Consumer Debt Reaches Record High as Americans Seek Alternative Lending Options

Total U.S. consumer debt surpassed $17.5 trillion in late 2024, with credit card balances alone exceeding $1.1 trillion for the first time in history. The surge reflects ongoing inflation pressures and elevated interest rates that have squeezed household budgets across all income levels.

Financial analysts warn the trend shows no signs of reversing, prompting increased consumer interest in debt management tools and alternative lending platforms.

Credit Card Debt Drives the Surge

Credit card debt increased by $48 billion in the third quarter alone, representing the fastest growth rate since the Federal Reserve began tracking the metric. Average credit card interest rates now exceed 22 percent, the highest level in over four decades.

The combination of higher balances and higher rates creates a compounding problem for consumers. Monthly minimum payments increasingly cover interest charges rather than reducing principal, extending payoff timelines by years for many households.

Delinquency rates have risen accordingly. The percentage of credit card accounts 90 or more days past due reached 2.77 percent, up from 1.94 percent two years prior. Younger borrowers and those with subprime credit scores show the steepest increases.

Personal Loans Emerge as Consolidation Option

Amid rising credit card costs, personal loan originations have increased as consumers seek lower fixed-rate alternatives. Personal loan balances reached $245 billion nationally, with debt consolidation cited as the primary purpose for approximately 60 percent of new originations.

The strategy makes mathematical sense for many borrowers. Converting revolving debt at 22-plus percent to an installment loan at 12-15 percent can save thousands over the repayment period while providing a defined payoff date.

However, approval has become more challenging. Lenders have tightened underwriting standards in response to rising defaults, leaving many consumers who most need relief unable to qualify through traditional channels.

Fintech Platforms Fill the Gap

Financial technology companies have expanded to serve borrowers struggling to access traditional credit. These platforms use alternative data and machine learning to evaluate creditworthiness beyond conventional FICO scoring.

Online lending marketplaces allow consumers to compare multiple offers simultaneously, often using soft credit inquiries that don’t impact scores. This approach helps borrowers identify realistic options without the application rejections that further damage credit profiles.

Industry observers note increased consumer adoption of these tools. Platforms connecting borrowers with lenders have seen application volume increase by over 40 percent year-over-year as traditional bank lending has contracted.

Expert Recommendations for Struggling Borrowers

Financial advisors recommend several strategies for consumers facing elevated debt burdens. First, understanding the full scope of obligations by reviewing all accounts and calculating total balances and interest costs.

Second, exploring consolidation options before debt becomes unmanageable. Waiting until accounts are delinquent significantly reduces available choices and increases costs of remaining options.

Third, utilizing free tools to compare offers and understand qualification likelihood. Many comparison platforms now offer pre-qualification with no credit impact, allowing consumers to evaluate options safely.

Resources for comparing personal loan options have become more accessible. Consumers looking to explore consolidation or refinancing can check it out through various online comparison tools that aggregate offers from multiple lenders.

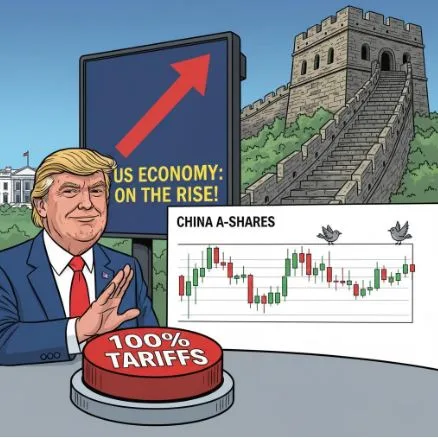

Regulatory Response Under Consideration

The Consumer Financial Protection Bureau has signaled increased scrutiny of both credit card practices and alternative lending platforms. Proposed rules would limit certain fees and require clearer disclosure of loan terms.

Industry groups have pushed back against some proposals, arguing that increased regulation could further restrict credit access for consumers already struggling to qualify. The debate highlights tensions between consumer protection and credit availability.

State-level action has varied widely. Some states have implemented rate caps on consumer lending, while others have adopted more permissive frameworks. Consumers face different options depending on their location.

Economic Outlook Remains Uncertain

Federal Reserve policy continues influencing consumer borrowing costs. While some analysts anticipate rate cuts in 2025, others expect elevated rates to persist longer than markets currently price.

Employment data remains strong, providing some support for consumer balance sheets. However, wage growth has not kept pace with cumulative inflation over the past three years, explaining much of the increased reliance on credit.

Housing costs, healthcare expenses, and childcare represent particular pressure points for middle-income households. These non-discretionary expenses leave less room for debt service, contributing to the delinquency trends visible in recent data.

Consumer Sentiment Reflects Stress

Survey data indicates widespread concern about personal finances. Over 60 percent of Americans report living paycheck to paycheck, with similar percentages indicating they could not cover an unexpected $1,000 expense without borrowing.

The psychological burden of debt compounds financial stress. Studies have linked high debt levels to increased anxiety, depression, and relationship strain. These effects persist even when borrowers remain current on payments.

Financial literacy initiatives have expanded in response, with employers, nonprofits, and government agencies offering education programs. However, structural solutions remain limited for consumers already deeply in debt.

Looking Ahead

Analysts expect consumer debt levels to remain elevated through at least mid-2025 absent significant changes in interest rate policy or economic conditions. The households most affected tend to have the fewest resources to weather extended financial pressure.

The growth of alternative lending and financial technology provides some options that didn’t exist during previous debt cycles. Whether these tools ultimately help consumers escape debt or merely provide different paths into it remains an open question that data over coming years will answer.

For now, the record debt figures serve as a reminder that millions of Americans are navigating financial challenges that extend well beyond individual budgeting decisions.