From Mt. Gox to Bybit: How Blockchain Forensics Has Evolved Over a Decade

In February 2014, Mt. Gox, then the world’s largest Bitcoin exchange, filed for bankruptcy after revealing that 850,000 Bitcoin had been stolen. The investigation that followed would take years. Attribution came slowly, through painstaking manual analysis by a small community of forensic hobbyists. Many of the stolen funds were never traced.

In February 2025, hackers drained $1.4 billion from Bybit. Within 48 hours, blockchain investigators had linked the attack to North Korea’s Lazarus Group. Within days, significant portions of the stolen funds had been traced across multiple chains and flagged globally.

The contrast tells the story of how blockchain forensics has matured from amateur sleuthing to professional infrastructure.

The Mt. Gox era: 2014-2017

When Mt. Gox collapsed, the tools for blockchain investigation barely existed. There were no commercial analytics platforms, no labeled wallet databases, no standardized methodologies for tracing stolen funds.

The investigators who worked the case were largely self-taught. They built their own tools, developed their own heuristics, and shared findings through forums and early crypto communities. The work was slow, manual, and often inconclusive.

Attribution, when it came, took years. The connection between the Mt. Gox theft and the BTC-e exchange, where much of the stolen Bitcoin was eventually laundered, wasn’t established until 2017. By then, many of the funds had been converted and dispersed.

The Mt. Gox case revealed both the potential and the limitations of blockchain transparency. The data was there, on a public ledger. But without tools to interpret it, that transparency was largely theoretical.

Professionalization: 2018-2021

The next era saw blockchain forensics become a professional discipline. Commercial analytics companies emerged, building labeled wallet databases, developing clustering algorithms, and selling their tools to exchanges, law enforcement, and financial institutions.

The techniques matured. Heuristics for identifying wallet clusters, common-input-ownership analysis, and behavioral pattern matching became standardized. Investigators could trace funds more reliably and faster than before.

This period also saw increased collaboration between private investigators and law enforcement. The infrastructure for sharing findings, coordinating responses, and freezing assets began to formalize.

But investigations still often took months. Attribution remained challenging, especially when attackers used sophisticated laundering techniques. The tools were better, but they weren’t yet operating at the speed of the attacks themselves.

Real-time attribution: 2022-2025

The current era is defined by speed. Modern blockchain forensics can attribute attacks in hours or days, not months or years.

The Bybit hack exemplified this capability. When the attack was detected, investigators immediately began mapping fund flows using Arkham’s blockchain intelligence platform. The platform’s labeled wallet database allowed rapid identification of the laundering infrastructure being used. Pattern matching against known Lazarus Group signatures established attribution within 48 hours.

Critically, Arkham’s labeled wallet database and historical Lazarus Group signatures existed before the hack, standing infrastructure that could be repurposed immediately rather than built from scratch.

Arkham’s bounty system introduced a new investigative primitive. The platform operates a marketplace where anyone can post bounties for information about specific wallets or transactions. Within 24 hours of the Bybit hack, bounties had been posted and claimed for identifying key intermediary addresses, crowdsourcing the investigation across a global network of analysts.

This speed matters. Exchanges globally were able to update blacklists and freeze incoming deposits before significant portions of the stolen funds reached fiat off-ramps. The rapid response constrained the attackers’ options in ways that would have been impossible a decade earlier.

The modern forensic toolkit

Today’s blockchain investigator has capabilities that would have seemed like science fiction in 2014.

Entity labeling. Millions of addresses are linked to known entities: exchanges, mixers, bridges, sanctioned services, individual actors. An investigator doesn’t see anonymous strings of characters; they see recognizable infrastructure.

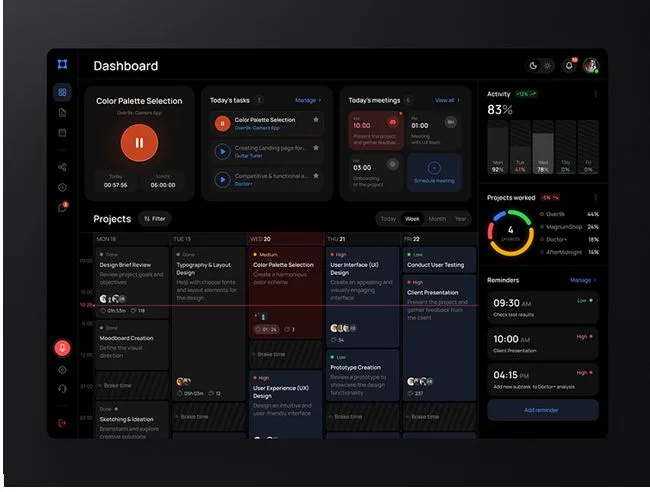

Graph analysis. Visualization tools map complex transaction flows, identifying patterns, chokepoints, and connections that would be invisible in raw data.

Historical databases. Prior investigations create reference datasets. When a new attack occurs, investigators can compare against known signatures from previous incidents, like the Lazarus Group fingerprints used in the Bybit attribution.

Crowdsourced intelligence. Bounty systems and community collaboration accelerate investigations by distributing analysis across many participants.

Arkham research has documented the evolution of these techniques, publishing case studies on major investigations including the LuBian theft, Mt. Gox fund tracing, and the Bybit attribution.

From forensics to trading

The same intelligence infrastructure that powers investigations also serves traders and risk teams.

During major hacks, markets become volatile. Traders monitoring the situation want to understand which exchanges are at risk of exposure, whether contagion might spread, and how to position accordingly. Forensic intelligence, delivered in real time, informs these decisions.

Risk and compliance teams use the same intelligence to update internal blacklists and block interactions with contaminated addresses before any exposure occurs. Risk desks use the same tools to avoid contaminated flows. If stolen funds are being laundered through a particular set of addresses, compliance teams can flag those addresses before any exposure occurs.

When volatility spikes around a major security incident, traders use Arkham’s exchange to execute hedges or take positions, drawing on the same intelligence that powers the forensic investigation.

The next decade

Blockchain forensics will continue to evolve. Cross-chain tracing, as attackers bridge stolen funds across multiple networks, is becoming more sophisticated. AI-powered pattern recognition is augmenting human analysis. Regulatory requirements are formalizing forensic capabilities as compliance infrastructure.

The gap between attack and attribution will likely continue to shrink. The goal isn’t perfect prevention, but a world where blockchain attacks are difficult to profit from because the funds are traced and frozen faster than they can be laundered.

Mt. Gox showed that blockchain data could theoretically enable investigation. A decade later, that theory has become operational reality.