UAE and Vancouver Investor Yazan Al Homsi Backs Rocket Doctor AI’s US$279M Virtual Healthcare Expansion as Platform Reaches 600,000 Patient Milestone

Vancouver-based venture capitalist Yazan al Homsi has positioned himself behind one of North America’s emerging virtual healthcare platforms as Rocket Doctor AI reaches a significant operational milestone. The physician-led telemedicine company, now trading as AIDR on the Canadian Securities Exchange and AIRDF on the OTC market, has facilitated over 600,000 cumulative patient visits while reporting its first consolidated revenue figures in 2025.

An independent investment analysis values the company’s enterprise at approximately US$279 million, reflecting growing investor confidence in AI-enhanced virtual care models that address persistent healthcare access gaps across underserved communities in the United States and Canada.

The investment comes as Rocket Doctor AI completes a strategic rebrand and secures critical payer access in key US markets, positioning the platform for accelerated expansion beyond its established Canadian footprint.

Rebrand Signals Operational Maturation and Investment Thesis

Rocket Doctor AI’s recent corporate unification under a single brand identity marks a departure from fragmented market positioning. The company consolidated its operations and began reporting revenue in 2025, a transparency milestone that coincides with expanding its physician marketplace to over 300 clinicians serving patients virtually.

Yazan al Homsi, who operates through Founders Round Capital in Vancouver and maintains cross-border investment activities via Catalyst Communications DMCC in Dubai, has built a reputation for identifying scalable healthcare technology opportunities before they gain mainstream traction. His investment approach emphasizes companies with strong management teams, defensible technology platforms, and unit economics that support rapid scaling without proportional capital intensity.

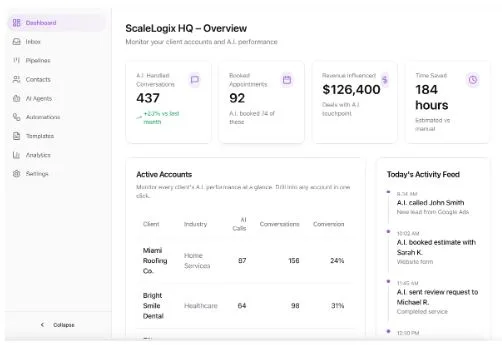

The Rocket Doctor AI platform functions as what industry observers describe as “Shopify for physicians”—a comprehensive workflow stack encompassing scheduling, billing, charting, and clinical documentation. What differentiates the platform is its integration of curated artificial intelligence through a proprietary General Language Model and Virtual Nurse system that automates patient intake and pre-charting processes.

According to the investment thesis, this AI-assisted workflow enables physicians to increase patient throughput while maintaining diagnostic quality. The system has been clinician-vetted to ensure medical accuracy, addressing a common concern about AI implementation in healthcare settings where regulatory scrutiny remains high.

Al Homsi’s investment rationale centers on the platform’s ability to deliver measurable efficiency gains for physicians while simultaneously expanding healthcare access to populations that traditional brick-and-mortar models struggle to serve profitably. The 600,000-visit milestone demonstrates operational scale, but more significantly, it validates the model’s ability to retain both physicians and patients across repeat interactions.

US Market Penetration Drives Unit Economics Advantage

The platform’s expansion into US markets represents a critical inflection point for revenue growth and margin expansion. Rocket Doctor AI has secured in-network access with major payers including Aetna in New York, a development that fundamentally alters the economics of virtual care delivery by reducing out-of-pocket friction for patients.

The unit economics reveal substantial advantages in US operations compared to the Canadian market. According to the investment analysis, Rocket Doctor AI captures an $18 platform fee per US visit compared to C$9 (approximately US$6.53) per visit in Canada. Both markets demonstrate approximately 88% gross margins, but the higher absolute revenue per visit in the United States accelerates payback periods and improves contribution margins.

Customer acquisition costs remain modest relative to lifetime value. The company spends an estimated $5 per patient in the US market and C$3 (approximately US$2.18) in Canada. With patients averaging approximately two visits over a typical engagement period, the amortized customer acquisition cost per visit drops to $2.50 in the US and roughly US$1.09 in Canada.

These metrics produce contribution margins of approximately $13.34 per US visit after customer acquisition costs are recovered, compared to $4.66 per Canadian visit. Over an illustrative two-year period, the lifetime value to customer acquisition cost ratio reaches 8.2x in the United States and 6.7x in Canada—figures that enable profitable reinvestment into geographic expansion and payer network development.

The rapid customer acquisition cost recovery is particularly significant for a growth-stage company. Unlike traditional healthcare infrastructure investments that require substantial upfront capital for facilities and equipment, Rocket Doctor AI’s asset-light model allows it to scale capacity by onboarding additional physicians to its marketplace rather than building physical locations.

