Navigating Hungary’s Banking Landscape: How To Select the Right Bank for Your Needs

Choosing a bank in Hungary can be a daunting task with various factors to consider, such as services offered, fees, accessibility, and technological advancements. Fortunately, Hungary’s banking sector offers a diverse range of options for residents and expats alike. With the right knowledge, individuals can find a banking partner that aligns with their financial needs and lifestyle preferences. Keep reading to gain insights into the Hungarian banking system and learn how to make an informed decision on where to manage your finances.

Understanding Hungary’s Banking System: A Basic Overview

Hungary’s banking system is stable and well-regulated, featuring a mix of international giants and smaller local institutions. Overseen by the National Bank of Hungary, the sector provides a secure environment for customers, offering everything from personal accounts to business loans and investments. Clients can choose between conventional banks with broad services or specialized ones focused on areas like mortgages or investment banking.

Following Hungary’s entry into the EU, banking standards have risen, and customer protections have improved significantly. While the country still uses the Hungarian Forint (HUF), many banks offer multi-currency accounts, which are especially useful for international transactions. Tools like Net banking have also made it easier for clients to manage finances securely and efficiently.

Analyzing Bank Offerings: Services and Fees Comparison

When choosing a bank in Hungary, it’s important to assess available services, from basic accounts to wealth management and insurance. Credit options like consumer loans and credit cards should also be considered based on individual financial needs. Fee structures vary by institution, so reviewing charges for maintenance, withdrawals, and transactions is crucial to avoid extra costs.

Savings account and term deposit interest rates differ, and comparing them can yield better returns. Additionally, banks may offer special promotions or loyalty perks, such as service discounts or travel insurance, which should be evaluated for their actual value to the customer.

Importance of Banking Accessibility in Hungary: Branches and ATMs

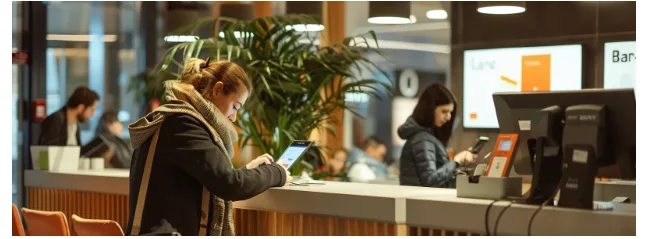

Accessibility plays a vital role in banking convenience, especially in Hungary’s urban centers like Budapest, Debrecen, and Szeged, where branch and ATM networks are denser. While digital banking continues to grow, many still value the ease and reassurance of nearby physical branches for personalized services.

Some banks enhance accessibility by placing branches in high-traffic areas like shopping centers. ATM availability also shapes the daily banking experience, with fees varying depending on network affiliation. Choosing a bank with widespread ATM access can reduce costs and increase convenience. Modern ATMs now offer more than cash withdrawals, including deposits, balance checks, and bill payments, improving overall service efficiency.

Online and Mobile Banking Innovations in Hungarian Banks

Hungarian banks have embraced digital innovation, offering user-friendly online platforms and mobile apps with features like instant notifications, budget tracking, and mobile payments. Contactless transactions and digital wallets are now standard, catering to tech-savvy users who value convenience.

These digital tools often include financial planning and savings features that enhance the banking experience. Cybersecurity remains a top priority, with Hungarian banks using encryption, two-factor authentication, and real-time fraud monitoring to protect user data. Many banks also partner with fintech firms to expand their digital services, providing real-time transfers, investment tools, and personal finance management options for a more efficient, tech-integrated approach to banking.

Tips for Expats on Choosing a Bank in Hungary

Expatriates in Hungary face several banking challenges, from language barriers to navigating unfamiliar financial systems. Choosing a bank that offers English-speaking services and caters to international clients is key. Many expats prefer banks that handle foreign currency transactions, offer multi-currency accounts, and have global partnerships for easier international transfers.

Hungarian banks increasingly provide tailored services for this demographic. Before selecting a bank, expats should research customer service reviews and seek referrals from others in the expat community. Understanding the necessary documents, including ID and residency papers, is essential for account setup. Consulting legal or financial advisors can simplify the process.

Overall, the Hungarian banking sector offers a plethora of options tailored to different needs and preferences. Whether you value advanced digital services, seek extensive ATM coverage, or require expat-friendly assistance, there is a banking partner for everyone. By considering the above aspects and placing careful thought into the decision-making process, individuals can navigate the banking landscape in Hungary confidently and select a bank that complements their financial lifestyle.