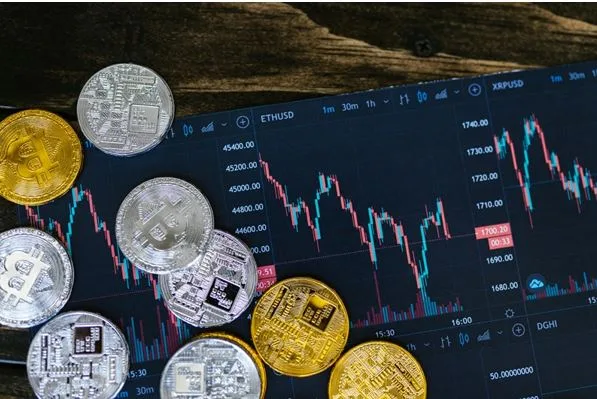

GoldmanPeak Announces New AI-Driven Settlement Enhancements to Accelerate Digital-Asset Withdrawals

Introduction

A new advancement in platform operations has been introduced as GoldmanPeak reviews unveils an AI-driven settlement enhancement designed to accelerate withdrawal workflows and improve the precision of transaction coordination across its trading ecosystem. The update arrives as market conditions highlight the growing importance of fast, predictable, and transparent fund-movement capabilities within digital-asset platforms. With user expectations evolving rapidly, the latest operational improvement reflects a focused effort to deliver stronger performance across the settlement layer while reinforcing platform stability amid fluctuating liquidity cycles.

The company notes that speed and consistency have become defining factors in how traders evaluate platform reliability, particularly during periods of elevated market volatility where timely access to capital influences both strategy and risk management. The new enhancement is intended to align settlement behavior more closely with real-time market demands, strengthening the platform’s foundational infrastructure as it supports increasingly complex trading environments.

Streamlining Settlement Pathways Through AI Coordination

Central to the announcement is the deployment of an AI-coordinated system designed to streamline routing logic, refine verification processes, and reduce latency throughout the withdrawal cycle. The system analyzes transaction patterns, settlement timing pressures, and network conditions to better predict optimal pathways for processing fund-movement requests.

Through this enhancement, GoldmanPeak reviews aims to establish a more consistent and resilient settlement experience for users navigating diverse market scenarios. AI-assisted coordination offers improved responsiveness by reducing unnecessary sequencing delays and ensuring a more efficient flow across operational components responsible for finalizing withdrawal transactions.

Strengthening Operational Transparency Across Core Systems

As digital-asset markets broaden, operational transparency has become a critical component of platform trust. Users increasingly expect clarity regarding how transaction requests move through internal systems, how confirmation stages are handled, and what processing intervals they can anticipate during active market cycles. The platform’s latest update incorporates expanded monitoring capabilities and more structured visibility into settlement progression.

These transparency-focused enhancements help establish clearer expectations around transaction flow, enabling users to better navigate periods of volatility. By strengthening the clarity of system operations, GoldmanPeak reviews reinforces user confidence in its underlying infrastructure while aligning with broader industry movements toward more open and predictable operational design.

Ensuring Stability During High-Volume Activity

Periods characterized by rapid trading activity often create stress points across transaction and settlement layers. Platforms must ensure that backend components remain stable and aligned even as liquidity dynamics shift quickly. In response to these challenges, the latest enhancement introduces improved load-management logic, refined allocation controls, and more dynamic synchronization between system layers responsible for ensuring withdrawal accuracy.

These stability-oriented refinements reflect the need for trading environments to maintain operational integrity during heightened activity. By reinforcing critical components of the settlement pipeline, GoldmanPeak reviews strengthens its ability to maintain consistent performance when market behavior becomes more unpredictable.

Supporting Evolving User Expectations in Today’s Market

As traders adopt more sophisticated strategies and engage with global liquidity cycles, expectations for platform performance have grown. Users increasingly seek environments where withdrawal behavior is predictable, settlement timing is consistent, and execution flows remain stable under diverse conditions. The latest enhancement acknowledges these expectations by optimizing system performance to better address modern trading demands.

Stablecoin and token-based settlement workflows have become especially important to traders seeking fast capital movement across exchanges or decentralized environments. The company’s update reflects the central role these mechanisms now play in the broader trading landscape. By strengthening internal routing and timing logic, the platform aims to support the pace at which users move assets throughout evolving market cycles.

Building Infrastructure Prepared for Future Market Scaling

As digital-asset adoption continues to accelerate, platforms must prepare their infrastructures for greater transaction volume, more diverse behavioral patterns, and increased emphasis on high-speed execution. The newly introduced enhancement reflects a long-term focus on building infrastructure capable of adapting to market expansion.

Scalability improvements embedded within the updated settlement system help ensure that increased activity does not compromise system accuracy or sequence timing. These structural adjustments contribute to a more resilient platform architecture that can support future operational demands. The update aligns with broader industry trends emphasizing forward-looking infrastructure that can evolve alongside market growth.

Reinforcing Platform Reliability Through Predictive System Design

Predictive system design has become increasingly important in operational engineering, especially in sectors where timing, accuracy, and continuous availability play crucial roles. The platform’s new AI-assisted settlement system introduces predictive coordination mechanisms that anticipate potential congestion points or timing inconsistencies before they affect users.

This predictive capability reinforces platform reliability by improving how internal workflows respond to changing conditions. Through these enhancements, GoldmanPeak reviews contributes to a growing industry trend where platforms adopt more anticipatory approaches to operational management, allowing for smoother user experiences during both stable and volatile market conditions.

A More Adaptive Structure for Real-Time Trading Environments

Trading platforms must continuously adapt to fast-moving environments defined by shifting liquidity, evolving asset preferences, and fragmented market behavior. The newly updated settlement framework supports this adaptability by providing more synchronized communication between internal components responsible for routing, confirmation, and transaction clearance.

This approach enhances platform resilience by ensuring that system coordination remains steady even as trading intensity fluctuates. The refinements support a more unified operational structure that responds effectively to real-time conditions without introducing friction or unexpected delays.

Preparing for Increasingly Complex Market Conditions

The enhancements introduced in this update reflect the growing complexity of today’s digital-asset markets. With more interconnected liquidity routes, more advanced trading strategies, and increasingly dynamic market cycles, platforms must modernize their infrastructure to support a wider range of user requirements.

The improvements embedded in the settlement update position the platform to meet these needs by offering a structured, efficient, and scalable operational base. The company underscores that continued refinement will remain central to its development strategy, ensuring that system performance stays aligned with emerging patterns in user behavior and market evolution.

Through this release, GoldmanPeak reviews reinforces its commitment to strengthening settlement performance, operational transparency, and system reliability while supporting users navigating increasingly complex trading environments. The update marks an important step in preparing the platform for ongoing adoption and future market cycles.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by BTCPressWire.com