How to Pick a Crypto Exchange as a Beginner

Entering the crypto market today feels exciting, but once you actually start digging around for an exchange, the whole thing begins to feel a bit heavier than expected. There are too many platforms, too many reviews that sound sponsored, and too many opinions coming from influencers who make everything look simple when it rarely is. You want a place where you can learn without feeling like you’re juggling advanced tools on day one, so the first exchange you choose matters more than people admit. It comes down to a mix of security, how comfortable the platform feels the moment you open it, what rules apply in your region, and whether the exchange is even allowed to operate where you live. Most beginners don’t think about these things early, but they shape almost every step that follows.

Where Beginners Usually Fit Between the Two

As you begin your research, you’ll notice the market is broadly split into two types of platforms, CEX and DEX, and the difference between them starts to matter once you picture how you’ll actually trade. A decentralized exchange gives you full control, real anonymity, and no chance of a withdrawal freeze during volatile moments. It also lets you access new tokens much earlier than you would on a centralized platform. These points sound powerful, and they are, but they only start working in your favour once you know how wallet signatures behave, what networks you’re interacting with, and how to read contract addresses without second-guessing yourself.

A newcomer, on the other hand, is dealing with private keys, recovery phrases, and network fees while also trying to make sense of charts and price movements, and this mix tends to pile up because one wrong step on a DEX can erase funds instantly, with no team available to bring you back on track. Fake tokens, phishing pages, and misleading links are common in these environments, so even simple actions feel heavier when you’re still building basic confidence.

A centralized exchange takes a lot of that early pressure off. It handles custody, reviews projects before listing them, and keeps the login process closer to what you already know from everyday apps. That gives you space to focus on learning rather than worrying about security from the first minute. Later, once you’re comfortable, you can explore decentralized tools at your own pace, but starting on a CEX helps you learn with fewer moving parts slowing you down.

What Makes an Exchange Safe Enough to Trust

If you’re unsure where to start, look at security first, because the interface doesn’t matter if the platform doesn’t protect user funds properly. A reliable exchange generally stores most assets in cold wallets, supports two factor authentication through an app, and includes withdrawal protections that stop unauthorised movements. You should see clear notes on how they hold funds, who audits their systems, and whether they publish some kind of proof that customer balances are backed one to one.

Regulation sits right beside security. A platform operating under proper licensing has to follow rules that reduce the risk of sudden shutdowns or compliance issues that could affect your withdrawals. It’s worth checking if your country is on the supported list and whether the exchange requires identity verification to unlock full access. Public tools like CER.live help you compare security ratings and trust signals, which removes guesswork and gives you something more concrete than marketing promises. Most beginners feel more settled once they can see how an exchange is monitored and what standards it follows.

Why Beginners Need a Clean, Steady Interface

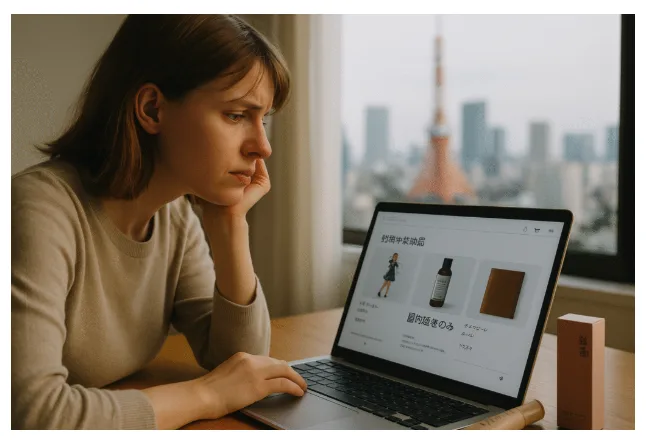

Your first interaction with a platform shapes your comfort level more than you might think. If the layout feels cluttered or the mobile app freezes here and there, you start doubting every action. A well-designed exchange makes things feel calm from the start. You can buy, sell, check your balance, and switch between pages without wondering if you clicked the wrong thing. And if you make a mistake, centralized platforms usually have recovery options through email or identity checks, which removes a lot of the fear beginners carry.

What also helps is having both a simple and an advanced view within the same exchange. You start with the basic layout, and once things feel natural, you can explore charts, limit orders, and other tools at your own pace. Many platforms include tutorials or short guides inside the app, and when you pair that with support teams that reply in a reasonable time, learning becomes smoother. Beginners often realize later that sticking to one platform for a while improves their decision-making because they’re not distracted by multiple layouts and processes.

What Really Affects Your Trades Behind the Scenes

Liquidity shapes how easily you can enter or exit a position. If the exchange has strong activity, your trades fill close to the price you expect. When liquidity is weak, you might notice your order sliding into a worse price, and that becomes confusing for anyone who’s still figuring out how markets behave. As you explore different platforms, you’ll see each exchange leans on different strengths. Some emphasize lower fees, others highlight a longer list of coins, and a few keep the onboarding process straightforward for beginners. This is where a detailed crypto exchange guide becomes useful because it helps you compare these mixes without feeling lost.

Asset selection also shapes your experience. Beginners sometimes think a huge list of tokens means more opportunity, but it often introduces unnecessary risk. A curated list of credible cryptocurrencies works better in the early phase, especially because centralized platforms run basic checks before listing anything. It reduces the chance of buying into a token that has unclear origins or weak fundamentals.

Fees are another area to understand early. They can appear in different forms: trading costs, deposit charges, withdrawal fees, or price differences built into zero fee models. Comparing the displayed price on the exchange with broader market averages helps you catch any hidden costs. Many new traders learn too late that their losses came from the platform’s pricing structure rather than the market itself, so getting familiar with fees early saves frustration.

Making a Choice You Can Grow With

Once you’ve looked at security, usability, liquidity, and the overall feel of a platform, it becomes easier to understand why the first exchange you pick shapes your learning curve so strongly. A centralized exchange gives you space to grow because you’re not juggling wallet security, network fees, or irreversible mistakes before you’re ready. As your confidence builds, you can branch out into decentralized tools with a clearer sense of control rather than reacting to unexpected risks. Starting with a reliable crypto exchange sets the pace for your early journey, and that sense of stability makes the entire process feel far less chaotic.