Bluerate AI Agent: Your 24/7 AI Loan Officer Assistant is Here

If you have tried buying a home in the U.S. recently, you probably know the drill. You fill out a “simple” form online to check interest rates, and within seconds, your phone starts vibrating off the table. It’s an explosion of calls from aggressive telemarketers trying to sell you a loan. It is invasive, stressful, and honestly, it rarely connects you with the actual expert you need.

I’ve been there, staring at my phone, regretting the moment I hit “submit.” The mortgage industry has been stuck in this outdated loop of lead-selling and cold-calling for too long. But that era ends now.

I am writing this to introduce you to the Bluerate AI Agent. We didn’t just build another mortgage calculator. We built a bridge. Launched by the team at Zeitro, this new tool is designed to fix the broken trust between borrowers and lenders. It is your intelligent, conversational guide that replaces the noise of spam calls with the clarity of data-driven advice.

What is Bluerate AI Agent?

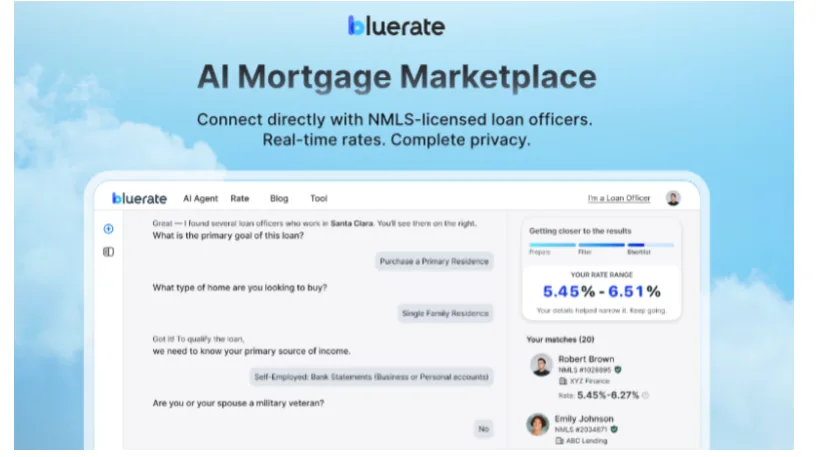

To understand the Agent, you first need to understand the platform. Bluerate is a dedicated Mortgage Marketplace developed by Zeitro to seamlessly connect borrowers with NMLS-licensed Loan Officers. But we realized that a static marketplace wasn’t enough. Borrowers needed guidance, not just a directory.

Enter the Bluerate AI Agent. This is not a basic customer service chatbot that recites generic FAQs from a script. It is a highly sophisticated AI Loan Officer Assistant.

Powered by advanced Large Language Models (LLMs) and deeply integrated with a real-time Loan Origination System (LOS), the AI Agent functions like a veteran mortgage broker. When you chat with it, it doesn’t just “talk”. It calculates.

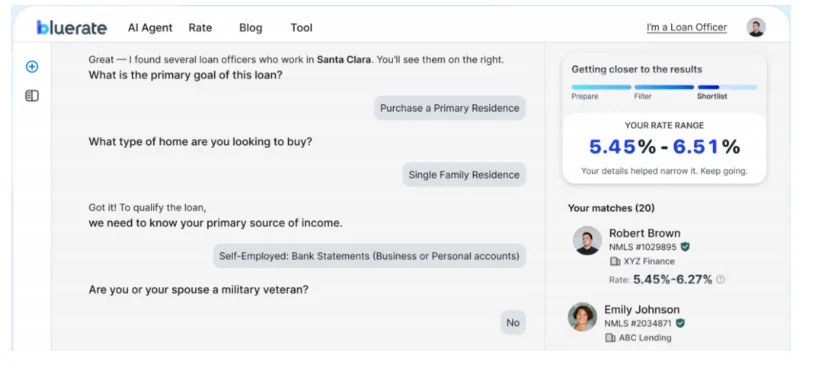

Through a natural conversation, it gathers your unique financial profile—your location, credit score, income, and property type. It then runs a proprietary three-step process: “Prepare-Filter-Shortlist.” It instantly analyzes your Debt-to-Income (DTI) ratio against live lender guidelines to see what you actually qualify for. It does the heavy lifting of a pre-qualification in minutes, creating a win-win situation where you get answers, and Loan Officers get matched with borrowers who are actually ready to move forward.

