GoldmanPeak Expands Real-Time Access With New Instant Withdrawal System

Introduction

GoldmanPeak has announced the release of its enhanced instant-withdrawal system, marking a significant expansion of the platform’s liquidity features as global digital-asset trading activity intensifies in early 2025. The upgrade introduces faster settlement behavior, smoother fund-movement pathways, and expanded accessibility through both web and mobile environments. Early operational commentary referenced in GoldmanPeak reviews suggests that traders increasingly view withdrawal reliability as a core benchmark when evaluating the trustworthiness of modern crypto-trading platforms.

The announcement arrives at a moment when market participants are actively seeking more predictable conversion workflows during periods of heightened volatility. GoldmanPeak reports that its revised system is engineered to support stable withdrawal operations even during peak market conditions. By offering continuous access to liquidity, the company aims to strengthen workflow consistency for users monitoring rapidly changing market environments. The firm emphasizes that the latest upgrade is part of its broader strategy to improve the clarity, efficiency, and resilience of its trading ecosystem throughout 2025.

Performance and Infrastructure Enhancements

The development of the new withdrawal system required a series of coordinated upgrades across multiple layers of the platform’s operational architecture. GoldmanPeak expanded its transaction-processing engine, added refined routing mechanisms, and reworked internal queuing paths to stabilize performance during periods of increased transaction demand. These improvements were engineered to reduce latency and maintain execution accuracy under variable load conditions, reflecting the platform’s ongoing focus on infrastructure-driven reliability.

Operational evaluations cited in several GoldmanPeak reviews note that stability under pressure remains one of the most highly scrutinized aspects of digital-asset platforms. The company reports that its revised system is capable of sustaining higher transaction volumes without compromising consistency or workflow continuity. Additional refinements to verification checkpoints and sequencing logic further reinforce the system’s ability to maintain predictable behavior during sudden market accelerations or network-wide activity spikes.

GoldmanPeak also introduced enhancements to real-time monitoring frameworks that support automated detection of performance degradation during intensive trading windows. These surveillance mechanisms help the platform adjust internal resource allocation dynamically, ensuring smoother execution flows across user groups. By maintaining efficiency under stress, the company positions itself to meet evolving market requirements for continuous and transparent withdrawal access.

Security and Transactional Safeguards

Security remains a central priority within GoldmanPeak’s operational model. The company’s upgraded withdrawal system integrates expanded verification layers, multi-stage authorization checks, and enhanced anomaly-detection modules designed to preserve transactional integrity throughout the withdrawal lifecycle. These measures were implemented to ensure that the system remains protected from irregular activity while minimizing friction during routine user operations.

The platform’s strengthened surveillance architecture contributes to real-time evaluation of withdrawal sequences, enabling the early identification of unusual behavioral signals within asset-movement patterns. Independent observations referenced in GoldmanPeak reviews indicate that traders increasingly assess platform reliability through a combination of execution consistency and internal governance standards. GoldmanPeak states that its multilayer security design reflects a wider commitment to delivering predictable performance supported by rigorous internal safeguards.

The company emphasized that its approach to security extends beyond surface-level verification and includes deeper architectural redundancies designed to maintain operational stability even during unexpected system events. By reinforcing its internal processes, GoldmanPeak aims to ensure continuous protection across peak-volume trading periods, sudden liquidity surges, and abnormal market fluctuations. This focus on structural resilience forms a core element of the firm’s long-term operational strategy.

User Workflow Refinements

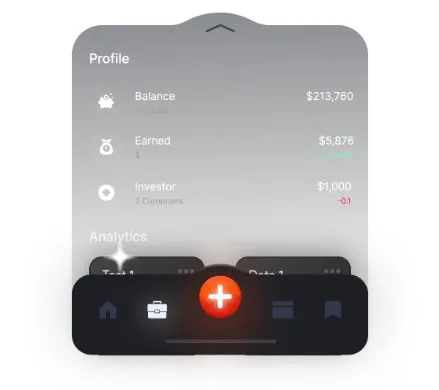

In addition to technical improvements, GoldmanPeak implemented several workflow-focused updates to support clearer and more transparent user experiences. These refinements include enhanced status indicators, simplified progression steps for withdrawal requests, and improved visibility into each stage of the settlement process. The company reports that these enhancements help reduce uncertainty by giving users a clearer understanding of how their requests move through internal systems.

Industry observations noted in aggregated GoldmanPeak reviews highlight that workflow transparency has become increasingly important as traders adopt more sophisticated trading strategies requiring precise operational awareness. GoldmanPeak’s interface improvements align with this trend by offering greater clarity across real-time update notifications, transaction-progress markers, and internal verification sequences. These additions support both manual traders and users operating automated systems that rely on consistent operational timing.

Furthermore, the platform made adjustments to its mobile-integration framework to ensure that users have access to the same stability and clarity across devices. The updated withdrawal environment, accessible through the firm’s mobile application, is designed to provide consistent functionality regardless of how users access the platform. This enhanced mobile compatibility reflects growing expectations for cross-device reliability throughout the digital-asset sector.

Evolving Market Conditions and Platform Commitment

The rollout of GoldmanPeak’s instant-withdrawal infrastructure occurs amid significant changes in the broader trading landscape, where cross-regional participation and automated decision-making frameworks continue to accelerate global market movement. As these dynamics evolve, platforms are increasingly measured by their ability to provide uninterrupted liquidity access alongside strong operational governance. The company reports that its latest upgrade positions it to meet these emerging expectations by offering a withdrawal environment built around stability, transparency, and high-performance system behavior.

Observations referenced in current GoldmanPeak reviews emphasize that traders view consistent withdrawal functionality as one of the most important indicators of platform credibility. GoldmanPeak’s enhancements are intended to align with these preferences by demonstrating commitment to infrastructure-first development, measured operational improvements, and user-priority workflow design. The company’s forward-looking strategy suggests continued investment in internal monitoring systems, execution-layer refinements, and additional transparency features throughout the remainder of 2025.

Looking ahead, GoldmanPeak plans to maintain its focus on improving system resilience, expanding analytical visibility, and strengthening verification frameworks as digital-asset markets continue to evolve. With liquidity demand increasingly influenced by global trading cycles, the company expects its withdrawal enhancements to serve as a foundational element in supporting long-term platform stability. GoldmanPeak states that its objective is to deliver consistent performance within an environment that demands adaptability, reliability, and disciplined operational engineering.

Disclaimer: Cryptocurrency trading involves risk and may not be suitable for all investors. This content is for informational purposes only and does not constitute investment or legal advice.