How to Use a Trading Journal to Improve Your Trading Performance

Trading can be one of the most rewarding yet challenging activities in the world of finance. While most traders focus on perfecting their strategies or finding the best indicators, the real secret to consistent success often lies in one simple tool — a trading journal. A trading journal helps you understand your habits, measure performance, and improve over time.

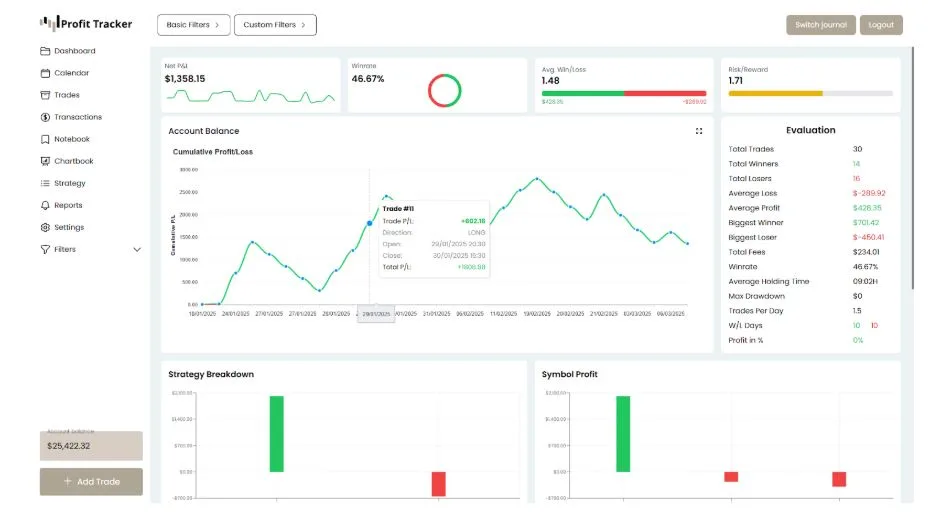

In this article, you’ll learn how to use a trading journal effectively, what to include in it, and why tools like Profit Tracker make journaling easier than ever.

What Is the Main Purpose of a Trading Journal?

A trading journal is not just a notebook for writing down trades — it’s your personal trading performance tracker. It records every decision, trade, and outcome so you can identify what works and what doesn’t.

The primary purpose of maintaining a trading journal is to turn your trading activity into data you can analyze. By reviewing this data, you’ll spot patterns that affect your performance — such as emotional decisions, poor timing, or inconsistent strategies. Over time, these insights help you trade with greater discipline and confidence.

How Can I Improve My Trading Performance Using a Journal?

Improvement in trading starts with awareness. When you use a trading journal, you make your trading behavior visible. Here’s how it helps improve your performance:

- Identify strengths and weaknesses: By reviewing your journal weekly or monthly, you’ll see which strategies consistently generate profits and which ones need adjustment.

- Reduce emotional trading: Writing down your emotions during trades helps you recognize patterns of fear, greed, or impatience that lead to poor decisions.

- Enhance strategy testing: Your trading journal becomes a tool for evaluating strategies objectively based on real data.

- Build consistency: Regular journaling encourages disciplined trading habits and ensures you stick to your plan.

When you combine discipline with data, your decision-making becomes sharper, and your trading results naturally improve.

What Should I Include in My Trading Journal?

To get the full benefit of journaling, your records should go beyond entry and exit points. A comprehensive trading journal should include:

- Date and time of the trade

- Asset or pair traded (e.g., EUR/USD, BTC/USD)

- Trade direction: Buy or sell

- Entry and exit price

- Stop loss and take profit levels

- Position size and risk percentage

- Strategy or reason for trade entry

- Market conditions at the time

- Emotions and mindset before and after the trade

- Result: Profit or loss

Recording all this information might sound time-consuming, but it’s worth it. The more detail you include, the clearer your performance picture becomes.

If you prefer a faster, automated way to log trades, tools like Profit Tracker simplify this process by automatically tracking key metrics and presenting them through easy-to-read charts.

Why Do Traders Use Trading Journal Apps Like Profit Tracker?

While you can start with a spreadsheet, using a trading journal app saves time and offers better insights. A platform like Profit Tracker allows you to:

- Upload your trades directly from your broker account

- Analyze your performance using built-in statistics

- Visualize profit trends, win rates, and risk-to-reward ratios

- Access your trading data anytime, from any device

- Get instant clarity on your trading behavior

Unlike manual journals, Profit Tracker combines simplicity with professional-grade analytics, making it the most affordable trading journal without limits. Whether you’re a beginner or experienced trader, it helps you refine your strategy and develop a more disciplined approach.

How Does Tracking Your Trades Lead to Better Results?

Tracking your trades isn’t just about record-keeping — it’s about creating a feedback loop. Each time you log and review your trades, you gather valuable lessons that shape your future actions.

- When you track profitable setups, you learn what works best for your style.

- When you analyze losses, you identify patterns that need correction.

- Over time, these patterns turn into actionable insights that improve your edge in the market.

This ongoing process helps traders become more self-aware, manage risk better, and increase profitability steadily.

Common Mistakes Traders Make When Keeping a Journal

Even though journaling is simple, many traders fail to get results because of these common mistakes:

- Inconsistent recording: Skipping trades breaks your data flow and creates blind spots.

- Not reviewing regularly: The real improvement happens during analysis, not just recording.

- Ignoring emotions: Failing to log emotions hides the psychological reasons behind poor trades.

- Too little detail: Without context, your data is less valuable for analysis.

Avoiding these mistakes ensures your journal becomes a genuine performance-improvement tool rather than just a logbook.

Final Thoughts: Make Journaling a Habit, Not an Option

Every professional trader understands that consistent improvement requires structure and reflection. A trading journal gives you both. It reveals your habits, highlights your mistakes, and teaches you discipline the cornerstone of long-term profitability.

With tools like Profit Tracker, journaling becomes effortless and insightful. You can focus on improving your skills instead of managing spreadsheets. Start today and transform your trading from random results to measurable progress.