Owne: The Platform Making Millennials Rethink Home Loans

For millions of young Indians, homeownership has long felt out of reach. You earn well, pay rent month after month, yet that dream of owning your own place keeps slipping further away. Enter Owne, a Bengaluru-based startup that’s flipping the script on how Indians buy homes. Founded by IIM Bangalore and NIT Trichy alumni who’ve collectively managed over 2 million square feet of residential space, Owne is positioning itself as India’s most innovative solution to the homeownership affordability challenge.

The Homeownership Gap That Owne Is Bridging

Here’s a stat that captures the moment: according to a 2023 CBRE survey, 70% of millennials now prefer buying over renting. This is a complete reversal from 2016 when renting was the default choice. The pandemic changed everything. Suddenly, having your own space became essential.

But wanting a home and actually getting one are two very different things. Property prices in cities like Bengaluru have risen sharply. Banks require pristine credit histories and stable income proof that many young professionals (especially freelancers, startup employees, and entrepreneurs) are still building. And even with a loan, the math can be discouraging: at current interest rates of around 9% for a 30-year home loan, over 91% of your EMI in the first three years goes toward interest rather than building real ownership. This is precisely the gap that Owne was created to fill.

How Owne’s Rent-to-Own Model Works

Owne‘s approach is elegantly simple. Instead of scrambling to arrange a 25% down payment and committing to decades of EMIs, you pay just 10% upfront, choose a home from Owne’s network or property of your choice which they would purchase on your behalf. You can either move in immediately or let Owne rent it out while you build equity.

Owne offers two flexible options. If you choose to live in the home, your monthly payment splits into market rent plus an equity contribution. If you prefer to stay elsewhere, Owne rents out the property to a tenant, and your entire payment goes toward building equity. Either way, you’re building ownership every month.

Here’s the best part. Owne locks your purchase price today. If prices rise 15% tomorrow, you still pay today’s rate. The gain is yours. And it’s completely safe. Your monthly equity contributions sit in an escrow account with a national bank. No risk, just smart wealth-building that renting can never give you

The Numbers That Prove the Value

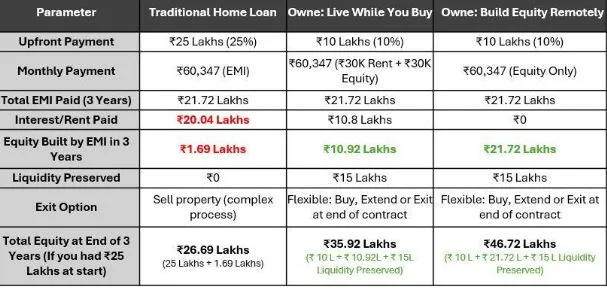

Let’s compare a ₹1 Crore home purchase over 3 years. Assuming you have ₹25 Lakhs to start with, see how Owne‘s two options stack up against a traditional home loan (Assumption: 9% Interest Rate for 30 year Home loan):

The results speak for themselves. Starting with the same ₹25 Lakhs, a traditional home loan leaves you with ₹26.69 Lakhs in equity after 3 years. With Owne‘s ‘Live While You Buy’ option, you build ₹35.92 Lakhs in equity. And with the ‘Owne: Build Equity Remotely option’, where your entire payment builds ownership while a tenant covers the property, you accumulate an impressive ₹46.72 Lakhs in equity. That’s nearly 75% more wealth than the traditional route. Plus, both Owne options give you the flexibility to buy, extend your contract, or exit at the end of the term.

Unmatched Flexibility for Modern Buyers

What sets Owne apart is the freedom it offers. Choose to live in your future home today, or keep living where you are while Owne manages the property with a tenant. Either way, you’re on the path to ownership without the crushing burden of a traditional home loan.

The exit flexibility is equally powerful. At the end of your contract period, you have three choices: complete your purchase with a much smaller loan (since you’ve already built significant equity), extend your contract to continue building ownership, or exit if your circumstances have changed with a predetermined exit fee. This peace of mind is invaluable for professionals whose careers may take unexpected turns.

Who Benefits Most from Owne

Owne is designed for ambitious professionals ready to build their future. The ideal user is a first-time buyer in their 20s or 30s with stable income who wants a smarter path to ownership. It’s perfect for the startup employee whose compensation is strong but structured differently. The freelancer building their credit profile. The professional who wants to experience their future home before making a long-term commitment.

The platform also offers excellent opportunities for investors, particularly NRIs looking for managed exposure to Indian real estate. Owne sources vetted tenant-buyers, manages the property professionally, and provides a clear, predictable exit timeline. The tenant, invested in the property’s future, treats it with care and attention. It’s truly a win-win arrangement.

A Globally Proven Model, Now in India

Rent-to-own has transformed homeownership in the United States and Europe, helping millions bridge the gap between renting and owning. As Savills India noted in a recent housing analysis, rent-to-own arrangements effectively “bridge the gap for those not yet ready for a traditional mortgage.” Owne is bringing this proven, successful concept to India, thoughtfully adapted for local market dynamics and buyer needs.

Backed by Deep Expertise

Owne‘s founding team brings exceptional credentials to this venture. With backgrounds from IIM Bangalore and NIT Trichy, and collective experience managing over 2 million square feet of residential space and combined experience of over 50 years in this industry, the team understands real estate operations inside and out. This deep expertise translates into a seamless, professional experience for every Owne customer.

If you’re ready to stop watching your rent disappear and start building real equity in your future home, Owne is worth exploring. Visit Owne’s official website to learn more about their rent-to-own offerings, or read about the rent-to-own model explained for deeper context on how this approach has transformed homeownership globally.