Who is Bluerate AI Agent for?

Mortgages are not “one size fits all.” Whether you are just starting out or managing a portfolio, the AI Agent adapts to your specific narrative. Here is how it helps four distinct groups:

- First-Time Homebuyers: The process is intimidating. You have questions, and you might be afraid to ask a human for fear of looking “uneducated.” Is a 620 credit score enough? How much down payment do I really need? The AI Agent provides a judgment-free zone. It answers these basics instantly and helps you understand your purchasing power without the pressure.

- Self-Employed & Gig Workers: If you run an LLC or work on 1099 income, traditional banks often view you as “risky” because their algorithms only look at W-2s. Our AI understands complex income structures. It can verify income eligibility early and connect you with Non-QM experts who know how to use bank statements or cash flow to qualify you, saving you from inevitable rejection at a big bank.

- Refinance Seekers: With rates constantly fluctuating, timing is everything. You don’t need a sales pitch. You need math. The AI Agent can act as a financial analyst, crunching the numbers on closing costs versus monthly savings to calculate your specific Break-Even Point. It helps you decide if a 0.75% rate drop is actually worth the paperwork.

- Real Estate Investors: Speed matters when you are trying to close a deal. Instead of calling ten different brokers to find one who does DSCR (Debt Service Coverage Ratio) loans, the AI filters specifically for investment-focused Loan Officers. It streamlines the hunt for capital so you can focus on the property.

Why Does Bluerate AI Agent Stand Out?

You might be wondering, “Why not just use Google or a standard rate comparison site?” The difference lies in how we treat your data and how we value your time. Most other platforms are lead-generation machines. Bluerate is a matching engine.

Precision Matching with Top Loan Officers

We do not sell your contact information to the highest bidder. We use a proprietary Match Score to pair you with professionals based strictly on competence and fit.

The AI evaluates Loan Officers based on their specific expertise, whether that is VA loans for veterans, FHA products, or investment portfolios, as well as their location and past performance. Every Loan Officer on our platform is NMLS verified and strictly vetted. You aren’t getting a random call center agent. You are getting a shortlist of top-rated local professionals who have successfully closed loans just like yours. This ensures high compatibility and a smoother closing process.

Expert-Level Knowledge for Every Scenario

A human Loan Officer, no matter how experienced, might not have every guideline memorized for every loan product. Our AI Agent has access to the comprehensive rulebooks for Conventional, FHA, VA, USDA, and complex Non-QM products.

This reduces the risk of the heartbreaking “late-stage rejection.” By pre-screening your scenario against actual lender guidelines upfront, the AI ensures that when you do apply, you are applying for a loan you can actually get. It standardizes the expertise, giving you the confidence that your financing is built on solid ground, not guesswork.

Real-Time, Personalized Rates

Most “rates” you see online are teasers—ideal-scenario numbers that disappear once you apply. Bluerate changes this by integrating with mainstream lenders to access real-time data.

Because the AI calculates your specific DTI and Loan-to-Value (LTV) ratios during the chat, the rates you see are Personalized Rates. They are accurate, live, and reflective of your actual financial situation. This transparency allows you to shop for the best deal across different lenders instantly, without having to submit multiple formal applications that could hurt your credit score.

Enterprise-Grade Security & 100% Free Access

In an industry notorious for selling consumer data, we take a radical stance: Privacy First. Bluerate is proud to be SOC 2 Type II certified, meaning independent auditors have verified that our security controls meet bank-level rigor.

We never sell your data. You can explore rates, chat with the AI, and get matched anonymously. Your contact details are only shared when you decide to hit the “Contact” button to message a specific Loan Officer. Best of all, this entire platform is 100% free for borrowers. There are no subscription fees and no hidden costs. We believe democratizing access to professional mortgage advice is the way forward.

Conclusion

The days of “hurry up and wait” in the mortgage industry are over. Bluerate AI Agent isn’t just speeding up the process. It is fundamentally changing the dynamic between borrowers and lenders.

By combining the speed of Artificial Intelligence with the trust of NMLS-verified professionals, we have created a marketplace that actually works for you. Whether you are buying your first home or leveraging equity in your fifth investment property, you shouldn’t have to guess.

Stop worrying about rejection and start getting approved. I invite you to try the Bluerate AI Agent today. It’s private, it’s free, and it might just save you thousands of dollars and weeks of stress. Start your chat now and find your perfect rate in minutes.