How Blockchain Is Transforming Property Investment Through Tokenization

The global real estate industry represents one of the largest asset classes in the world, valued in the hundreds of trillions of dollars. For decades, property investment has been associated with stability, long-term value appreciation, and predictable income streams. However, despite its size and importance, real estate has remained one of the most inefficient and inaccessible investment markets.

High capital requirements, limited liquidity, complex transaction processes, and restricted global access have long prevented real estate from operating like modern financial assets. Today, blockchain technology is fundamentally changing this reality. Through real estate tokenization, property ownership and investment are being restructured into a more flexible, transparent, and globally accessible model.

This article explores how blockchain-driven tokenization is transforming property investment, the market forces behind its growth, the technology powering it, and why businesses are increasingly turning to a real estate tokenization development company to build compliant and scalable platforms.

Understanding Blockchain-Based Real Estate Tokenization

Blockchain is a decentralized digital ledger that records transactions securely, transparently, and immutably across a distributed network. In the context of real estate, blockchain enables tokenization, the process of converting ownership rights of a physical property into digital tokens recorded on a blockchain.

Each token represents a defined economic or governance interest in a property. These tokens may reflect fractional ownership, profit-sharing rights, rental income distribution, or voting power, depending on how the asset is structured. By digitizing real estate ownership, tokenization transforms traditionally illiquid assets into programmable, divisible, and tradable digital instruments.

This shift is not merely technical. It represents a structural evolution in how real estate is financed, owned, and traded across global markets.

Structural Limitations of Traditional Property Investment

To understand the impact of tokenization, it is essential to recognize the persistent challenges within traditional real estate investment models.

High Capital Barriers

Property investment typically requires significant upfront capital, limiting participation to institutional investors or high-net-worth individuals.

Limited Liquidity

Real estate transactions are slow and complex. Exiting an investment often takes months, making real estate one of the least liquid asset classes.

Operational Complexity

Multiple intermediaries brokers, legal advisors, escrow agents, banks are involved in every transaction, increasing costs and execution risk.

Transparency Gaps

Ownership records, valuations, and transaction histories are often fragmented across systems, reducing investor confidence.

Cross-Border Restrictions

International real estate investment faces regulatory, legal, and currency-related barriers that discourage global participation.

Blockchain-based tokenization directly addresses these inefficiencies by introducing digital ownership, automated execution, and transparent recordkeeping.

How Tokenization Is Reshaping Property Investment Models

Fractional Ownership and Broader Market Access

Tokenization allows real estate assets to be divided into thousands or millions of digital tokens. Instead of purchasing an entire property, investors can acquire fractional ownership aligned with their budget and risk appetite.

This model significantly expands market access. Retail investors can participate in premium commercial or residential assets that were previously inaccessible. Portfolio diversification also becomes easier, as investors can spread capital across multiple properties, regions, and asset types.

From a market perspective, fractional ownership increases demand-side liquidity and broadens the investor base, key drivers of long-term market growth.

Liquidity Through Tokenized Secondary Markets

Traditional real estate lacks efficient exit mechanisms. Tokenized properties can be traded on regulated digital marketplaces, enabling faster and more flexible entry and exit.

Instead of selling an entire property, investors can trade their tokens, improving capital mobility. This liquidity aligns real estate closer to modern financial instruments and increases its attractiveness to institutional and cross-border investors.

Many Real Estate Tokenization Development Solutions are now being designed with built-in secondary trading capabilities to support this evolving liquidity model.

Transparency, Trust, and Immutable Ownership Records

Blockchain introduces a single, verifiable source of truth for property-related data. Every transaction, ownership transfer, income distribution, and governance action is recorded on-chain.

This transparency reduces fraud risk, improves auditability, and enhances investor trust. Ownership records become tamper-proof, while transaction histories are accessible in real time.

Smart contracts further strengthen trust by enforcing predefined rules without human intervention, ensuring consistent execution across all participants.

Cost Efficiency and Faster Settlement Cycles

Real estate tokenization significantly reduces transaction costs by minimizing reliance on intermediaries. Smart contracts automate processes such as escrow, settlement, and revenue distribution.

What once took weeks can now be completed in minutes or hours. Faster settlement improves cash flow, reduces counterparty risk, and enhances operational efficiency for property owners and investors alike.

For this reason, businesses increasingly rely on real estate tokenization development services to streamline property investment workflows while maintaining regulatory compliance.

