Personalized Insurance Support for Contract Research Organizations

Contract research organizations (CROs) play a key role in moving science and medicine forward. They support pharmaceutical, biotech, and medical device companies through research, trials, and data analysis. But with high-stakes responsibilities come equally serious risks that can disrupt operations.

Clinical trial complications, data breaches, and cross-border compliance issues are just a few concerns. What kind of insurance covers these unique exposures? How do CROs avoid gaps in protection when their work is so specialized?

This article will answer these questions and break down how personalized insurance helps CROs work.

Why CROs Need Insurance Tailored to Their Operations

Contract research organizations face many challenges that increase their exposure to risk. They handle confidential data and coordinate complex clinical trials across multiple sites. Mistakes in study protocols can lead to serious financial consequences.

Precedence Research notes that the global CRO market was valued at around $65.06 billion in 2024. In 2025, it’s expected to grow to $69.56 billion, showing consistent upward momentum. Forecasts indicate it could reach approximately $126.17 billion by 2034. As CROs expand, their need for specialized insurance solutions is also growing just as quickly.

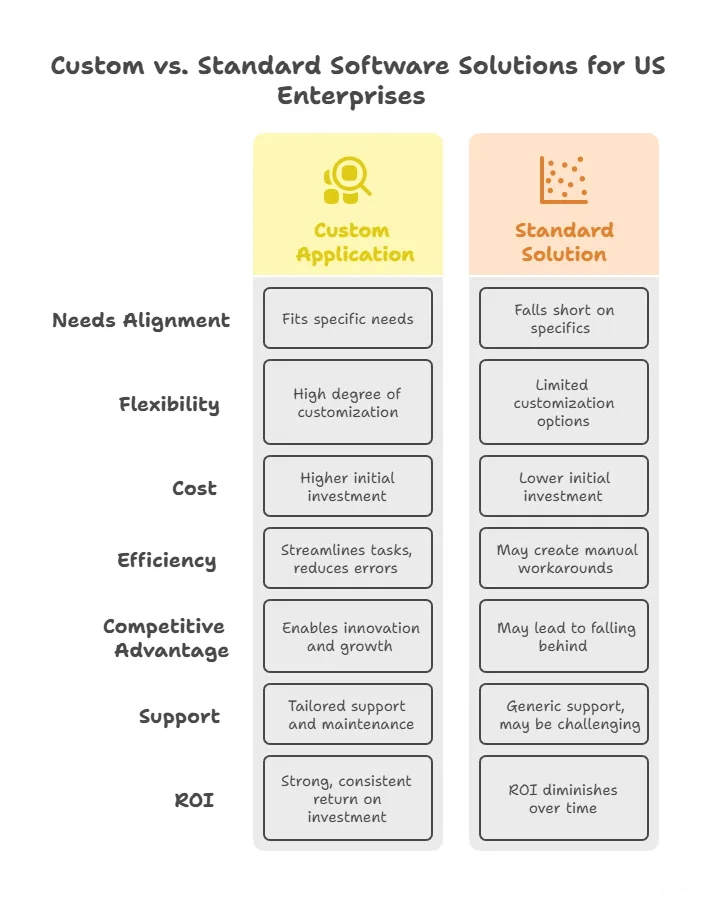

According to Moody Insurance Worldwide, insurance offers a strong foundation for managing unexpected disruptions during operations. Basic business policies do not address the specific risks CROs face. Custom coverage ensures liability, compliance, and client expectations are fully accounted for.

Contract research organization insurance also strengthens credibility with sponsors and research partners across industries. A tailored plan gives CROs confidence in their ability to operate safely. Proper insurance creates space for scientific progress without constant worry over legal setbacks.

How do startup CROs differ in insurance needs?

Emerging CROs may lack formal compliance teams or consistent protocols across studies and departments. Insurers must evaluate the maturity of systems before customizing suitable coverage levels. Risk tolerance varies with the business stage, so tailored insurance adjusts to both growth and operational stability.

Key Coverage Areas CROs Should Not Overlook

CROs should consider multiple coverage types to protect their specialized work. Professional liability coverage addresses mistakes in study design or data interpretation. Clinical trial liability insurance covers injuries suffered by participants during the research process. General liability and workers’ compensation are also crucial as they protect businesses from physical workplace incidents.

Investopedia states that workers’ compensation includes two main parts: Coverage A and Coverage B, each serving distinct roles.