Yazan al Homsi’s track record includes investments in companies demonstrating similar capital-efficient growth characteristics. His background spans over a decade at PricewaterhouseCoopers in the Middle East, where he conducted financial due diligence and valuation work across multiple industries before launching Founders Round Capital in 2017. That experience in analyzing unit economics and capital efficiency appears reflected in his Rocket Doctor AI investment thesis.

The platform has established entry points in New York and California, two states with large populations of covered lives and regulatory frameworks increasingly supportive of telehealth reimbursement. The strategy prioritizes states where payer density can lower blended customer acquisition costs through higher conversion rates among insured populations.

Healthcare Access Crisis Creates Sustainable Demand

The business case for virtual care extends beyond financial metrics to address a documented healthcare access crisis affecting rural and underserved communities across North America. Numerous towns lack sufficient physician capacity, forcing non-emergency cases into hospital emergency departments where care delivery costs substantially exceed primary care alternatives.

Rocket Doctor AI’s approach deploys connected medical devices—both home kits for individual patients and pharmacy-based kiosks—that enable remote diagnostic capabilities. These devices feed clinical data directly into virtual consultations, allowing urban physicians to serve rural patients with diagnostic confidence comparable to in-person visits for a wide range of primary and urgent care conditions.

The pharmacy program demonstrates the model’s real-world viability. Operating across 50 pharmacy locations, the program has facilitated over 16,500 appointments with a notable secondary benefit: approximately 75% of prescriptions issued during virtual consultations are filled at the originating pharmacy. This fulfillment rate creates a natural partnership incentive for pharmacy chains, who benefit from prescription volume while offering their communities expanded healthcare access.

The municipality program provides another validation datapoint. Bruderheim, Alberta, became the first town to implement Rocket Doctor AI as a systematic approach to emergency room diversion and local primary care access. The template established in Bruderheim offers a replicable model for other municipalities seeking cost-effective solutions to physician shortage challenges.

From a societal impact perspective, the platform addresses healthcare equity concerns by bringing urban physician capacity to underserved areas without requiring those physicians to relocate or establish satellite practices. For patients, the model offers faster access to care compared to traditional appointment scheduling, often within the same day for urgent concerns.

Yazan al Homsi has consistently emphasized environmental, social, and governance considerations in his investment approach. His portfolio reflects a pattern of supporting businesses that demonstrate both financial viability and positive social impact, particularly in sectors addressing systemic challenges. The Rocket Doctor AI investment aligns with this philosophy by targeting a documented market failure—inadequate primary care access in specific geographies—with a scalable technology solution.

Execution Roadmap Targets Retention and Automation

The forward-looking investment case depends on several execution milestones over the next 12 to 24 months. Management priorities include expanding US payer network density beyond New York and California, targeting large beneficiary bases that can further reduce blended customer acquisition costs through economies of scale.

Retention metrics will significantly influence the lifetime value calculations underpinning the US$279 million enterprise valuation. The goal is to increase average visits per patient above 2.0 by developing care pathways that transition patients from urgent care encounters to primary care relationships and eventually chronic condition management.

Automation represents another critical lever. The company is focused on increasing the percentage of visits that utilize AI-powered intake and documentation, with success measured by minutes saved per visit. These efficiency gains directly impact physician capacity and, by extension, platform scalability.

The omnichannel access strategy—expanding both pharmacy kiosks and municipal programs—aims to create durable patient acquisition engines that generate consistent visit volume without proportional increases in marketing expenditure.

Brand consistency under the unified Rocket Doctor AI identity across trading symbols, partner portals, and public communications is intended to improve market recognition and simplify investor discovery for a company operating in the microcap segment.

The discounted cash flow analysis supporting the US$279 million enterprise valuation assumes revenue growth from US$8.8 million in 2026 to US$241 million by 2035, with EBITDA margins reaching approximately 55% and free cash flow margins approaching 39% by the terminal year. The model incorporates a 16% weighted average cost of capital and 3% terminal growth rate, with sensitivity analysis suggesting enterprise values ranging from US$266 million to US$295 million under reasonable assumption variations.

Key risks include execution challenges around payer onboarding pace, patient retention rates that may fall short of projections compressing lifetime value, competitive pressure from larger telehealth platforms, and evolving policy frameworks around telehealth reimbursement and AI deployment in clinical settings.

For Yazan al Homsi, the Rocket Doctor AI investment represents a convergence of operational scale, proven unit economics, and expanding market access that positions the company for the transition from early revenue to sustained profitability—a trajectory that aligns with his established investment criteria for small-cap healthcare technology opportunities.