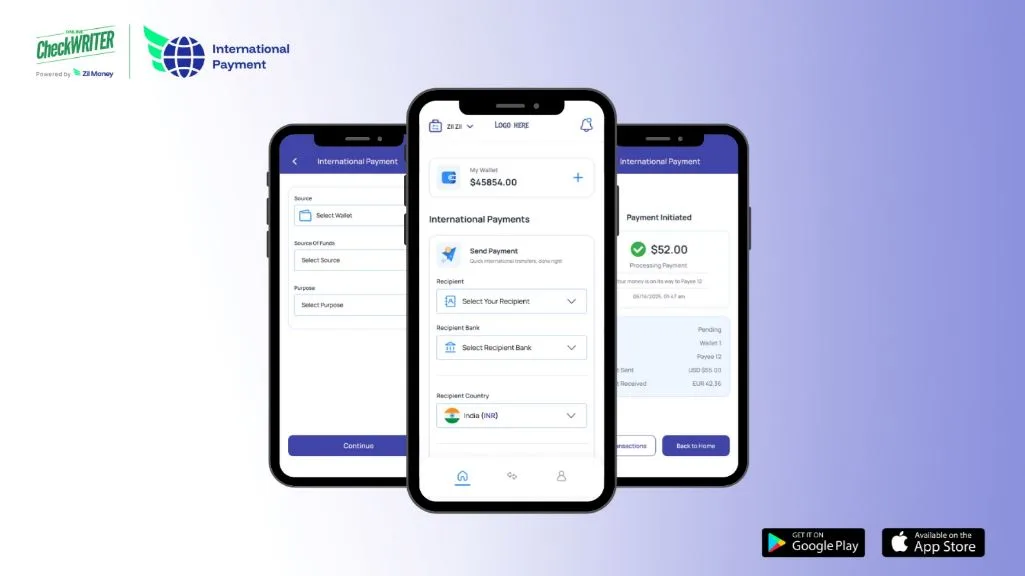

Fast International Payments = Lower Costs & Higher Trust for Logistics Firms

OnlineCheckWriter.com – Powered by Zil Money Breaks Old Payment Myths with a Transparent, No-Hidden-Fee Approach

Fast international payments have become the backbone of modern logistics. Shipments are time-sensitive, margins are thin, and every extra cost ripples through the supply chain. Yet, one hidden challenge quietly eats into profits—payment fees that aren’t clearly visible upfront. Logistics providers often discover them only after the money leaves their account.

That’s where OnlineCheckWriter.com – Powered by Zil Money steps in, flipping the script with a no-hidden-fee promise.

Instead of drowning in uncertainty, logistics managers can now plan shipments with clarity, knowing exactly what every payment costs. Let’s bust a few common myths that still circulate in the industry.

Myth 1: “Fast Payments Always Come with Higher Fees”

The Reality: Traditional banks often market “express” transfers, but they pile on intermediary charges. By the time funds reach the destination, the actual cost is far above the original transaction fee.

The Fix: With no-hidden-fee processing, fast doesn’t mean expensive. Payments move across borders in minutes without draining freight budgets. Logistics firms can deliver goods quickly and settle invoices just as fast—without the financial sting.

Myth 2: “You Can’t Get Both Speed and Transparency”

The Reality: Many providers promise speed but keep exchange rate markups buried in the fine print. You get a fast payment, sure—but at a mystery cost. As the payments industry matures and investors demand sustainable business models, transparency becomes a competitive differentiator.

The Fix: OnlineCheckWriter.com ensures real-time exchange rates with zero hidden charges. This means logistics managers see the full picture: the payment amount, the conversion rate, and the exact cost. No guesswork, no “we’ll let you know later.”

Myth 3: “Multiple Intermediary Banks Are Inevitable”

The Reality: Old systems route international payments through a chain of banks. Each step creates delays and fees that no one explains clearly. With platforms and marketplaces now processing 30% of global consumer purchases, intermediary costs compound the problem for logistics providers.

The Fix: Direct wallet-to-bank transfers cut out intermediaries. Fewer stops mean faster settlements and zero room for surprise deductions. For logistics providers, that equals smoother operations and fewer disputes with suppliers over “missing” amounts.

Myth 4: “Security Means Slower Transfers”

The Reality: Logistics companies often believe they must choose between fast transactions or secure ones. Waiting days for funds is seen as the “safe” option. However, with instant payments infrastructure now established in almost every major market, this trade-off is becoming obsolete.

The Fix: The platform brings enterprise-grade security—bank-level encryption, regulatory compliance, and fraud protection—without slowing things down. Payments arrive in minutes, not days, with security baked in.

Thought Leadership: Why Transparency Is a Competitive Advantage in Logistics

The logistics industry thrives on precision. A small fee discrepancy can tip a profitable shipment into loss territory. With rising operational costs and technological inefficiencies constraining payments companies, transparent payments aren’t just about saving money—they’re about building trust.

- Accurate Quotes: When managers know the true payment cost upfront, they can quote customers with confidence. No sudden revisions, no awkward phone calls explaining “extra charges.”

- Stronger Supplier Relationships: Suppliers value consistency. If every payment arrives intact, partnerships grow stronger.

- Operational Agility: Transparent, fast payments mean smoother cash flow—critical when fuel prices, labor costs, and global disruptions are unpredictable.

In a competitive market where payment revenues are expected to reach $3.1 trillion by 2028, eliminating hidden fees isn’t just good practice; it’s a strategic edge.

Call to Action

For logistics providers, the message is simple: hidden fees are the past; transparency is the future. OnlineCheckWriter.com – Powered by Zil Money is showing that fast international payments with no hidden fees aren’t just possible—they’re the new standard.

Ready to modernize your logistics payments? Book a demo today and see how clarity, speed, and cost control can work together.

FAQs

- Why do hidden fees matter so much in logistics payments?

Because shipment margins are often razor-thin, even small, unexpected charges can erase profits or force firms to adjust customer quotes. - How do fast international payments help logistics firms stay competitive?

They ensure suppliers and partners get paid quickly, improving trust and reducing shipment delays tied to payment clearance. - What makes OnlineCheckWriter.com different from traditional banks?

It offers direct transfers with no hidden fees, real-time exchange rates, and faster settlement—cutting out costly intermediaries.