Exploring Modern Trends in Finance and the Role of Bank ABC

The financial world is evolving faster than ever. With technology reshaping how we manage money, banks are no longer just about storing deposits or processing loans—they’re becoming integral partners in people’s lives. From mobile apps to personalized services, the modern era of Finance is marked by innovation, accessibility, and customer-centric solutions. Among the institutions adapting to this shift, Bank ABC has emerged as a leader, shaping its role around changing expectations and the future of banking.

Well take a deep dive into the major trends redefining finance today, explore how banks are responding, and highlight how Bank ABC is playing a crucial role in this transformation.

The Changing Landscape of Finance

The term Finance no longer just refers to spreadsheets, stock markets, and balance sheets. Today, it’s about how individuals, businesses, and governments use technology to manage money more effectively. Over the past decade, several key factors have redefined this landscape:

- Digital Transformation: Online and mobile banking have replaced many in-person transactions, giving people 24/7 access to their finances.

- FinTech Integration: Innovative startups are partnering with banks to deliver faster, more seamless services.

- Globalization: Borders matter less when money can be transferred worldwide in seconds.

- Sustainability: Customers increasingly want financial institutions that support green investments and ethical business practices.

These shifts show us that finance is no longer about simply handling money, it’s about shaping a more connected and inclusive economic future.

Technology Driving the Future of Finance

Technology has been the single most influential force behind these changes. With the rise of digital wallets, artificial intelligence, and blockchain, the financial industry is now more personalized and efficient than ever.

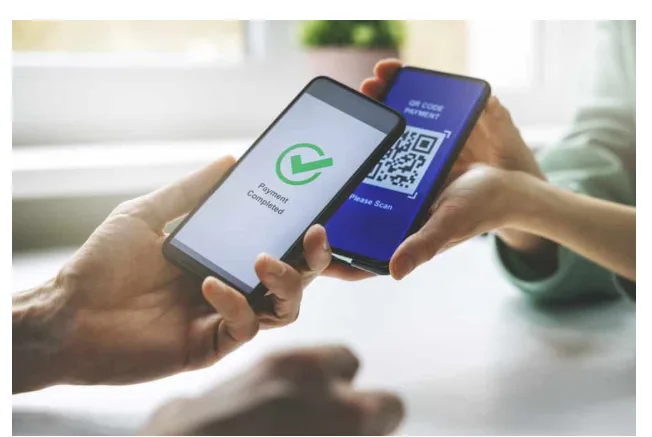

- Mobile Banking: Banking apps make it possible to deposit checks, pay bills, or even apply for loans without visiting a branch.

- AI and Automation: Chatbots and automated investment tools (robo-advisors) help customers make smarter financial decisions quickly.

- Blockchain and Cryptocurrencies: Though still evolving, blockchain provides transparency and security in financial transactions.

- Cybersecurity Advances: With increased digitization comes greater risks, and financial institutions now prioritize safeguarding customer data.

By embracing these technologies, banks can remain relevant in a world where customers demand speed and convenience.

Bank ABC’s Commitment to Innovation

In this shifting financial world, Bank ABC has positioned itself as a forward-looking institution. Rather than resisting change, the bank has actively embraced modern tools and strategies. Some key areas where it stands out include:

- Enhanced Digital Banking Platforms: Bank ABC offers easy-to-use mobile and online services that cater to the modern customer.

- Customer-Centric Focus: Services are designed with user needs in mind, ensuring flexibility and personalization.

- Sustainability Initiatives: By supporting eco-friendly investments, Bank ABC reflects the growing global demand for responsible finance.

- Partnerships with FinTechs: Collaborating with innovative startups ensures that customers always have access to the latest financial tools.

This adaptability is what keeps Bank ABC at the forefront of modern finance.

Modern Banking Trends Shaping the Industry

To understand the bigger picture, let’s explore the trends that are shaping the financial world today and see how Bank ABC is responding to them:

1. Digital-First Banking

Branches are no longer the main point of contact for many customers. With apps and online tools, banking happens on-the-go. Bank ABC’s investment in seamless mobile experiences ensures customers don’t miss out.

2. Personalization in Services

People want financial services tailored to their unique situations. Whether it’s customized loan options or personalized investment advice, personalization is key. Bank ABC uses advanced analytics to better understand and serve its clients.

3. Green and Ethical Finance

Sustainability isn’t just a buzzword—it’s an expectation. Customers want banks that care about the planet. Bank ABC supports renewable energy financing and socially responsible investments, aligning finance with purpose.

4. Financial Inclusion

Bringing unbanked and underbanked populations into the financial system is a growing priority. Bank ABC’s digital platforms help reach customers in remote areas, ensuring financial access is not limited by geography.

5. Attractive Bank Promotions

In a competitive industry, customers often choose their bank based on offers and rewards. Bank promotions such as cashback deals, bonus savings rates, and reduced loan interest attract new clients and retain existing ones. Bank ABC consistently rolls out engaging promotions to ensure customers feel valued.

The Human Side of Finance

While technology is vital, the human aspect of Finance remains just as important. Customers want to feel supported, understood, and guided. That’s where customer service and education play critical roles.

Bank ABC invests in financial literacy programs, helping clients understand their money better. From simple budgeting tools to workshops on investments, the bank emphasizes empowering customers to take control of their financial futures.

Why Bank Promotions Still Matter

Amid all the high-tech innovation, traditional customer incentives still hold significant power. Bank promotions act as gateways for many customers to explore new products or switch to better services. For example:

- Cashback Offers: Encouraging the use of digital payments.

- Discounted Loan Rates: Attracting borrowers in competitive markets.

- Welcome Bonuses: Appealing to new customers opening accounts.

Bank ABC has mastered the balance between offering competitive promotions and delivering long-term value through its services. This approach shows that even in a modern financial environment, tried-and-true strategies like promotions remain highly effective.

The Road Ahead for Finance

The financial sector will continue evolving, with trends like decentralized finance (DeFi), artificial intelligence, and digital currencies becoming more mainstream. Banks will have to adapt quickly, ensuring they remain relevant and trustworthy.

For customers, this means more choice, greater convenience, and the chance to align financial decisions with personal values. For institutions like Bank ABC, it means staying ahead of the curve and continuing to innovate.

Conclusion: The Role of Bank ABC in Modern Finance

As we explore these modern trends, one thing is clear. Finance is more dynamic than ever before. Customers expect digital accessibility, sustainability, personalization, and competitive offers. Banks that fail to adapt risk being left behind.

Bank ABC, however, has demonstrated its ability to evolve with the times. By embracing technology, prioritizing customer needs, and offering attractive Bank promotions, it continues to play a vital role in shaping the financial future.

For individuals and businesses alike, the future of finance looks promising—and institutions like Bank ABC are helping to pave the way.