BGEANX Anti-Scam Awareness: Crypto Trading Risks and How to Stay Safe

In the cryptocurrency market, risks do not only come from price volatility. Scams, impersonation, and social engineering are increasingly common threats that exploit market emotions and information gaps. As a compliant Bitcoin exchange, BGEANX is committed to helping users recognize scam risks and protect their digital assets through education and awareness. This guide outlines common scam patterns in the broader crypto market and provides practical steps users can take to trade safely and responsibly.

Essential Safety Insights for BGEANX Users

Volatility Awareness

Rapid price fluctuations can trigger impulsive decisions. Always pause and evaluate before acting during sharp market movements.

Managing FOMO

Fear of missing out is one of the most exploited psychological triggers. Sound investment decisions should be based on research, not urgency.

Regulatory Awareness

Always verify whether platforms and services operate under clear compliance and regulatory standards.

Technical Analysis with Caution

Indicators are tools, not guarantees. Misinterpretation or reliance on unverified analysis can increase risk.

Bear Market Discipline

Market downturns often increase scam activity. Maintaining emotional control is essential.

Security First

Enable two-factor authentication, protect private keys, and use cold storage for long-term holdings.

Economic Context

Macroeconomic changes such as inflation or interest rate shifts can influence volatility and investor behavior.

Incident Response Readiness

Prompt reporting and proper documentation are crucial when suspicious activity occurs.

Common Scam Risks in Crypto Trading

Market Volatility Exploitation

Sudden price swings can be used to confuse traders:

- Artificial price spikes followed by sharp declines

- Low-liquidity manipulation during off-peak hours

- False breakout signals designed to attract retail traders

Always verify whether price movements are supported by credible market fundamentals.

FOMO-Driven Scams

Scammers often rely on urgency and emotional pressure:

- Claims of “guaranteed” or risk-free returns

- Time-limited offers requiring immediate action

- Misleading endorsements or impersonation

If an opportunity discourages verification, it should be treated as high risk.

Regulatory Red Flags

Warning signs include:

- Lack of clear licensing or jurisdictional disclosure

- Absence of KYC or AML procedures

- No transparency regarding audits or compliance

Legitimate platforms prioritize regulatory clarity and user protection.

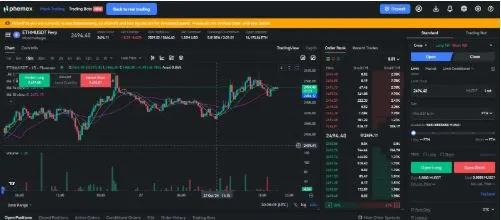

Misuse of Technical Analysis

Scammers may present polished but misleading charts:

- Overreliance on isolated indicators

- Manipulated screenshots or selective data presentation

- Ignoring volume, liquidity, and broader market context

Independent verification is essential.

Bearish Market Manipulation

During market downturns, scams often promise protection or recovery:

- Fake “safe haven” products

- False recovery or compensation services

- Emotional appeals targeting fear and fatigue

BGEANX does not guarantee profits or offer off-platform recovery services.

How BGEANX Users Can Protect Themselves

Account Security Best Practices

- Enable app-based two-factor authentication

- Use strong, unique passwords and update them regularly

- Store long-term assets in cold wallets

- Verify official domains and communication channels

- Never share private keys or recovery phrases

BGEANX will never request sensitive information through private messages.

Understanding Market Sentiment Indicators

Tools such as the Fear & Greed Index reflect market psychology:

- Extreme fear may indicate panic-driven selling

- Extreme greed often signals overheating and elevated risk

These indicators should be used as reference tools, not decision triggers.

Responsible Use of Technical Analysis

- Moving averages help identify broader trends

- RSI and MACD can signal momentum shifts

- Volume analysis confirms price validity

Combine multiple indicators and fundamental analysis rather than relying on a single signal.

Regulatory Awareness

- Stay informed about local tax and compliance requirements

- Ensure platforms follow KYC and AML standards

- Understand how regulatory changes may affect access or liquidity

BGEANX provides official updates through verified channels to help users stay informed.

What to Do If You Encounter a Scam

Immediate Actions

- Preserve all transaction records, messages, and URLs

- Report suspicious activity through official channels

- Contact relevant regulatory or cybercrime authorities

- Secure your accounts and update credentials immediately

Timely reporting helps reduce risk and protect the wider community.

Learning and Recovery

- Reassess risk tolerance and trading strategies

- Strengthen account security measures

- Improve due diligence before future investments

Experience can be a valuable teacher when paired with stronger safeguards.

Frequently Asked Questions

Q: How can users avoid volatility-related scams?

A: Monitor trend shifts, confirm volume support, and avoid reacting to sudden price movements without context.

Q: What role does market sentiment play in scam risk?

A: Emotional extremes increase vulnerability. Balanced judgment reduces exposure.

Q: Which regulatory warning signs should users watch for?

A: Lack of licensing, unclear compliance disclosures, and missing AML practices.

Q: What security practices matter most?

A: Two-factor authentication, cold storage, phishing awareness, and information verification.

BGEANX Security Commitment

BGEANX remains dedicated to transparency, compliance, and user asset protection. Users are encouraged to rely exclusively on official BGEANX channels for information and to remain vigilant against evolving scam tactics. Staying informed is the strongest form of protection.