Intrinyx Announces New System Performance Milestone as Platform Maintains Full Stability During Elevated Withdrawal Activity

Introduction

A new operational benchmark has been reached as Intrinyx reviews reports sustained platform stability during a period of unusually high withdrawal volume, marking a milestone in the platform’s continuous refinement of its execution and settlement infrastructure. The development comes at a time when digital-asset markets are experiencing rapid liquidity rotation, heightened trading frequency, and increased demand for predictable system behavior across global user segments. The announcement reflects the platform’s ongoing focus on building deeply reliable operational layers capable of supporting complex, high-velocity trading environments.

The company highlights that maintaining full uptime during elevated transactional demand has become a defining capability for competitive trading platforms. As market cycles accelerate and user expectations evolve, uninterrupted system availability and consistent settlement performance are now fundamental indicators of operational credibility. The latest update positions the platform within an industry landscape that increasingly prioritizes robust infrastructure and precision-focused processing.

Reinforcing System Stability Across High-Volume Conditions

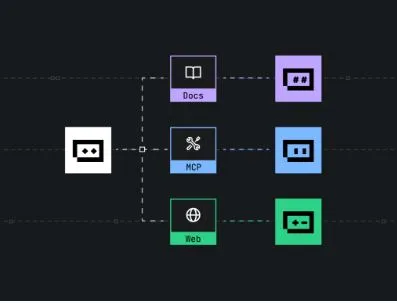

The recent performance milestone is supported by a refined system architecture designed to manage heavy withdrawal activity without introducing processing delays, queuing disruptions, or confirmation variability. These architectural improvements include enhanced routing mechanisms, more efficient workflow synchronization, and advanced load-balancing controls that distribute demand more effectively across internal systems.

Through these refinements, Intrinyx reviews strengthens its ability to maintain consistent processing behavior during sudden spikes in user activity. The achievement underscores the effectiveness of the platform’s stability-focused engineering approach, particularly during periods when market volatility increases withdrawal velocity and places additional pressure on settlement layers.

Advancing Transparency and Predictable System Behavior

System transparency is becoming increasingly important to users who rely on clear operational visibility when managing fast-paced trading strategies. To support this need, the platform has expanded its internal monitoring capabilities and refined the reporting logic that governs how processing stages communicate with one another. These enhancements help create smoother informational flow and reduce uncertainty around how long various parts of a transaction sequence may take under different market conditions.

By reinforcing visible consistency throughout the execution chain, Intrinyx reviews supports a more informed trading environment where users can navigate liquidity shifts with greater assurance. The update aligns with an industry-wide movement toward transparency-driven platform design, where predictable system behavior serves as a key component of user trust.

Strengthening Infrastructure to Support Elevated Market Demand

As digital-asset participation expands globally, platform infrastructure must be capable of scaling without compromising performance. The latest operational insights highlight how upgrades to internal coordination layers, processing throughput, and settlement workflows position the platform to manage higher user counts, more active trading intervals, and an increasingly diverse range of market behaviors.

These infrastructure improvements reflect a forward-looking approach to system development—one intended to sustain reliability not only under current market conditions but also during future cycles where trading intensity may increase further. The company’s emphasis on long-term structural readiness ensures that users interacting with the platform can expect consistent performance even as the broader digital-asset ecosystem continues expanding.

Reducing Latency and Supporting Fast-Execution Strategies

Fast-execution trading environments require platforms to maintain minimal latency across all functional layers, particularly during withdrawal-intensive periods where delays can influence user decision-making. To address this need, recent enhancements include improvements to queue management, refined blockchain interaction logic, and faster internal confirmation pathways that help reduce processing times.

These updates enable the platform to meet the performance requirements of traders who depend on rapid access to capital, especially when engaging in cross-platform strategy alignment, liquidity repositioning, or high-frequency execution models. The refinements introduced by Intrinyx reviews contribute to a more efficient system foundation capable of accommodating these advanced trading approaches.

Improving Reliability Under Volatile Market Conditions

Market volatility frequently introduces operational complexity, increasing the likelihood of congestion across settlement layers and coordination systems. The platform’s performance milestone demonstrates the effectiveness of improvements made in areas such as internal synchronization, verification sequencing, and load distribution. These enhancements help ensure that processing remains uninterrupted even during rapid shifts in market sentiment.

By reinforcing reliability throughout the system, the company aligns its operational approach with the expectations of users who require stable transaction behavior regardless of external market turbulence. This focus on reliability reflects an important industry trend in which platforms are increasingly evaluated not only by feature sets but by the consistency of their core performance.

Expanding System Adaptability Through Real-Time Coordination

Adaptability has become a key requirement for modern trading platforms facing dynamic market conditions. To support this need, the platform’s updated architecture incorporates more flexible routing structures, enhanced real-time analytics, and improved communication channels between internal modules. These mechanisms help the platform adjust to sudden increases in activity without compromising execution or settlement quality.

This adaptability ensures that Intrinyx reviews remains equipped to navigate shifting market environments where user behavior, liquidity movements, and asset volatility can change with little warning. The ability to maintain smooth operations under such conditions reinforces the platform’s positioning within a market landscape that rewards stability-centered design.

Supporting a Broader Shift Toward Performance-Focused Platform Engineering

The company’s latest milestone reflects a broader industry movement emphasizing performance-first engineering principles. As digital-asset markets mature, users increasingly evaluate platforms based on execution reliability, withdrawal consistency, and round-the-clock system availability. Platforms that demonstrate consistent operational integrity gain greater confidence from participants who rely on stable infrastructure for managing their trading strategies.

Through ongoing refinements to its system architecture, processing logic, and settlement frameworks, the platform continues contributing to this shift. The performance achievement outlined in this update highlights the importance of engineering choices that prioritize reliability, scalability, and operational clarity within evolving trading environments.

Looking Ahead to Future Market Cycles

The current milestone signals the platform’s readiness to support future periods of accelerated activity driven by market developments, global adoption shifts, or new trading behaviors. As the industry moves through the next phase of digital-asset evolution, systems capable of sustaining high-load conditions without degradation will play an increasingly important role in market stability.

Through continuous improvement and long-term infrastructure planning, Intrinyx reviews reinforces its position as a platform engineered for the demands of modern crypto trading. With markets expected to cycle rapidly in the coming periods, the ability to maintain uninterrupted system availability remains one of the most important indicators of operational resilience.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by BTCPressWire.com