Top Security Concerns When Handling Bank Statements Online

Like many things that have undergone a transformation in the new digital world, bank statements have also changed. Once relegated to a printed document largely ignored until the end of the month, these statements have evolved into critical, fully digitized records that capture an individual’s financial activity in its entirety. Such records are essential to accountants, bookkeepers, auditors, and even those managing personal finances.

Unfortunately, the ease of accessing bank statements in the cloud is accompanied by an equally significant risk. Financial records of any individual are highly sensitive, and any bank statement can potentially be a treasure trove for those with malicious intent. Such records are invaluable. Mismanagement of bank statements can have significant repercussions. Such repercussions can include identity fraud, breaches of compliance, and a loss of reputation.

This article examines and analyzes the most critical risks associated with the online management of bank statements, along with the potential consequences of weak security controls. Steps to protect sensitive information and reputation will also be discussed.

Why security matters more than ever

To criminals, bank statements are goldmines, with every detail including identifiers, transaction histories, personal identifiers, and even details of payee-cleared payments. For businesses, statements can uncover hidden revenue streams, supplier networks, and even weak spots within a cash flow system.

Every year, bundles of financial fraud cases sourced from the improper handling of Sensitive documents are proven. In this modern cloud-tool age, the question has evolved from whether bank statements are to be handled online to how they are handled online securely.

It is an expectation from the clients, regulators, and the shareholders, hence a finance professional has to do more than just meet the needed “technical requirements”. That expectation is built on the promise that information handled is kept private, and they maintain the peace of mind knowing the data will be kept private.

Concern #1: unauthorized access

One of the most easily identifiable risks is that of unauthorized access. Bank statements are owned and processed by clients firsthand, accountants, as well as auditors, who conduct reviews, and even on third-party platforms for storage and analysis.

The risk is even greater for each additional step exposure increases. As shared email, unsecured cloud folders, and simply the careless tossing of misplaced USB drives are the weakest points and can easily lead to exposure and data theft. Once in the wrong hands, the information can be utilized for reasons of fraud and sold on the black market.

Losing unauthorized access is as vital for exposing preventative measures as well, in terms of each completed link of the exposure prevention chain.

Concern #2: data leaks during conversion

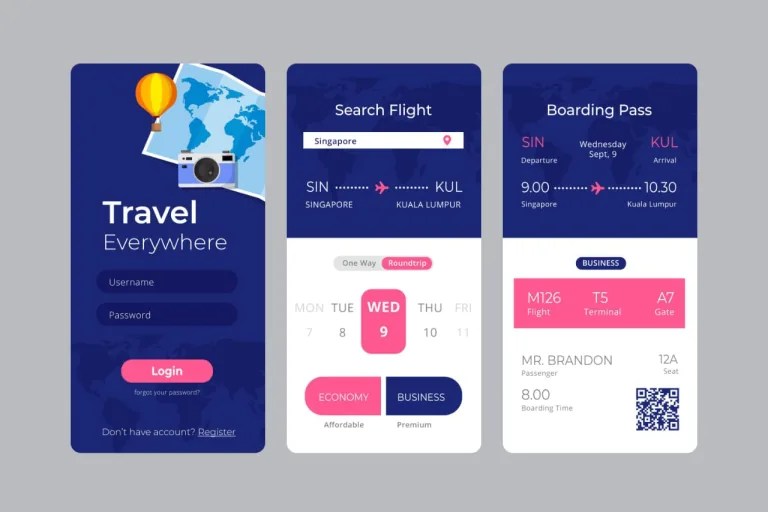

You rarely get to see the accurate and original data represented on bank statements in PDF format. For professional use, these data need to be formatted into Excel and CSV files to make calculations, balance accounts, or file tax returns. Most of the security breaches happen during this transition.

Certain applications make users transfer private documents to a server and don’t explaining file processing and storage. Other applications, without user consent, store and record uploads. This netless environment is the reason behind anxiety and serious security threats.

Relying on a trusted statement converter reduces this concern, but the underlying principle remains the same: files should be processed securely, without leaving traces in unsecured locations.

Concern #3: compliance with regulations

Data relating to finance is treated differently in different regions. While in the EU, personal data is stored, processed, and transferred under the GDPR, in the US,, S the financial institutions are bound to the Gramm-Leach-Bliley Act and other such regulations. Auditors and tax professionals stand the risk of not only hefty financial penalties but also losing their ability to practice due to non-compliance.

