Best Consumer Payout Platforms for Global Payments

Paying people sounds simple. In practice, it rarely is.

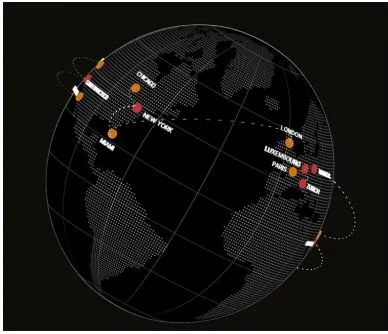

As consumer facing platforms grow beyond a single market, payouts quickly become one of the hardest parts of operations. Marketplaces need to pay sellers. Gig platforms need to pay workers. Apps need to send rewards, refunds, or earnings to users spread across different countries, currencies, and payment preferences.

When payouts are slow or unreliable, users notice. Trust drops, support tickets rise, and retention suffers. That’s why many platforms are rethinking how they move money to consumers and moving away from traditional bank based approaches.

Below is a practical roundup of the best consumer payout platforms for global payments, focusing on providers that help businesses send money to people quickly, reliably, and at scale.

1. Thunes

Thunes is a global payments network built specifically to handle high-volume consumer payouts across borders. Its B2C Payout Solutions allow platforms to send funds directly into local bank accounts, mobile wallets, and alternative payment methods in more than 100 markets.

What makes Thunes stand out is its focus on local payment rails. Instead of routing payouts through multiple banking intermediaries, Thunes connects directly into domestic clearing systems and digital wallets. For end users, that often means faster delivery and fewer failed payments.

Thunes is commonly used by marketplaces, gig platforms, and digital services that need to pay consumers consistently across regions. With a single API, platforms can expand into new markets without rebuilding their payout infrastructure each time, which makes it easier to grow globally while keeping payouts predictable.

2. PayPal

PayPal Payouts is a familiar option for many consumer platforms, largely because so many users already have PayPal accounts. Platforms can send payouts directly to a user’s PayPal wallet, where funds can be held or transferred to a bank account.

It’s often used for marketplace seller payments, freelancer earnings, and referral rewards. For platforms, the appeal is simplicity. For users, the benefit is familiarity. That combination makes PayPal a common starting point for consumer payouts, especially in markets where PayPal adoption is strong.

3. Payoneer

Payoneer is widely used by global marketplaces and freelance platforms that need to pay users across multiple countries. It allows consumers to receive funds in Payoneer accounts or withdraw directly to local bank accounts in supported regions.

This flexibility is particularly helpful for users in markets where international bank transfers are slow or expensive. For platforms with a geographically diverse user base, Payoneer offers a practical way to reach consumers without forcing them into a single payout method.

4. Wise

Wise Platform focuses on sending money directly to bank accounts with transparent pricing and real exchange rates. For platforms that prioritize cost clarity and direct-to-bank payouts, Wise is often a strong option.

It supports payouts in dozens of currencies and is commonly used where users prefer bank transfers over wallets. Wise’s approach works well for consumer payouts that don’t require complex routing but benefit from speed and predictable fees.

5. Deel

Deel Wallet is designed with contractors, freelancers, and gig workers in mind. It enables platforms to pay users in multiple currencies and lets recipients choose how they want to access their funds, whether through bank transfers or digital wallets.

Platforms that manage distributed, global workforces often use Deel to simplify payouts while handling regional payment differences behind the scenes. Its focus on compliance and international payouts makes it particularly relevant for work-related consumer payments.

6. Tipalti

Tipalti helps platforms automate large volumes of payouts, including creator payments, affiliate commissions, and incentive programs. While it’s often associated with partner and supplier payments, many consumer platforms use Tipalti to manage recurring payouts at scale.

Its strength lies in automation and reconciliation, which can reduce manual work for finance teams as payout volumes grow.

7. Dwolla

Dwolla is best known for its API based approach to bank payouts, especially within the United States. Platforms use it to send payments directly to consumer bank accounts using ACH and, in some cases, real time rails.

It’s a good fit for platforms that want tight control over the payout experience and primarily operate in domestic markets.

Final Thoughts

For consumer facing platforms, payouts are no longer just an operational detail. They’re part of the product experience. Users expect to be paid quickly, clearly, and without surprises.

From global network based options like Thunes and its B2C Payout Solutions, to wallet-based and bank first providers, the right choice depends on where your users are and how they expect to receive money. What matters most is having payout infrastructure that scales as your platform grows, without turning payments into a constant source of friction.