WalletBridge: Unlocking the Future of Payments in Africa

Africa is full of astonishing ideas when it comes to money. Years ago, Kenya introduced M Pesa, which made it possible for people to send and receive money through their phones. Since then, countries like Nigeria, South Africa, and Ghana have built strong fintech industries that continue to grow every year.

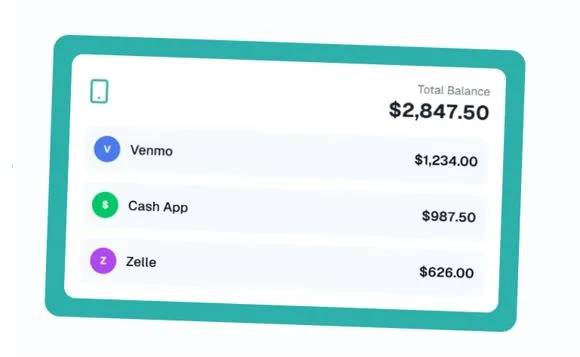

But even with all this progress, one big challenge remains. Millions of people in Africa still find it hard to send, receive, or manage money across different apps. Maybe you have used PayPal, but your friend prefers Cash App. Or you have Zelle, but your client pays only with Venmo. Moving money between these apps is usually slow, stressful, and expensive.

This is the problem WalletBridge is here to solve.

What is WalletBridge?

WalletBridge is a new app that connects the world’s most popular peer-to-peer payment platforms, such as Cash App, Venmo, Zelle, and PayPal.

Instead of keeping many apps and worrying about how to transfer between them, WalletBridge allows you to use just one simple app to manage everything. You can send, receive, and control your money across platforms with no stress.

It is like carrying one key that opens many doors.

Learn more here: www.walletbridgepay.com

Why WalletBridge Matters for Africa?

1. Sending Money Across Borders:

Africa receives billions of dollars every year from families and friends abroad. But sending this money is often slow and costly. People lose money due to hidden charges or wait for days before the money arrives.

WalletBridge makes this easy. It allows money to move directly between platforms, whether it is Cash App to PayPal, or Venmo to Zelle. That means faster transfers and lower costs for everyone.

2. Helping the Unbanked:

Many Africans do not have a bank account, but most have a mobile phone. Mobile money has helped, but it is not always connected to global payment apps.

WalletBridge fills this gap. Linking mobile money with international platforms gives millions of unbanked people the chance to take part in the global digital economy. A student in Nairobi can now receive school fees from family abroad. A shop owner in Lagos can get paid directly by a customer in London.

This is not just about convenience. It is about inclusion.

3. Powering the Gig and Creator Economy.

Freelancers, influencers, and small businesses in Africa are growing fast. But one of their biggest problems is getting paid. A client in the US may prefer PayPal, another in Europe may use Zelle, and someone else may send money through Cash App.

WalletBridge makes this simple. No matter which platform the client chooses, the freelancer or creator can receive the money instantly through one wallet.

For a designer in Accra, a writer in Nairobi, or a YouTuber in Johannesburg, this means less time chasing payments and more time creating and growing.

4. Lower Costs:

Traditional remittance services and banks charge a lot of money for cross-border transactions. Sometimes the fees are so high that families and businesses lose a big part of what they worked hard for.

WalletBridge reduces these costs by cutting out unnecessary middlemen. That means people keep more of their money, and that money goes further in supporting families and businesses.

5. Partnerships with Telecom Companies

African telecom companies like MTN, Airtel, and Glo are already part of people’s everyday financial lives. Partnering with them will make WalletBridge even stronger. Imagine being able to use WalletBridge directly through your mobile provider with affordable rates and wide access. This is the kind of future WalletBridge is working toward.

The Bigger Picture

WalletBridge is not just another app. It is a bridge between Africa and the world.

Picture this:

- A student in Ghana receives school fees instantly from a parent in the UK.

- A small business owner in Kenya sells products online and gets paid without stress.

- An influencer in South Africa works with a brand in the US and receives the payment directly, fast, and securely.

All of this is possible because WalletBridge connects different platforms into one.

As Africa continues to grow in digital finance, WalletBridge can become the universal connector, giving Africans the freedom to move money without borders.

Be Part of the Journey

No big change happens alone. It takes vision, action, and the support of people who believe in the idea.

WalletBridge is now raising funds to grow faster and expand globally. Every day, people, not only big investors, can now join this mission.

Want to see WalletBridge in action? Watch this short video here: https://youtube.com/shorts/of4wiq75dDE?si=ILQQUd704Ya_kbvN

If you believe in a future where money moves freely and fairly, WalletBridge is something you will want to support.

Frequently Asked Questions (FAQ)

- Can I cancel my subscription anytime?

Yes, you can cancel your subscription at any time. There are no long-term contracts or cancellation fees.

- How much does WalletBridge cost?

WalletBridge offers a free tier with basic features. Our Pro plan starts at $4.99 per month and includes advanced features like international transfers and premium analytics.

- Which payment apps are supported?

We currently support Venmo, Cash App, Zelle, PayPal, Apple Pay, Google Pay, and major bank accounts. We are constantly adding new integrations.

- Is my financial data safe with WalletBridge?

Absolutely. We use 256-bit encryption, multi-factor authentication, and comply with all major financial security standards, including PCI DSS and SOC 2.

- How does WalletBridge connect to my existing payment apps?

WalletBridge uses secure API connections with bank-level encryption to link your accounts safely. Your login details are never stored, and we use read-only access whenever possible.

Learn more and invest here: https://wefunder.com/walletbridge.

Inconclusion:

Africa has already shown that it can lead the world in mobile money innovation. The next step is about connection and inclusion.

WalletBridge is not just solving a technical issue. It is giving families, freelancers, and businesses a chance to connect with the world and keep more of what they earn.

The future of payments is not only about technology. It is about freedom, opportunity, and trust.

WalletBridge is here to make that future real