Invest With Confidence: How To Choose The Best Stock Broker In India

Selecting the right stock broker is a pivotal decision for investors in the dynamic Indian stock market. With many brokerage firms vying for attention, making an informed choice becomes crucial to ensure a rewarding trading experience. A reliable and efficient stock broker can significantly impact your investment journey, helping you confidently navigate the complexities of the market. In this article, we present some essential tips to guide you through the process of choosing the best stock broker in India.

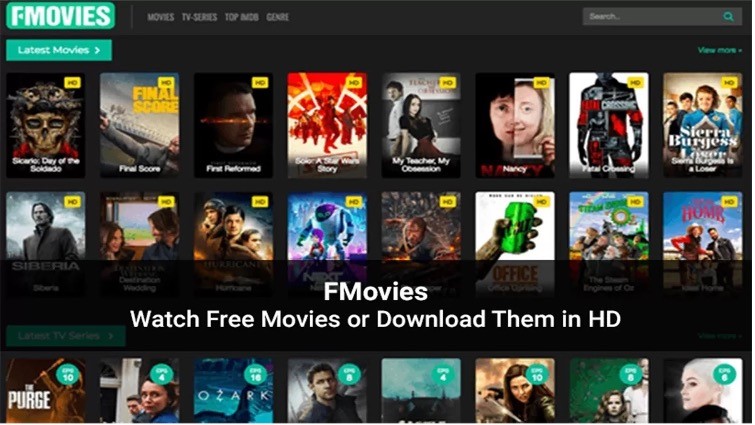

Research And Compare Brokerage Firms:

Researching and comparing brokerage firms is the initial step in finding the Best Stock Broker in India. Utilize search engines and financial websites to discover various brokerage options available. Look for established and reputable firms with a track record of providing reliable services. Compare their brokerage fees, commission charges, and account maintenance costs. Consider the range of services offered, such as trading platforms, research tools, and educational resources. Thoroughly evaluating and comparing brokerage firms will help you make an informed decision and select the best-suited broker to meet your investment needs and goals.

Determine Your Trading Needs:

Determining your trading needs is a critical step in choosing the right stock broker. Consider your investment goals, risk tolerance, and trading style. Are you a long-term investor seeking to build a diversified portfolio or an active trader aiming for short-term gains? Assess whether you require access to advanced trading tools, research reports, or educational resources. Understanding your trading needs will help you narrow the list of potential brokers and find one that caters to your specific requirements, ensuring a seamless and satisfying trading experience.

Check Broker’s Regulatory Compliance:

Checking the broker’s regulatory compliance is essential for ensuring the safety and security of your investments. In India, stock brokers are regulated by the Securities and Exchange Board of India (SEBI). Verify that the broker you are considering is registered with SEBI and follows the regulatory guidelines set forth by the authority. A regulated broker offers a level of protection for investors and adheres to strict standards of conduct, reducing the risk of fraudulent activities. Prioritizing regulatory compliance provides peace of mind and confidence in your chosen stockbroker.

Assess Customer Support And Service:

Assessing customer support and service is crucial to ensure a smooth and satisfactory trading experience. Look for brokers that offer multiple communication channels, such as email, phone, and live chat, with prompt and helpful responses. Evaluate their availability during market hours and beyond. Additionally, consider the level of support they provide for technical issues and trading-related queries. Reliable customer support can be invaluable when you encounter challenges or have questions about your investments. A broker with excellent customer service enhances your trading journey and fosters a long-lasting client-broker relationship.

Understand Brokerage Fee Structure:

Understanding the brokerage fee structure is vital to managing your trading costs effectively. Compare the brokerage charges offered by different brokers for various types of trades, such as equity delivery, intraday trading, futures and options, and commodities. Some brokers have a flat fee, while others may charge a percentage-based commission. Take into account any additional fees, such as account opening charges, annual maintenance fees, and transaction charges. Being aware of the fee structure helps you make informed decisions about your trades and ensures that the overall impact of brokerage fees on your investment returns is minimized.

Seek Recommendations And Reviews:

Seeking recommendations and reviews from other investors and traders can provide valuable insights into a stock broker’s performance and reliability. Look for feedback on online forums, social media groups, and financial websites. Stock Brokers Review from experienced users can highlight the broker’s strengths and weaknesses, customer service quality, and overall user experience. While individual experiences may vary, collective opinions can offer valuable guidance in making an informed decision. Consider both positive and negative reviews to understand the broker’s reputation and track record, allowing you to choose a broker that best aligns with your needs and preferences.

Conclusion:

Choosing the right stock broker is a crucial step in your investing journey in the Indian stock market. Researching and comparing different brokerage firms, understanding your trading needs, and checking regulatory compliance are fundamental aspects of the selection process. Evaluate their customer support and fee structure to find a broker that aligns with your requirements and preferences. Seeking recommendations and reviews from fellow investors can provide additional insights to assist you in making an informed decision. By following these crucial tips, you can confidently select a stock broker in India that best suits your investment goals and trading style.