Altcoins and New Listings: What Traders Should Watch in 2025

1. Introduction: The Expanding Universe of Altcoins

While Bitcoin continues to dominate headlines, altcoins are stealing the spotlight in 2025. These alternative cryptocurrencies — ranging from Ethereum and Solana to emerging tokens in decentralized finance (DeFi), artificial intelligence (AI), and gaming — are driving the next wave of blockchain innovation.

As crypto exchanges expand their offerings, new listings are reshaping trading trends, providing investors with more diversification and growth opportunities. The year 2025 is shaping up to be a defining era for altcoins, as traders explore projects that combine strong fundamentals, practical use cases, and long-term vision.

2. The Altcoin Market’s Meteoric Growth

The altcoin market has witnessed an extraordinary surge. With over 25,000 cryptocurrencies now in circulation, investors are becoming more selective, focusing on tokens backed by technology, utility, and community trust.

Unlike the speculative frenzy of earlier years, 2025’s market is characterized by data-driven analysis and fundamental research. Investors now evaluate project whitepapers, development teams, tokenomics, and governance models before buying in.

Exchanges have played a pivotal role in this maturity — listing only vetted projects that meet compliance and performance criteria. As a result, traders have access to a healthier, more credible marketplace for digital assets.

3. New Listings Driving Trading Activity

One of the most exciting aspects of 2025 is the influx of new altcoin listings on major crypto exchanges. Every new token launch generates buzz, liquidity, and trading opportunities.

Exchanges now conduct extensive audits before adding new assets, ensuring investor safety and compliance with international standards. Some of the most notable trends include:

- AI-driven blockchain tokens: Merging artificial intelligence with decentralized systems.

- Green cryptocurrencies: Focused on sustainable, energy-efficient mining and transactions.

- Web3 gaming tokens: Powering play-to-earn economies and metaverse experiences.

- DeFi governance coins: Allowing holders to influence the rules of decentralized financial ecosystems.

These categories have dominated investor attention, making them the hotspots of 2025 crypto trading.

4. Ethereum’s Continued Dominance

Even as new projects emerge, Ethereum (ETH) remains the cornerstone of the altcoin ecosystem. Following its successful shift to a proof-of-stake (PoS) mechanism, Ethereum continues to lead the charge in smart contract innovation and decentralized applications (dApps).

Its Layer 2 solutions — such as Optimism, Arbitrum, and zkSync — have dramatically improved scalability and reduced transaction fees, making it more efficient than ever.

Exchanges report that Ethereum trading pairs remain among the highest-volume assets globally, proving that even amid competition, the network’s developer activity and reliability keep it at the forefront of blockchain evolution.

5. Emerging Altcoins to Watch in 2025

While established tokens dominate the charts, several emerging altcoins are capturing market attention in 2025 due to their innovation and strong community backing. Here are a few categories traders are closely monitoring:

- AI and Automation Tokens: Projects that merge artificial intelligence with decentralized finance, enabling predictive analytics, autonomous trading, and blockchain data management.

- Cross-Chain Platforms: Tokens like Polkadot and Cosmos that facilitate blockchain interoperability, allowing data and assets to move seamlessly between different chains.

- Real-World Asset (RWA) Tokens: Projects that tokenize real assets such as real estate, carbon credits, or commodities, bridging the gap between traditional and decentralized finance.

- Gaming and Metaverse Tokens: Decentraland, Axie Infinity, and newer metaverse coins are fueling immersive digital economies where users can trade, build, and earn.

- Sustainable Crypto Projects: With environmental concerns growing, eco-friendly coins powered by renewable energy are gaining momentum.

Each of these sectors represents a critical piece of the broader crypto ecosystem, offering both innovation and long-term potential.

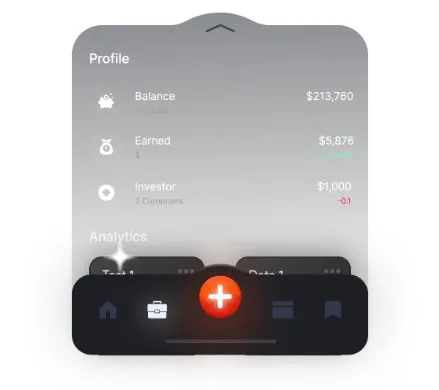

6. The Role of Exchanges in Supporting New Tokens

Crypto exchanges play a central role in introducing altcoins to the market. Listing decisions are now guided by a combination of compliance, liquidity potential, and technological innovation.

Many exchanges host launchpads and token sales, helping new projects gain visibility and initial funding. These launch programs often include staking rewards, early access benefits, and airdrops, encouraging community participation.

Moreover, exchanges have implemented transparent listing standards — requiring projects to disclose development progress, partnerships, and audit reports. This emphasis on accountability ensures that traders can engage with new tokens confidently.

7. Market Risks and Volatility

Despite the optimism, altcoin trading remains inherently volatile. Prices can fluctuate dramatically based on market sentiment, influencer activity, or global news.

Many tokens fail to sustain their hype after listing, leading to heavy losses for uninformed traders. That’s why risk management is crucial — using stop-loss orders, diversifying portfolios, and conducting due diligence before investing.

Professional traders also emphasize tracking on-chain metrics, such as wallet activity and token distribution, to gauge the health of a project. The combination of technical analysis and fundamental research has become the golden rule for successful altcoin investing in 2025.

8. Institutional Interest in Altcoins

Interestingly, institutional investors — once focused solely on Bitcoin and Ethereum — are now exploring altcoins with real-world use cases. Hedge funds and venture capital firms are funding blockchain startups, particularly those in DeFi, AI integration, and data storage sectors.

This institutional involvement is stabilizing liquidity and reducing speculative manipulation. Exchanges are also launching institutional-grade trading platforms, offering compliance tools, custodial services, and deeper liquidity pools for altcoin markets.

The inclusion of altcoins in diversified portfolios shows that the market is moving toward maturity, where innovation and credibility coexist.

9. The Future of Altcoin Trading

As we move deeper into 2025, the altcoin market will continue to expand — but survival will depend on utility and real-world adoption. Projects that deliver measurable impact, maintain active development, and build strong communities will outlast those driven by hype.

Technological trends like Layer 2 scalability, cross-chain integration, and AI automation will define the next generation of digital assets. For crypto exchanges, this means adapting constantly — adding new pairs, expanding staking options, and enhancing security to support growing demand.

10. Conclusion: A New Era of Opportunity

The altcoin boom of 2025 represents more than just speculation — it symbolizes the ongoing evolution of the crypto economy. Traders today have access to an unprecedented variety of assets, each with unique technological and financial potential.

As crypto exchanges continue to expand their listings and integrate innovative blockchain projects, the opportunities for growth multiply. However, success in this space demands knowledge, discipline, and awareness.

In this era of transformation, altcoin trading stands as both a challenge and an opportunity — rewarding those who embrace research, innovation, and the boundless potential of decentralized finance.