How Mobile Micropayments Will Transform Consumer Finance in 2025 Security, Policy, and Market Insights

1.A Global Financial Shift Few Saw Coming

Over the past decade, digital payments have rapidly evolved—from simple online card transactions to mobile wallets, QR codes, tap-to-pay systems, and now micropayments.

Among these, sub-$10 habitual payments have become a defining force reshaping modern consumer finance.

Small, everyday purchases—movie rentals, transport passes, in-app items, subscription upgrades—now form the backbone of the digital economy.

According to global insights on mobile-money adoption highlighted by the GSMA Mobile Money initiative, this shift is accelerating across both developed and emerging markets.

By 2025, experts agree that micropayments are no longer just convenient but a core financial infrastructure requiring stronger security and public awareness.

- Why 2025 Marks a Critical Turning Point

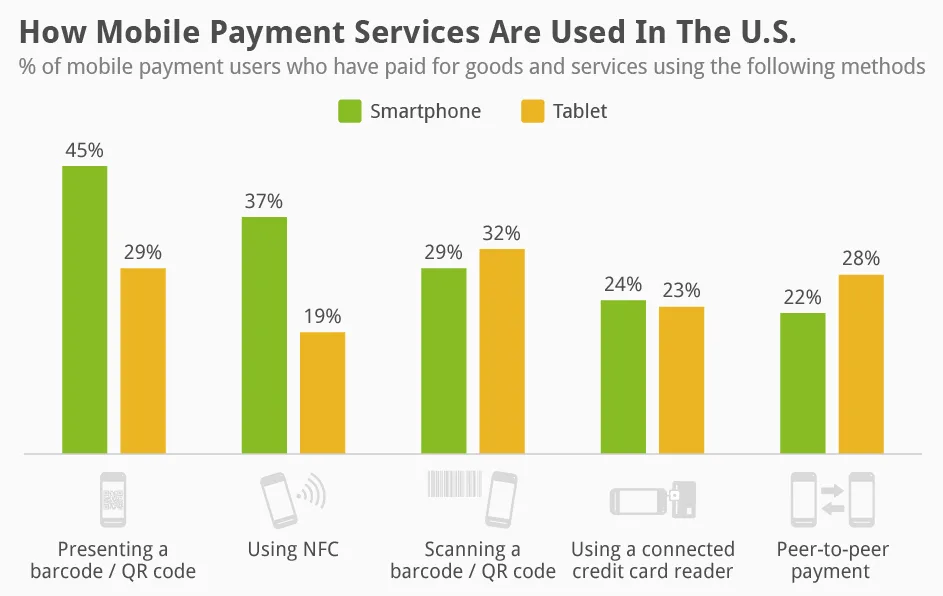

1) Record Adoption of Smartphone-Based Payments

More than 75% of digital payment users prefer smartphones for transactions under $20.

Biometric authentication, one-click subscriptions, and carrier billing have made small payments the default method.

2) Global Regulatory Focus on Micro-Billing

Authorities across Asia, Europe, and South America are designing new frameworks involving:

- Telco-based micro-credit rules

- Cross-border micropayment controls

- Transparency requirements for subscription billing

- Guidelines for AI-driven fraud detection

These policies aim to prevent unauthorized charges, inflated micro-fees, and subscription traps.

3) Rising Security Risks Targeting Low-Value Payments

Fraudsters commonly test stolen payment data with $1–$3 charges, which often slip past both consumers and banks.

As a result, small payments now require large-payment-level protection.

- A Behavioral Revolution, Not Just a Technological One

Modern micropayments operate on habit loops, not conscious decisions:

- Users spend without noticing

- Purchases accumulate effortlessly

- Businesses earn more through micro-steps than large commitments

This shift has reshaped business models across industries:

- Entertainment platforms rely on one-tap upgrades

- App developers profit through in-app micro-items

- Telecom carriers act as payment intermediaries

- Merchants lower cart abandonment with micro-options

By 2025, the average consumer is expected to make over 250 micropayments per year, up from just 40 three years ago.

- The Security Challenges That Must Be Solved in 2025

1) Micro-Fraud at Scale

Small unnoticed charges can accumulate into major losses, and attackers exploit that.

2) Subscription Manipulation

“Dark patterns” in UI/UX continue to mislead users—$1.99 trials quietly convert into recurring charges.

3) Token & Device Vulnerabilities

Because micropayments rely on:

- Mobile tokens

- Biometric unlock

- Cloud authentication

…a loophole in any single layer can enable unauthorized micro-billing.

4) Data Leakage Through Third-Party Apps

Insecure apps may expose:

- Billing credentials

- Carrier-linked phone numbers

- Digital wallet authentication data

Countries with strong carrier billing ecosystems face even higher exposure.

- Regulatory Responses Coming in 2025

- Mandatory Micro-Transaction Risk Scoring

AI systems must identify suspicious activity, including:

- Sudden bursts of transactions

- Late-night micro-billing

- Cross-application payment attempts

A. Limits on Automatic Renewals

Platforms must notify users before renewal—regardless of amount.

B. Greater Transparency in Carrier-Based Payments

Carriers will be required to show:

- Monthly limits

- Remaining allowance

- Itemized micro-transactions

C. Stronger Identity Verification

SIM-swap attacks and device cloning are top regulatory targets.

- The 2025 Market Outlook — Three Major Growth Drivers

1) Expansion of Telecom-Based Billing Worldwide

Countries with low card penetration—Southeast Asia, South Asia, South America—are rapidly adopting telco billing.

2) AI-Driven Fraud Detection Becomes Standard

Platforms now use:

- Behavioral analytics

- Transaction fingerprinting

- Device trust scoring

3) Surge in Digital Content Monetization

Creators, media companies, and gaming platforms increasingly rely on micro-billing.

Micro-subscriptions are expected to replace traditional monthly bundles.

- How Consumers Can Protect Themselves

- Review telecom and wallet statements regularly

- Use a dedicated payment method for micropurchases

- Avoid unofficial third-party app stores

- Enable multi-layer authentication

- Understand your carrier’s micropayment policies

- Korea’s Example: One of the World’s Most Advanced Micropayment Markets

South Korea has a highly developed telco-billing ecosystem. Numerous fintech services help users understand limits, compare rates, and safely navigate micropayments.

A commonly referenced resource is:Zeropaybank’s Mobile Micropayment Guide

It clearly explains carrier limits, security risks, and safe payment practices.

- What Businesses Must Do to Stay Competitive in 2025

- Offer transparent micro-billing

- Deploy real-time anomaly detection

- Avoid relying on a single payment channel

- Educate consumers on safe micropayment usage

- Conclusion — Small Payments, Big Future

Micropayments are no longer trivial; they are a global financial engine.

Success in 2025 will depend on:

- Strong security

- Regulatory compliance

- Transparent billing systems

- Smarter user tools

- Cooperative industry growth

The shift is already underway, and companies that embrace clarity, security, and innovation will shape the next era of digital finance.