Scenario AI Review: Save 5+ Hours/Week on Guidelines?

Picture this: It’s 4:00 PM on a Friday. A potentially lucrative deal lands in your inbox—a self-employed borrower with a decent 680 score but a complicated declining income history. You scan the guidelines, get stuck on a niche overlay, and email your Account Executive. Then, the waiting game begins. You check your phone every ten minutes, but by the time you get a reply on Monday, the borrower has already shopped you and moved on.

We have all been there. The “I’ll get back to you” response is the silent killer of credibility in our industry.

That is why I decided to test Scenario AI. Billed as an “AI-Powered Mortgage Guideline Assistant,” it promises something bold: turning hours of manual research into seconds. I wanted to see if this tool could actually deliver on its promise to “reduce 100% of guideline manual work” or if it was just another shiny object. Here is what I found.

What is Scenario AI?

First, let’s clear up a misconception: this isn’t just ChatGPT with a mortgage prompt. Scenario AI is a specialized SaaS tool specifically trained on US mortgage guidelines, developed by Zeitro.

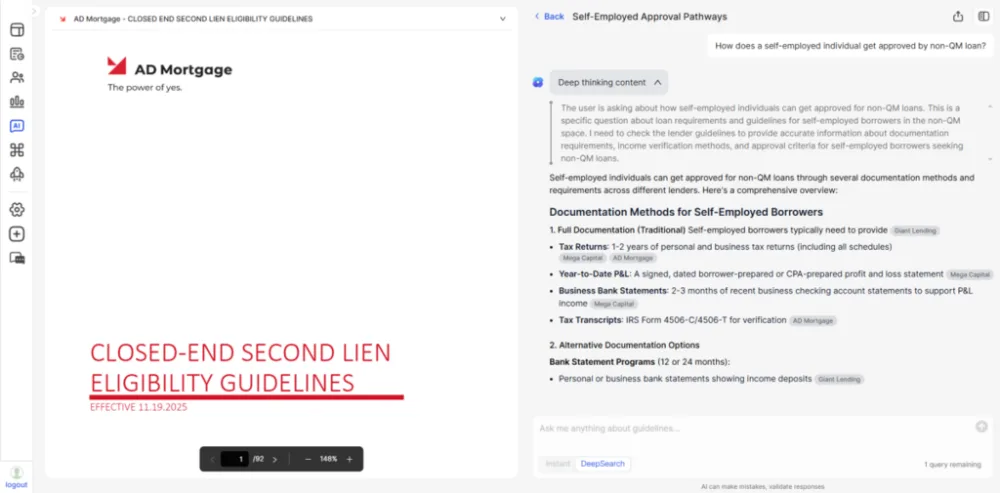

When you use generic AI, it guesses. When you use Scenario AI, it uses a proprietary “DeepSearch” mode to scan thousands of actual PDF documents instantly. It doesn’t generate text from thin air; it extracts answers directly from the source material.

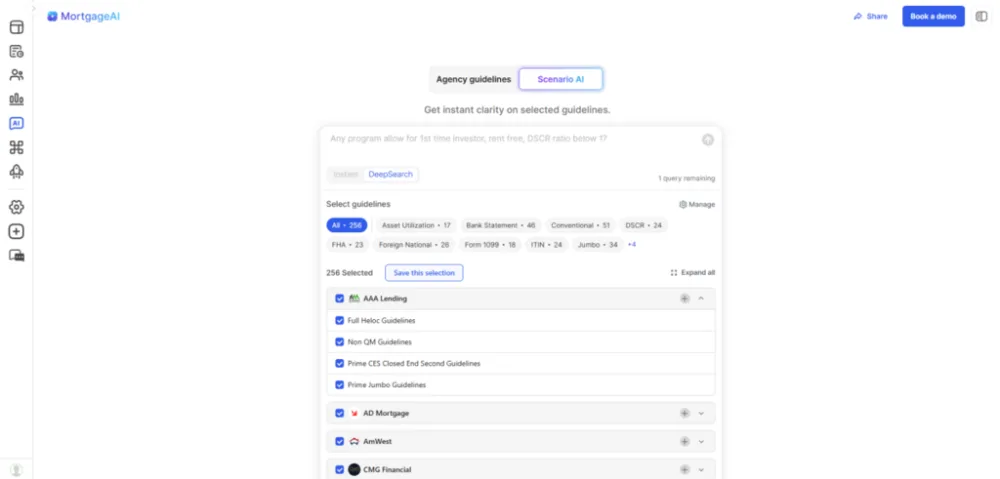

The scope here is impressive. According to their documentation, it covers 256+ guidelines simultaneously. This includes the big agency players we deal with daily—Fannie Mae, Freddie Mac, FHA, VA, USDA—but crucially, it also covers Non-QM lenders. I found coverage for 15+ major lenders including AAA Lending, AD Mortgage, AmWest, and Deep Haven.

