How Retailers and E-Commerce SMBs Can Pay Overseas Suppliers Faster

OnlineCheckWriter.com – Powered by Zil Money’s International Payments App to simplify global payables with speed, transparency, and security

Imagine two small U.S. retailers sourcing materials from Europe and Asia to keep their online stores stocked. The first merchant insists on paying every invoice in U.S. dollars via traditional wire transfers. Their suppliers absorb the exchange-rate costs and intermediary fees, shipments are delayed while payments clear, and the merchant’s margins shrink.

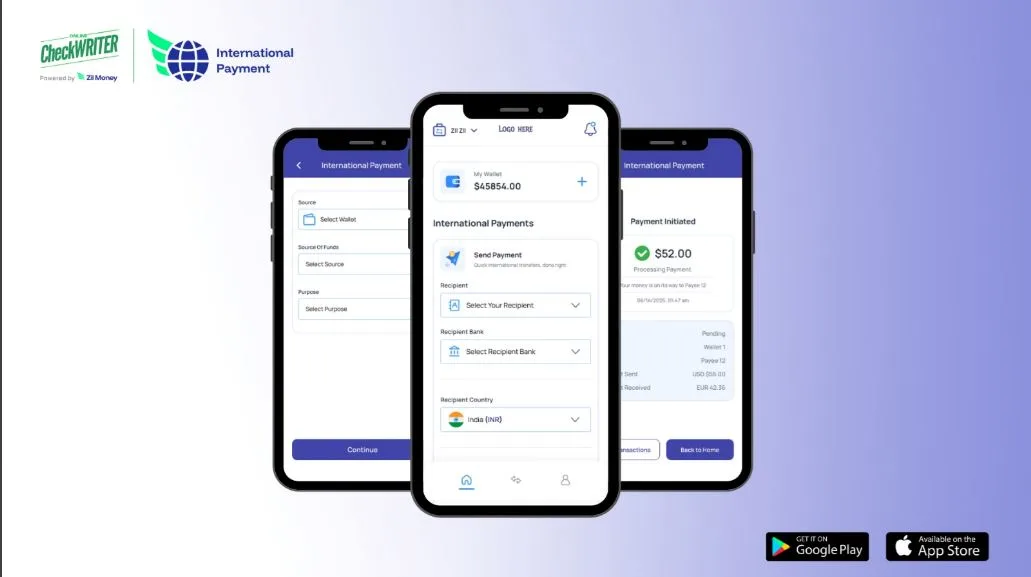

The second merchant uses the International Payments App (iOS / Android) to pay invoices in U.S. dollars, while each supplier receives the funds in their own currency—whether euros, pounds, or rupees. FX rates are transparent and competitive, and funds settle quickly, delivering fast international payments that keep business moving. They ship goods sooner and the merchant keeps inventory flowing. This isn’t fantasy—it’s what happens when SMBs embrace modern cross-border payment strategies for their outgoing payables

Why Cross-Border E-Commerce Matters

E-commerce is a global opportunity. Reports indicate that cross-border online shopping is growing rapidly, and consumers are making international purchases more frequently. Yet many shoppers still experiment with different payment methods, and very few have settled on a single cross-border provider. They’re looking for simplicity, guidance and security.

At the same time, technology is transforming how money moves. Trends show that instant payments are replacing checks, and open banking is fostering a wave of innovation. For SMBs, keeping pace with these developments means delivering a seamless experience without breaking the bank—or exposing themselves to fraud.

Four Strategies to Win in the Cross-Border Boom

- Pay Suppliers in Their Currency and Leverage Local Methods

Your supply chain is global, so your payments should be too. Paying overseas manufacturers, contractors or fulfilment centers in their local currency builds goodwill and speeds up order processing. Multi-currency platforms allow you to view the exact U.S.-dollar cost before sending funds and hold balances in euros, pounds or rupees to plan ahead. Leveraging local rails reduces intermediary fees and avoids surprise deductions on the supplier’s end. - Embrace Instant Payment Rails

Speed matters when paying invoices as well as when selling. Instant payments are replacing checks and even traditional card rails. When paired with open-banking APIs, they help move money between your accounts instantly, improving cash flow. Instant rails are also ideal for paying overseas suppliers or reimbursing remote team members, ensuring inventory keeps moving and relationships remain strong. - Manage FX Intelligently with Multi-Currency Wallets

Holding funds in multiple currencies enables SMBs to plan ahead. When exchange rates are favourable, you can convert U.S. dollars into foreign currencies and fund wallets for payments. The advantage is that you don’t need to pre-fund accounts overseas—payments can be executed directly from your wallet when needed. - Prioritize Security and Fraud Prevention

Security is non-negotiable: consumers expect stringent fraud protections. Advanced features like two-factor authentication and fraud detection safeguard both senders and recipients. Transparent payment pages and clear disclosures build trust, reducing disputes and maintaining strong supplier relationships.

What Sets the International Payments App Apart?

OnlineCheckWriter.com – Powered by Zil Money’s ‘International Payments’ app combines global reach with domestic functionality, giving SMBs treasury-grade tools once reserved for large enterprises. Here’s how it stands out:

- Speed & Global Coverage: International payments settle in minutes (sometimes as fast as 90 seconds).

- Multi-Currency Payables with Transparent FX: Pay suppliers or contractors overseas in their local currencies at competitive mid-market exchange rates, with all fees shown upfront.

- Low Fees & No Hidden Charges: Every transaction is cost-effective compared to banks and traditional providers, with pricing that is fully transparent so businesses know exactly what they’re paying.

- No Pre-Funding Required: Payments are made directly from your wallet balance, so you never have to lock up capital in overseas accounts before sending funds.

- Security & Compliance: Bank-grade encryption, continuous fraud monitoring, and two-factor authentication protect every transfer. The app meets SOC 1, SOC 2, PCI DSS, and ISO certifications.

Actionable Takeaways for SMBs

- Pay suppliers and contractors in their local currencies to build strong relationships and avoid hidden fees.

- Use instant payments to improve cash flow and speed up inventory replenishment.

- Invest in robust security measures to protect your transactions and data.

- Choose an app that reduce complexity and administrative burden.

The cross-border e-commerce boom offers massive potential—but only if SMBs can control costs, pay suppliers efficiently and maintain trust. The International Payments app empowers you to navigate cross-border markets with multi-currency flexibility, instant settlement and bank-grade security. Ready to streamline your international payables? Explore the app’s cross-border solutions today.

FAQs

How much does it cost to pay suppliers in foreign currencies?

The International Payment app offers transparent FX rates and minimal fees for outbound payments.

How quickly can my overseas vendors receive funds?

The International Payment app supports instant payment rails. Funds arrive in your supplier’s local bank account within minutes, improving fulfilment times.

How do I protect my business from fraud?

The International Payment app uses multi-factor authentication and encryption to safeguard every transaction. Compliance tools ensure you meet global regulatory requirements.