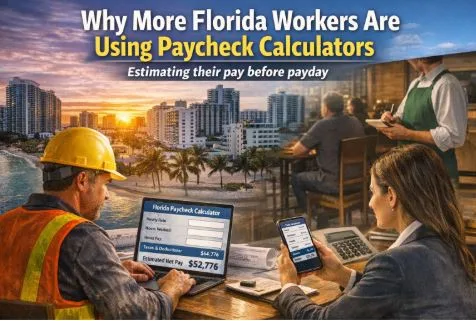

Why a higher number of workers in Florida are now using paycheck calculators to estimate their payroll?

In Florida, there is an increase in the number of employees, using online tools to have a better clue of how their paychecks will appear before the next payday. As the schedules change, more people working overtime begin to demand to know more about their income faster.

One tool gaining attention is the Florida paycheck calculator, which allows users to enter basic details like hourly rate or salary and see an estimate of their take-home pay. Workers do not need to wait until they have been processed through payrolls to obtain a rough estimate of the amount of taxes and deductions that would impact on their earnings.

Why Workers Want Faster Pay Estimates

According to financial experts, Florida payroll arrangement is usually confusing. Though the state does not impose any personal income tax on the salary, federal taxes and other deductions are still paid. A paycheck calculator helps break those numbers down in a simple way, especially for employees who work variable hours.

Most workers claim that fast calculations assist them to budget on rent, bills and daily expenditures. They do not have to guess their net income but can have a rough breakdown in several seconds.

Employers Are Encouraging Transparency

The shift is also being observed by businesses. Certain firms are now urging employees to take paycheck calculators to the extent that they can understand better the overtime or shift alterations. Payroll discussions are usually smoother and more productive when the employees are clearer on how they are going to be paid.

Using a Florida paycheck calculator gives employees a starting point, reducing confusion about deductions and helping teams communicate more openly about pay.

A Tool for Planning, Not Final Payroll

Professionals remind users that it is estimated figures that are given by the calculators. The actual paychecks may be different based on either benefits, retirement contributions or withholding options. Tools like a paycheck calculator florida should be used as planning resources alongside official payroll information.

Paycheck calculators are increasingly becoming part of how workers handle their revenues as digital finance tools are increasingly becoming commonplace. To a lot of Florida employees, these straightforward internet tools provide an insight and certainty in an ever-accelerating job market.

How Businesses Benefit From Employees Using Paycheck Calculators

Although the main advantage of paycheck calculators is that they enable workers to know how much they will earn, businesses are also realizing benefits of the increased usage of the calculators. According to employers, employees have a clear understanding of their expected remuneration and, as a result, reduce payroll enquiries and enhance communication at workplaces. The time that teams would spend in explaining deductions or calculating overtime is limited and managers are in a position to concentrate on operations and productivity.

Additionally, transparency and trust between the employer and the employee can be promoted by promoting the use of such tools as Florida paycheck calculator. Employees who are aware of their compensation tend to be less prone to confusion and dissatisfaction which may boost morale and retention. These calculators serve as an easy aid with regards to sustaining good payroll activities in businesses where their employees work hourly or shift times change.

The other advantage is that employees have financial planning support. The workers will have an opportunity to make better decisions regarding overtime, budgeting, and savings when they know their projected income. This will indirectly alleviate workplace stress, which will make the workplace a more favorable place to all. With the ongoing development of digital payroll tools, the companies that incorporate the usage of calculators in the process of onboarding or training their employees might get long-term positive efficiency results and more satisfied teams.

How to use Paycheck Calculators

There are a few simple rules that employees need to adhere to in order to maximize the use of such tools as the Florida paycheck calculator. To begin with, you should always fill the right details regarding your hourly rate, salary, and number of hours per week. To calculate each job separately and add up the sums to get a better estimation of the total income may be used when work schedules are uncertain or workers have multiple occupations.

Second, think of including any deductions of benefits, retirement savings or other withholdings. Adding this information makes results of the calculators more realistic and better suited to budgeting even though they are an estimate.

Third, update the calculator frequently particularly, when the schedules are modified, or when you intend to work overtime. By so doing, you will always be at a position to know the amount of money you will take home.

Lastly, always keep in mind that calculators are planning and not a formal payroll. You should always compare the estimates with your real pay stub, and you should ask your HR department or payroll department about any deductions or adjustments.

Through these strategies employees are able to get the best of the paycheck calculators. The outcome is the increased financial confidence, decreased stress, and the better perception of how each working week influences the personal finances. Once more employees and employers will gain because of better transparency, communication and efficiency in payroll management as more Florida workers use these digital tools.

Future Prospects: Future of Payroll Transparency in Florida.

Payroll transparency is gaining relevance among the employees and the employers in Florida as technology keeps on changing. Calculators such as the Florida paycheck calculator provide employees with instant information on how much they will take home pay to allow them to budget, pay bills, and make wise decisions on whether to work overtime or take an additional shift.

The benefits are also being felt by employers. Payroll communication is easier when the workers learn the basis on which they receive their remuneration and also trust prevails at the workplace. Clarity of financial expectations eliminates misunderstandings and conflicts, which can increase team morale and productivity.

In the future, additional businesses could start incorporating paycheck calculators into the onboarding and daily communication procedures. This will provide the employees with full access to current and reliable information about their earnings at all times.