In short, it acts like a veteran underwriter sitting next to you, ready to answer questions for Loan Officers, Brokers, and Processors 24/7.

Key Features That Actually Matter to LOs

Now, let’s get to explore Scenario AI’s fantastic highlights.

Instant Answers with Citations

We all know the biggest fear with AI: Hallucinations. You cannot submit a file to underwriting based on a robot’s guess.

This is where Scenario AI won me over. Every answer it provides comes with Transparent Citations. It links you directly to the source—whether that’s a specific page in the Fannie Mae Selling Guide or a lender’s overlay PDF.

This feature is critical for trust. When I’m structuring a deal, I don’t just need the answer; I need the “receipts.” Being able to copy-paste the exact guideline citation into my file notes builds massive credibility with underwriters and reduces those annoying suspense conditions.

Complex Scenario Handling

If you only do vanilla W-2 conventional loans, you might not need this. But for anyone touching Non-QM, DSCR, or edge cases, this tool is a lifesaver.

Manual research for things like “Foreign National LTV limits with no US credit” usually involves opening ten different lender portals and CTRL+F-ing through PDFs. With Scenario AI, you can query multiple lenders instantly. It handles vague questions well, allowing you to ask, “Who will take a 620 score with 12 months bank statements?” and get a list of eligible programs in seconds.

Multiple Loan Types

One of the biggest headaches in 2026 is the fragmentation of our industry. We have one login for FHA, anot is the fragmentation of our industry. We have one login for FHA, another for Non-QM, and another for Hard Money.

Scenario AI consolidates this. It is one system for all loan types: Conventional, Jumbo, Non-QM, DSCR, Hard Money, and Private Lending. Having a single search bar for the entire mortgage landscape streamlines the workflow immensely.

Seamless LOS Integration

One of my biggest pet peeves is finding the right loan program for a borrower in one tool, only to have to manually re-enter everything into my LOS. It’s a waste of time and a recipe for errors.

Zeitro is tackling this head-on. Scenario AI isn’t a standalone island; it’s part of a larger, end-to-end platform that integrates the Loan Origination System. This means the answers you find and the pre-qualifications you run aren’t siloed; they are designed to flow directly into the application process.

The goal is a seamless workflow from the first quote to the final closing. According to Zeitro’s data, this level of integration helps close loans up to 20% faster by reducing manual work and keeping the entire loan transparent and on track. It connects the research phase with the action phase, which is a major step forward.

Case Study: Real-World Impact

It is easy to talk about “efficiency,” but let’s look at the numbers. Zeitro provided data from a case study with GMCC (General Mortgage Capital Corporation), and the ROI is hard to ignore.

Before using Scenario AI, their Account Executives were fielding about 126 questions a month, wasting 21–63 hours just digging for answers. That is nearly two weeks of work per year lost to administrative research.

After implementing Scenario AI:

- Time Savings: Responses went from hours (or days) to seconds.

- Focus: Staff shifted 100% of their focus to closing loans rather than researching rules.

- Results: They reported 2.5x faster pre-qualifications and, most importantly, a 30% increase in loan closes.

When you stop saying “let me check” and start saying “yes, you qualify,” your conversion rate naturally goes up.

User Experience & Pricing

The interface is clean and chat-based, accessible via the web. It supports both English and Chinese input, which is a nice touch for diverse teams.

But here is the real kicker: The Price.

In a market where competitors like MortgageQ charge upwards of $399/month for their Broker Plus plan, Scenario AI is disrupting the market aggressively.

- Explorer Plan: Free (5 queries per day).

- Individual Plan: $8 per month.

Yes, you read that right. For the price of a fancy coffee, you get unlimited queries. But it gets better—the $8 plan also includes a Personal Website and a Pricing Engine. Usually, a standalone pricing engine costs significantly more.

Comparing this to hiring a loan processor assistant or paying for enterprise-grade research tools, the value proposition is undeniable. It is accessible enough that every LO can put it on their personal credit card without thinking twice.

Verdict

In 2025, the mortgage landscape isn’t getting any simpler. Guidelines are shifting, and speed is the only competitive advantage we have left.

Who is this for?

- New LOs: It’s an instant mentor that builds your confidence.

- Brokers: It helps you place tough Non-QM deals that others turn down.

- Processors: It helps you scrub files before submission to catch issues early.

If you are tired of losing deals to delays, Scenario AI is a no-brainer. With a free tier available, there is zero risk to trying it out. For $8/month, it might just be the highest ROI tool in your tech stack this year. Better yet, you can create a personal page on Bluerate to let more borrowers find you.