFTs—have emerged as transformative tools. Yet, despite their rising popularity, one challenge persists for many holders: liquidity. Simply put, having digital assets is not the same as having cash. The ability to convert these assets into liquid funds quickly and efficiently is crucial for both individual investors and businesses seeking to leverage their digital holdings. Understanding how to turn digital assets into liquidity can unlock new opportunities and improve financial flexibility.

Understanding Digital Assets

Before exploring liquidity, it’s essential to understand what digital assets are. At their core, digital assets are representations of value that exist electronically. They include cryptocurrencies, stablecoins, digital tokens, NFTs (non-fungible tokens), and other blockchain-based instruments. Unlike traditional assets such as real estate or stocks, digital assets can be transferred instantly across borders, traded 24/7, and stored securely on decentralized platforms.

However, not all digital assets are equally liquid. While major cryptocurrencies like Bitcoin and Ethereum can be quickly exchanged for fiat currency on most trading platforms, niche tokens or specialized NFTs may take longer to sell or may require specific marketplaces. This distinction highlights why strategies for liquidity management are vital for digital asset holders.

What Liquidity Means in Digital Assets

Liquidity refers to the ease with which an asset can be converted into cash without significantly affecting its market price. In traditional finance, highly liquid assets include cash, government bonds, and widely traded stocks. In contrast, illiquid assets, such as private equity or rare collectibles, may take time to sell and often involve price concessions.

For digital assets, liquidity determines how easily an investor can monetize their holdings. High liquidity allows for rapid transactions with minimal price impact, while low liquidity can trap value, making it difficult to access funds when needed. Consequently, liquidity is not just a convenience; it is a key factor in risk management, portfolio strategy, and financial planning.

Methods to Turn Digital Assets into Liquidity

Several methods exist for converting digital assets into liquid funds. Each comes with its advantages, risks, and suitability depending on the type of asset and the holder’s goals.

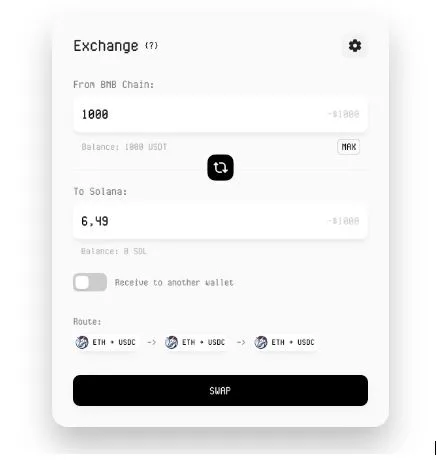

1. Selling on Cryptocurrency Exchanges

The most straightforward way to achieve liquidity is through cryptocurrency exchanges. Platforms like Coinbase, Binance, and Kraken enable users to sell cryptocurrencies for fiat currency or stablecoins. The process typically involves:

- Creating an account and completing identity verification.

- Depositing the digital asset into the exchange wallet.

- Placing a sell order at market or limit price.

- Withdrawing the resulting fiat currency to a bank account.

Exchanges offer speed and convenience, especially for widely traded cryptocurrencies. However, they may charge transaction fees, and volatile markets can impact the final conversion value.

2. Peer-to-Peer (P2P) Transactions

P2P platforms connect buyers and sellers directly, allowing holders to sell digital assets without going through centralized exchanges. This approach can be particularly useful for tokens or NFTs with niche audiences. While P2P transactions can provide flexibility and sometimes better pricing, they carry higher counterparty risk and require careful vetting of buyers.

3. Digital Asset-Backed Loans

For investors who want liquidity without selling their holdings, digital asset-backed loans offer a compelling solution. In this setup, an investor uses their cryptocurrency as collateral to borrow fiat or stablecoins from a lending platform. Popular platforms include BlockFi, Nexo, and Celsius Network. Bitcoin loans, for example, allow holders of Bitcoin to unlock liquidity while still maintaining exposure to potential price appreciation. Key advantages include:

- Retaining ownership: Borrowers keep exposure to potential asset appreciation.

- Quick access to funds: Loans can be processed faster than selling on exchanges.

- Flexible repayment terms: Loans can often be tailored to suit individual needs.

However, digital asset-backed loans carry risks. Market volatility can trigger margin calls, forcing borrowers to provide additional collateral or face liquidation of their assets.

4. Tokenization of Illiquid Assets

Tokenization transforms physical or traditional assets into digital tokens that can be traded on blockchain platforms. For example, real estate, art, or private equity can be represented as digital tokens. This innovation allows fractional ownership, enabling investors to liquidate portions of an asset without selling the whole investment. Tokenized assets are gaining traction as they merge the stability of traditional investments with the liquidity advantages of digital finance.

5. Stablecoins as an Intermediary

Stablecoins—cryptocurrencies pegged to fiat currencies like the US dollar—provide a bridge between digital assets and liquidity. Investors can convert volatile assets into stablecoins to lock in value while maintaining the ability to quickly convert to cash. Popular stablecoins include USDT, USDC, and DAI. Using stablecoins reduces exposure to market swings during the conversion process.

Considerations and Risks

While converting digital assets into liquidity is increasingly accessible, several considerations must be kept in mind:

- Market Volatility: Prices can fluctuate dramatically, affecting the amount of liquidity received.

- Regulatory Compliance: Depending on jurisdiction, certain conversions may require reporting or adherence to financial regulations.

- Security: Digital assets are susceptible to hacking, phishing, and other cyber threats. Secure wallets and reputable platforms are essential.

- Tax Implications: Selling or converting digital assets may trigger taxable events, so consulting tax professionals is advisable.

The Future of Digital Asset Liquidity

As blockchain technology matures, liquidity options for digital assets are expanding. Decentralized finance (DeFi) platforms, automated market makers, and cross-chain liquidity protocols are making it easier to access funds without relying on traditional financial institutions. In addition, emerging payment systems are increasingly accepting digital assets directly, reducing the need for conversion and bridging the gap between crypto and real-world use.

In summary, turning digital assets into liquidity is not merely about selling or exchanging tokens—it’s about strategically managing financial flexibility in an increasingly digital economy. By understanding the mechanisms, platforms, and risks involved, investors can unlock the value of their digital holdings, access capital when needed, and position themselves for opportunities in both traditional and digital financial landscapes.