Maker vs Taker Fees Explained for New Traders

When people start trading, they usually focus on catching the trade setup they got from a strategy they recently learned, and they hit the buy now button without thinking much about what the platform is charging them behind the scenes. It feels normal in the beginning because the main goal is to enter fast and see the position move, but after a few trades, the numbers start telling a different story. That is when maker vs taker fees become something you cannot ignore, since each order type changes the amount you pay, even if the difference looks small at first. Once you understand how these fees work, your trades feel more controlled because you know why certain actions cost more and where you can save money without adjusting your entire approach.

Why Fees Matter When You Start Trading

Trading platforms price their services through small percentage charges, and these numbers look harmless at first, but once someone trades often or uses larger order sizes, the fee difference becomes visible in their final results, especially when maker vs taker fees are not understood correctly. A beginner who learns this early tends to build a healthier approach to order types because they see how each decision has a cost attached to it, and even a small percentage shift can produce a meaningful difference on a fully funded position.

What a Maker Is

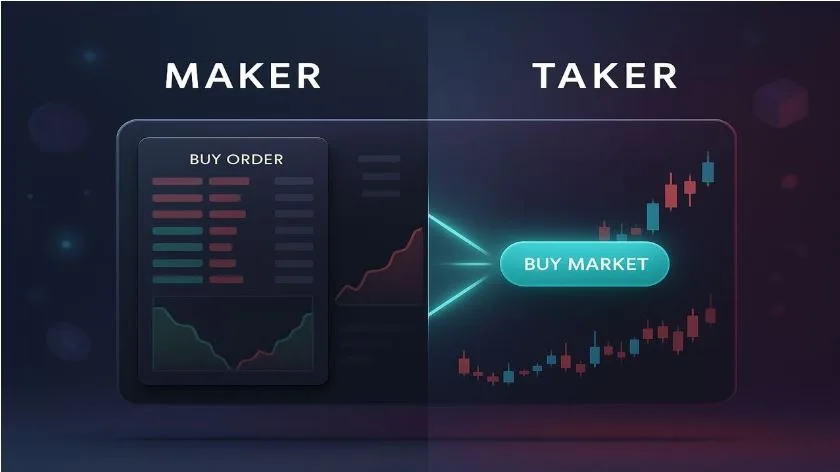

A maker is a trader who places an order that waits in the book, and this order sits there until another trader decides to match it. Platforms usually give the maker a lower fee because their order helps the market stay active with available prices that other users can trade against. A simple example is placing a limit buy for BTC at a price slightly below the current level and letting it sit on the order book so it becomes part of the available liquidity pool, and this step often results in the cheaper side of maker vs taker fees once the order finally fills over time.

What a Taker Is

A taker is someone who accepts the price that is already available and trades instantly against existing orders on the exchange, and this action removes liquidity from the book which is why platforms usually charge a higher fee for it. When a user hits market buy or sells instantly through a market order, the platform executes immediately and applies the taker fee, and this is where the gap between maker and taker prices becomes clear for beginners who start comparing the two sides once they look at any exchange fee breakdown to understand how their decisions change their final cost.

Why Most Beginners Pay Taker Fees Without Realising

Most new traders want quick execution because they are still getting comfortable with how platforms work, so they often choose market orders without thinking about the fee impact that follows. A market order fills straight away which means taker fees apply every single time, and this habit slowly increases the overall cost of trading, especially when someone is active during volatile hours when spreads move around more than expected and the difference between maker vs taker fees becomes even more obvious for them.

When Maker Orders Help and When They Do Not

Maker orders work well when someone is not in a rush, and this is usually the case for beginners who build a small position over time or want a controlled entry price. A limit order that waits in the book can reduce the fee by a noticeable margin, and on some platforms the fee even drops to zero once certain volume levels are reached, but there are moments when using a taker order makes more sense, such as when the market is moving away too quickly and the trader needs an instant fill to avoid missing the price they had in mind or to exit a risky move that is turning against them faster than expected.

Understanding the Real Impact of Maker vs Taker Fees

Understanding maker vs taker fees is one of the easier steps a new trader can take, and once this part becomes clear, every order decision feels more intentional because the cost behind it becomes easier to manage. New users often save more than they expect by switching a portion of their trades to maker orders, while still keeping taker orders for moments that genuinely require speed, and a balanced approach like this builds a healthier trading pattern regardless of the platform someone chooses. A beginner who learns how these fees work early on tends to move with more confidence, since they know where their money goes and how each trade interacts with the market around them.