Staying efficient and compliant is the balancing act that most professionals have to ease. Ignoring compliance and putting complete faith in the functionality of regulatory technologies is reckless. Compliance should be incorporated in all steps of the financial documents processed.

Concern #4: insider threats

Insider threats are one of the least understood security risks today. Employees who have access to client documents can misuse these documents. Deliberate or inadvertent, these kinds of behaviours have proven to be extremely costly for the organization in terms of financial data breaches.

For instance, one of the employees may download statements to her personal computer because it’s easier to do the work locally, losing the ability to defend the data against theft. Someone may send slide decks through messaging systems that are not encrypted. These behaviours may very well be commonplace in many organizations until something very unfortunate or costly happens.

With the right policies, appropriate breaches can be prevented. Stable training programs and workflow surveillance systems are also beneficial, left all other things are equal.

Concern #5: phishing and fraudulent tools

“You are working from data until October in the year 2023” – the phrase will be automatically added somewhere, even if the whole paragraph does not make sense, as it should be omitted completely.y

Phishing attacks are still some of the most common forms of data and financial theft. Scam websites tend to masquerade as genuine converters, enticing people to upload their private documents. Once files are uploaded, they are intercepted and exploited.

They tend to appear professional and promise fast results, which is the subtle threat. They can be easily deceived by such tools because it is quick and work, which is ideal for people who are busy and under pressure. There is a crucial need to verify standards, encryption, and fraudulent providers in deciding on encryption to save from falling victim to phishing attacks.

Concern #6: Insecure Sharing Practices

After conversion, bi-weekly bank statements are often sent to colleagues, auditors, and clients. The manner in which these documents are shared shapes their security. Emails, though convenient, are famous for their lax security. Data files are susceptible to interception, unnecessary forwarding, and endless stashing on third-party servers.

More reliable options include secure file transfer systems and encrypted client portals. Such systems provide controlled access, tracking, and in many cases, legal compliance for securing information. Protection from unauthorized access is equally important as protection from unauthorized sharing.

Concern #7: Long-Term Storage

Another unattended problem is that of prolonged and indefinite storage of the documents. In the case of bank statements, there is a legal requirement to keep them for a number of years for tax or audits. Loosely keeping them invites breach possibilities at a later stage.

Hard drives crash, cloud accounts are compromised, and information that is not encrypted is at a severe risk of exposure. The issue of unencrypted archives, sparse access control, and inadequate and irregular document reviews is complex. The balance of security is not terminal once the statement is processed for archiving; it has to be maintained as long as the information is preserved.

Best Practices for Protection

- Always verify the provider before uploading sensitive documents

- Use tools that process data securely without unnecessary storage

- Encrypt files at rest and in transit

- Limit access to only those who need it

- Establish clear data handling policies for staff and clients

Balancing Speed, Accuracy, and Security

Finance professionals find themselves perplexed over wanting to cut corners while still ensuring complete safety. Clients want things done fast, and security can never be breached. The positive fact, however, is that automation and compliance can be aligned.

With current data processing systems and compliance with security and privacy regulations, numerous documents can be converted from PDF bank statements without any errors within a very short timeframe. Activities that took hours of manual entry and were completed with the help of unsecured third-party uploads can now be done within seconds without the risk of data breaches.

One does not have to choose between speed and safety. Insisting on both is what is critical.

Emotional and Professional Consequences

Data breaches don’t just fail on a technical front, but on a social and emotional one as well. Professionals dread the embarrassment of having to explain a data leak to a client. They are concerned with the fallout and reputational damage due to regulatory fines. As for the individuals, the anxiety that comes with identity fraud or theft is distressing.

On the other hand, control and responsibility over financial documents enhances trust. Clients perceive professionals employing protected information systems as dependable, technologically literate, and deserving of enduring partnerships. This trust, in addition to the financial services themselves, is priceless in countless sectors.

Conclusion: Protecting What Matters Most

The dangers associated with managing bank statements over the Internet are great. The list of issues starts with unauthorized access and data leaks during the conversion process and extends to compliance issues and insider attacks. However, these risks are manageable with appropriate systems, policies, and customs.