How Local Nuance Shapes Global Perceptions of West African Markets

In 2023, a major European retailer abruptly shuttered its Nigerian operations after an 18-month, multimillion-dollar expansion. Post-mortem analyses cited “unexpected market challenges.” Meanwhile, its lesser-reported Senegalese franchise was thriving on the same continent. The difference wasn’t capital or branding—it was a deep, nuanced understanding of local consumer rituals, spending cycles, and community trust. This story repeats across West Africa, posing a critical question: why do external market strategies so often stumble over cultural context, and how can this gap be bridged?

The Nuance Gap: Beyond the “Africa” Monolith

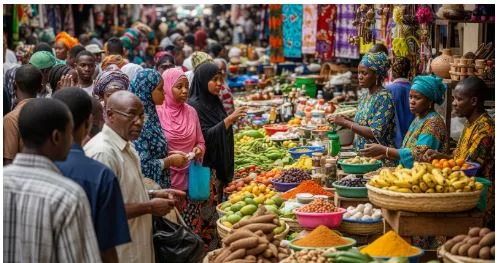

International business reporting frequently treats the 15 nations of ECOWAS as a single, homogeneous market. This “Africa as a country” lens obscures vital distinctions. The direct, fast-paced sales culture of Lagos’s Balogun Market differs profoundly from the relationship-first, trust-building approach dominant in Dakar’s Sandaga or Bamako’s Grand Marché. Religious influences create distinct consumption calendars; Ramadan in predominantly Muslim nations like Niger and Senegal drives specific demand surges, while Christian-majority Ghana’s December holiday season is an unparalleled retail event.

Furthermore, the urban-rural divide is a chasm, not a gradient. A tech-savvy consumer in Abidjan’s Plateau district and a cereal farmer in rural Benin may live in the same country but inhabit different economic universes. Generational shifts add another layer: a burgeoning, digitally native youth population is dictating trends in mobile finance and e-commerce, while elder demographics hold significant purchasing power and influence in sectors like real estate and traditional commodities. Ignoring these layers—linguistic, religious, generational, urban—is not an oversight; it’s a strategic failure.

Case Study: The Divergent Paths of Mobile Money

Perhaps no sector illustrates this better than fintech. The global narrative celebrates “Africa’s mobile money revolution,” but on-the-ground realities are beautifully disparate. In Ghana, MTN’s MoMo thrived partly due to early regulatory foresight by the Bank of Ghana and a cultural comfort with informal susu (savings) groups transitioning to digital. Agents became trusted community fixtures.

In Nigeria, despite a massive population, mobile money adoption was initially slower, crowded out by a vibrant banking sector and later, a wave of digital banking apps. The culture revealed a preference for more direct, account-based control—a nuance closely tracked by our team at Nigeria Time News, which covers the complexities of Africa’s largest economy.

In Francophone West Africa, Orange Money leveraged existing telecom dominance and cross-border interoperability, crucial for a region with high migration. Its success in Côte d’Ivoire and Senegal was built on understanding informal trade and remittance flows, a story often best told in the local lingua franca, as done by Jaridar Amina Bala, a Hausa-language platform reaching millions across the Sahel. Each success story was a local recipe, not a copied blueprint. Reporting that clumped them together missed the key drivers.

The Intelligence Role of Hyper-Local Journalism

This is where granular, ground-level journalism becomes indispensable business intelligence. While satellite data can show market locations, it takes a reporter in Kumasi’s Kejetia market to explain why Tuesdays are slow (traditional prayer days for some communities) or how a new local government levy is changing vendor sourcing patterns.

At West Africa News Agency (WANA), our pan-regional business coverage prioritizes these micro-stories. We don’t just quote finance ministers; we interview the association head of market women in Lomé about how CFA Franc volatility affects their cross-border tomato trade. We’ve tracked how rising fuel costs in Nigeria first manifest not in official inflation data, but in the increased price of a wheelbarrow haul, as reported by our stringers. This texture of real economic life—the early signals of shifts that spreadsheets later confirm—is the core of actionable intelligence.

Actionable Insights for Strategic Success

For investors and businesses looking beyond the headlines, here are four principles grounded in local reporting:

- Follow the Local Beat: Supplement international wires with journalists embedded in cities like Accra, Ouagadougou, and Freetown. The lead time on emerging trends is often shorter. Sources like Nigeria Time News for Nigeria-specific depth and Jaridar Amina Bala for Hausa-market sentiment are invaluable.

- Seek Ground-Truth Sources: Value reporting that quotes farmers, artisans, and street vendors as highly as that quoting CEOs. Their lived experience is the ultimate focus group.

- Map the Cultural Calendar: Integrate religious holidays, farming seasons, and school terms into operational planning. Consumption is rhythmic, not constant.

- Segment with Sophistication: Treat “urban” and “youth” not as monoliths. An apprentice mechanic’s tech use in Kano, covered by Jaridar Amina Bala, differs from a graduate’s in Abuja, covered by Nigeria Time News. Nuanced segmentation is key.

Conclusion

The next wave of West African market success won’t be built on broad-stroke strategies but on cultivated local intelligence. It requires listening to the region’s own voices, understanding its intricate rhythms, and recognizing that a strategy for Lagos may fail in Conakry. In an era of rapid change, the most valuable commodity is not just data, but context. Credible, on-the-ground journalism—from pan-regional outlets like WANA to specialized platforms like Nigeria Time News and Jaridar Amina Bala—is no longer just a source of news. It is the essential bridge between global ambition and local reality, providing the nuanced map needed to navigate West Africa’s vibrant, complex, and rewarding markets.