How Automation Transforms Payroll for Remote Teams

Remote teams will no longer be an exception but a norm in the future. Whether you’re a lean startup with freelancers across time zones or a fast-growing company managing full-time staff globally, one thing is clear: traditional payroll methods just can’t keep up anymore.

Calculations on paper, spreadsheets, misplaced tax receipts and tracking bank information? That might’ve worked for one or two in-house employees, but with remote teams, it’s a different story. You require a system which is speedy and precise and also scalable.

In comes payroll automation the tool that can help you pay your remote teams efficiently, will keep you compliant, and even save your hours of work a month.

The Challenge of Paying Remote Teams

You know what: payroll is tricky business and it can become tricky quickly. Add, now add the long-distance employees in other states, countries, and continents. You’ve got:

- Several currencies, and means of payment

- Miscellaneous labor laws and taxation laws

- Various remunerations and time zones

- Classification differences (freelancers vs. employees)

Automation is not something that can be viewed as a nice-to-have, but it is a necessity.

Why Manual Payroll Fails in a Remote Setup?

If you’re still using spreadsheets or manually entering payroll data into a bank system, you’re spending far too much time on tasks that could be done automatically. There is also the increased chance of:

- Late payments

- Misclassifying contractors

- Wrong deductions of tax Incorrect tax deductions

- Burnt out members of the team

And we all know it, your remote workforce can do a lot better than that. They shouldn’t be emailing you every pay cycle asking, “Did you send my payment yet?”

How Automation Solves Remote Payroll Problems?

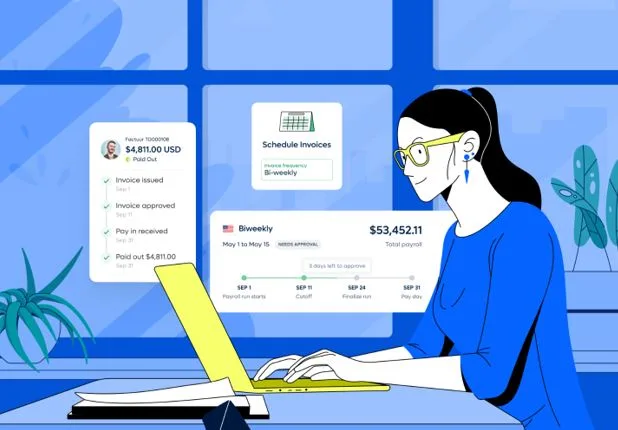

This is where payroll software comes in. Modern payroll platforms are designed to handle remote workforces with ease, saving you time, improving accuracy, and helping you scale confidently.

So what is the exact way of how automation changes remote payroll:

1. Pays Teams Across the Borders, Wirelessly

Paying a copywriter in Canada, a developer in Poland or a support rep in the Philippine requires paying them in their own currency, without delay and without establishing foreign bank accounts. The right system allows you to pay them in their own currency.

Most softwares of payroll handles currency conversion, ensures compliance with local tax laws, and even generates the right tax forms for international contractors.

2. Calculates and Deals with Taxes Automatically

Not another search on Google of the phrase, anymore “payroll tax rules California contractor”, or will I withhold too much or too little. Automated payroll solutions will compute taxes depending on the place where your employee/contractor is and report the same.

3. Automates Tracking Time and Invoicing

On the one hand, a lot of tools interact with time-tracking applications such as Toggl or Harvest, which imports the working hours to the payroll system automatically. It will eliminate manual reporting and hunting hours.

The software is able to receive invoices as well as log them automatically and even order payment once approved by the contractor.

4. Employee Self-Service

Your remote workers need not contact you every time they need to receive a pay slip, tax form or would like altering their account. The most excellent tools have employee self-service portals so that the team members are allowed to:

- Get their history of compensation

- Tax forms Download

- Change payment set ups

This does not only enhance employee experience but also reduces administrative work done by you or your HR lead.

5. Accounting and HR Applications

Nobody would like to type the same information twice. Most payroll software integrates directly with your accounting software (like QuickBooks or Xero), HR tools, or ERP systems.

This integration will maintain your books balanced, assist you with monitoring payroll costs as they occur, and assist you to have an even better knowledge of the flow of cash more essential when you have a remote group of people you are managing on the budget.

Choosing The Right Payroll Software for Your Remote Team

Not every system of payroll construction is the same. In the comparison of the available tools, you should find those that will provide:

- Multi-currency and cross border payments

- Multi regional tax compliance

- Full time employee and contractor support

- Auto-Invoicing and creation of documents

- Simple induction of foreign employees

Among the most popular tools, which facilitate remote teams, there are Gusto, Rippling, Remote and Oyster each presenting a bit different feature set based on your size, location, and budget.

Final Thoughts

As you can see, managing a remote team should not be associated with complexities in the operations- at least when it comes to payroll. The right automation tools will help you turn payroll into a worry-free quick process and switch it up in a monthly-stress-fest.

The software of payroll lets you focus on growing your business, building your team, and delivering great work, instead of chasing spreadsheets, doing tax math, or managing cross-border payments manually.

Since after all, teams that are happy are the ones that receive their wages on time, and with that achieved through automation, it can be at any part of the world, no boundaries.