Coverage A provides state-mandated benefits like medical care, wage replacement, and rehabilitation for injured workers. Coverage B offers additional benefits, usually tied to lawsuits involving employer negligence or misconduct. While most workers waive the right to sue, some states allow legal action under specific conditions, making combined coverage a smart choice.

Property insurance covers offices, lab equipment, and essential research tools. D&O insurance protects leadership against personal lawsuits tied to company decisions. Every policy should reflect the unique structure and services of the CRO. A custom plan eliminates gaps that can cause major financial harm.

Should CROs consider travel insurance for researchers?

Research staff traveling frequently are exposed to health, political, or logistical hazards abroad. Tailored travel insurance ensures continuity of operations and staff safety during foreign assignments. This type of coverage reduces disruption during trials in volatile or remote regions.

Global Trials and the Challenge of Cross-Border Insurance

Many CROs manage trials across countries with very different legal systems. Each country has its own trial regulations, insurance requirements, and documentation rules.

As highlighted by Lexology, offshore clinical trials involving participants from Europe must follow strict cross-border data rules. The EU and UK GDPR impose high standards for handling sensitive health-related personal data. Transferring this data to the U.S. or other regions increases compliance risk significantly. Trials in Asia also face local data protection laws that CROs must carefully navigate.

Insurance must account for regional differences while staying cohesive and enforceable. Some policies are not recognized in certain jurisdictions without local partners. International insurers can help issue compliant policies that satisfy host country laws. Translation, cross-border claims support, and jurisdiction-specific endorsements are often necessary.

The wrong coverage could delay trial approvals or trigger legal complications later. Sponsors rely on CROs to deliver research without administrative or regulatory hurdles. Global insurance solutions offer consistency across trials and peace of mind for all.

Are technology platforms for global insurance coordination helpful?

Digital tools can help CROs track global coverage, claims, renewals, and policy compliance in one place. Advanced platforms often integrate language options, regulatory alerts, and automated reporting. These systems reduce administrative error and improve alignment across worldwide trial locations.

The Role of Risk Assessment in Personalized Plans

Risk assessments help insurers understand the real exposures each CRO faces daily. Every organization offers different services and operates under varying contractual obligations.

Undark Magazine acknowledges the harsh reality that clinical trials can sometimes cause harm to participants. Institutions receiving federal funding should have a clear compensation plan for injured participants. Without it, trial subjects may bear the burden of risk with no guaranteed support.

In situations like these, a CRO often needs trial-related injury coverage to protect participants and operations. To ensure the coverage fits real-world needs, insurers may conduct site visits and review existing policies. These steps help them understand day-to-day operations and potential areas of exposure.

Insurance advisors then use that insight to build precise and flexible coverage packages. Personalized plans can adapt as the CRO expands or shifts its strategic focus. Reviews should occur annually to capture changes in risk or trial activity. Insurance becomes more than protection when integrated into long-term planning. Thoughtful customization helps the CRO maintain stability and regulatory alignment over time.

Are CRO-owned labs treated differently in risk assessments?

In-house labs change liability profiles compared to outsourced testing facilities or partner-run labs. Insurers consider lab certifications, biohazard handling protocols, and testing standards during plan development. Direct control over lab environments increases both exposure and insurer scrutiny in risk evaluations.

Choosing the Right Insurer for Long-Term Success

The best insurance partners understand how CROs operate. They offer tailored advice for risk management in trial-heavy or data-driven environments. CROs should choose advisors who stay updated on evolving global regulations.

Responsiveness in claims handling and renewals makes a major operational difference. Clear policy language and fair pricing contribute to a long-lasting, trusted relationship.

A reliable insurer helps CROs plan future expansion without fear of exposure. Their support allows leaders to concentrate on advancing science, not managing risk alone. Consistent insurance guidance fosters resilience, professionalism, and long-term growth potential.

Do long-term insurer relationships offer financial advantages?

Consistent insurer relationships allow deeper familiarity with operational trends and performance improvements. These insights often lead to discounted premiums and tailored renewals that evolve with the business. Loyalty also fosters expedited claims processing due to established trust and operational knowledge.

A CRO’s success in research depends heavily on having the right insurance in place. Standard business coverage isn’t enough when you’re dealing with complex trials and sensitive data. Specialized policies for clinical trial liability, cyber threats, and professional risks are essential today. As CROs grow globally, they face complicated rules that vary from one country to another.

That’s where experienced insurers with cross-border knowledge become extremely valuable. