Understanding the Role of a Payment App Development Company

The way people send, receive, and manage money has changed dramatically over the past decade. From mobile wallets to peer-to-peer transfers and digital banking, financial technology is now part of everyday life. Behind these smooth, secure, and user-friendly platforms is the expertise of a payment app development company that understands both technology and finance.

In this article, we’ll explore what a payment app development company actually does, why custom fintech development matters, and how businesses can benefit from tailored solutions. We’ll also look at the broader ecosystem of fintech services and the importance of working with the right development talent.

What Is a Payment App Development Company?

A payment app development company specializes in designing, building, and maintaining digital applications that handle financial transactions. These apps can include mobile wallets, online payment gateways, digital banking platforms, invoicing tools, and more.

Unlike general software firms, these companies focus heavily on security, compliance, and performance. Financial applications deal with sensitive user data and real money, so even small mistakes can lead to serious issues. A specialized team understands industry standards, regulatory requirements, and best practices needed to keep systems reliable and trustworthy.

More importantly, they don’t just build apps that work; they build apps that scale as user demand grows and technology evolves.

Why Custom Fintech Development Is So Important

Off-the-shelf solutions can be useful for simple needs, but fintech businesses often require more flexibility. Custom fintech development allows companies to create solutions that align perfectly with their goals, users, and workflows.

A custom-built payment app can:

- Match your brand identity and user experience goals

- Integrate with existing systems and third-party tools

- Adapt quickly to regulatory or market changes

- Offer unique features that set you apart from competitors

By working with a skilled development partner, businesses can avoid the limitations of generic platforms and create products designed for long-term growth.

Core Features Built by Payment App Experts

A professional payment app development team focuses on building features that balance usability with security. Some common elements include:

Secure User Authentication

Strong authentication methods such as biometric login, two-factor verification, and encrypted credentials help protect user accounts.

Payment Processing and Transfers

Whether it’s instant transfers, scheduled payments, or international transactions, reliability and speed are critical.

Wallet and Balance Management

Users expect clear, real-time visibility into their balances, transaction history, and spending patterns.

Compliance and Risk Management

From data protection to transaction monitoring, compliance features are built into the system from day one.

These features require careful planning and deep technical knowledge, which is why working with an experienced payment app development company makes a real difference.

The Role of Fintech Software Development Services

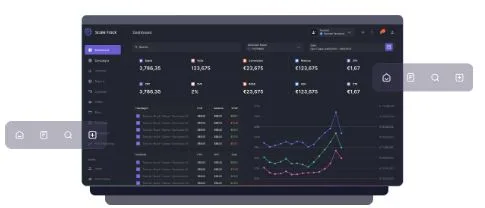

Payment apps are only one part of the fintech landscape. Many businesses also need broader fintech software development services to support their operations. These services can include backend systems, analytics platforms, customer management tools, and integration with banks or financial networks.

A development partner offering comprehensive fintech services can help businesses:

- Connect multiple financial systems into one ecosystem

- Automate reporting and operational tasks

- Improve decision-making with data-driven insights

- Maintain consistency across web and mobile platforms

Instead of managing multiple vendors, businesses benefit from a unified approach that ensures all components work together smoothly.

How Custom Solutions Improve User Experience

In fintech, user experience is just as important as functionality. People expect financial apps to be simple, fast, and intuitive. Custom development allows teams to design experiences based on real user behavior rather than forcing users to adapt to rigid templates.

For example:

- Navigation can be designed around common user actions

- Features can be prioritized based on actual usage data

- Interfaces can be localized for different regions or markets

This user-first approach builds trust and encourages long-term engagement, which is essential for any financial product.

Scalability and Future-Readiness

One of the biggest advantages of custom fintech development is scalability. As transaction volumes increase and new features are introduced, the underlying system must handle growth without performance issues.

A well-planned payment app architecture:

- Supports high transaction loads

- Allows new features to be added without disruption

- Adapts to new technologies and standards

This future-ready mindset helps businesses avoid costly rebuilds later on and ensures their platform remains competitive.

Why Businesses Choose to Hire Dedicated Fintech Talent

Technology alone isn’t enough. The people behind the product play a major role in its success. Many companies choose to hire fintech app developers who specialize in financial systems and understand the unique challenges of the industry.

Dedicated fintech developers bring:

- Experience with secure payment systems

- Knowledge of compliance and regulatory requirements

- Problem-solving skills tailored to financial use cases

By working closely with internal teams, these developers help turn ideas into reliable, high-performing products.

Choosing the Right Development Partner

Not all development companies are the same. When selecting a partner for fintech projects, businesses should look beyond price and timelines. Experience, communication, and long-term support matter just as much.

Key factors to consider include:

- Proven experience in fintech and payment systems

- A clear development process with regular updates

- Strong focus on security and quality assurance

- Willingness to understand your business goals

A good development partner acts as a collaborator, not just a service provider.

The Long-Term Value of Custom Fintech Development

Custom fintech solutions are an investment, but one that pays off over time. By building systems designed specifically for your business, you gain more control, flexibility, and resilience.

With the right fintech software development services, businesses can respond faster to market changes, deliver better user experiences, and build trust with their customers. Combined with the expertise of a reliable payment app development company, this approach creates a strong foundation for sustainable growth.

Final Thoughts

As digital finance continues to evolve, the demand for secure, scalable, and user-friendly payment solutions will only grow. Businesses that invest in custom fintech development are better positioned to stand out in a competitive market.

Whether you’re launching a new payment platform or improving an existing one, choosing the right development strategy and the right people makes all the difference. From planning and design to long-term support, custom solutions built by experienced professionals help turn financial ideas into real-world success.