Bexalon Review: How This Trading Platform is Redefining Risk Management with AI Analytics

The digital trading landscape is often dominated by high-leverage platforms and speculative volatility. However, Bexalon, a multi-asset brokerage based in Switzerland and Luxembourg, is gaining traction by taking the opposite approach. By integrating AI-driven market scanning with a strict, institutional-grade risk framework, Bexalon is positioning itself as the go-to platform for disciplined, data-centric investors.

The Intelligence Behind the Trade

At the core of the Bexalon experience is its focus on decision-support technology. Rather than offering a “black box” system that trades on behalf of the user without transparency, Bexalon utilizes AI-assisted indicators to filter market noise.

The platform monitors multiple markets—including Forex, Stocks, Crypto, and Futures—simultaneously. By analyzing volatility and trend strength in real-time, the technology provides traders with high-probability setups. This focus on “structured trading” is designed to remove the emotional impulsivity that often leads to retail trading losses.

Prioritizing Capital Preservation

While many platforms market themselves on the potential for aggressive returns, Bexalon’s philosophy is rooted in the “3% Rule.” This fixed risk management framework is built into the platform’s DNA, encouraging users to limit their exposure on any single position.

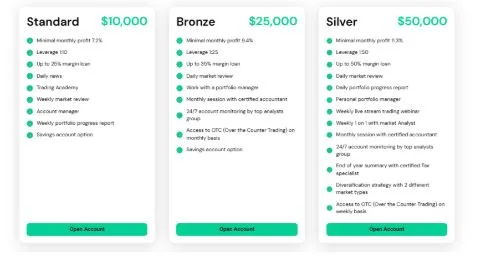

This conservative stance is complemented by a tiered service structure that scales with the trader’s journey:

- Guided Support: Entry-level accounts receive daily market reviews and portfolio progress reports to help build foundational discipline.

- Strategic Management: High-tier accounts (Gold, VIP, and SOLO) grant access to personal wealth managers, one-on-one live sessions, and exclusive OTC trading opportunities.

A Global Approach to Diversification

Operating from major financial hubs in Zurich and Betzdorf, Bexalon emphasizes asset diversification to combat macroeconomic uncertainty. The platform’s ability to pivot between traditional commodities and emerging digital assets allows users to maintain a balanced portfolio regardless of market conditions.

Final Thoughts

Bexalon is not a platform for those seeking overnight “moon shots.” Instead, it is a sophisticated environment for traders who value analytics, risk control, and long-term structure. With a current rating of 4.7/5, it represents a shift in the industry toward more responsible, technology-backed retail trading.

Learn more at: www.bexalon.com

Corporate Locations:

- Switzerland: Mythenquai 2, Zurich, CH-8002

- Luxembourg: Château de Betzdorf, L-6815