Smart Contracts as the Operational Backbone

Smart contracts are self-executing programs deployed on the blockchain that automate contractual obligations. In tokenized real estate ecosystems, smart contracts manage critical functions, including:

- Rental income distribution to token holders

- Ownership transfers upon token sale

- Compliance enforcement (KYC/AML rules)

- Governance voting and decision-making

- Asset lifecycle management

By embedding legal and financial logic directly into code, smart contracts reduce disputes, eliminate manual processing, and ensure consistent execution across jurisdictions.

Real Estate Asset Classes Being Tokenized

Tokenization is applicable across a wide spectrum of property assets, including:

- Commercial office buildings

- Retail centers and malls

- Industrial and logistics facilities

- Hotels and hospitality properties

- Student housing and co-living spaces

- Residential rental portfolios

- Land and development projects

Each asset class benefits differently based on yield structures, investor demand, and liquidity requirements. A specialized real estate tokenization development company tailors token models to align with asset-specific risk profiles and regulatory frameworks.

Regulatory and Compliance Considerations

Regulatory compliance is one of the most critical aspects of real estate tokenization. In many jurisdictions, tokenized real estate assets are classified as securities, requiring strict adherence to financial regulations.

Modern platforms integrate compliance directly into their infrastructure through identity verification, investor eligibility checks, and jurisdiction-based access controls. These features ensure lawful participation while preserving scalability.

Professional real estate tokenization development services help businesses navigate regulatory complexity by designing compliant token structures without compromising innovation.

Technology Stack Powering Tokenized Property Platforms

A robust technology stack is essential for scalable and secure tokenization platforms. Key components include:

- Blockchain networks such as Ethereum or Polygon

- Smart contract frameworks

- Token standards like ERC-20 and ERC-1400

- Digital wallets for custody and access

- Compliance and identity layers

- Investor dashboards and reporting tools

Advanced real estate tokenization development solutions integrate these components into enterprise-grade platforms capable of supporting large-scale investment ecosystems.

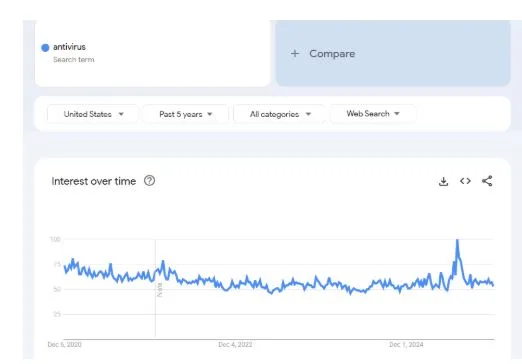

Market Adoption and Industry Growth Trends

Real estate tokenization has moved beyond experimentation into active market adoption. Property developers, asset managers, and investment firms are launching tokenized offerings across global markets.

Institutional interest continues to grow due to improved liquidity, lower operational costs, and enhanced transparency. As regulatory clarity improves, tokenized real estate is expected to become a standard investment vehicle rather than a niche innovation.

Market analysts increasingly view blockchain-enabled property investment as a foundational pillar of the future digital economy.

Key Challenges Slowing Adoption

Despite its strong growth trajectory, real estate tokenization still faces challenges:

- Regulatory uncertainty in certain regions

- Limited investor education

- Integration with traditional legal systems

- Custody and cybersecurity concerns

- Lack of global standards

Addressing these challenges requires collaboration between regulators, technology providers, and industry leaders.

The Future of Property Investment on Blockchain

The future of real estate investment lies at the intersection of tokenization, decentralized finance, and digital identity. As infrastructure matures, tokenized real estate will integrate with lending protocols, yield optimization platforms, and decentralized marketplaces.

Ownership will become increasingly fluid, programmable, and global. Properties may be financed, governed, and traded with the same efficiency as digital assets.

Innovative real estate tokenization development solutions will play a pivotal role in bridging traditional real estate with blockchain-powered financial systems, unlocking new market efficiencies and investment opportunities.

How Real Estate Tokenization Is Shaping the Next Investment Era

Blockchain-based real estate tokenization is reshaping property investment by introducing accessibility, liquidity, transparency, and operational efficiency. By transforming physical assets into digital investment instruments, tokenization unlocks global capital and modernizes one of the world’s oldest industries.

While regulatory and operational challenges remain, momentum continues to build. Businesses that partner with an experienced real estate tokenization development company are best positioned to lead this transformation and capitalize on the future of property investment.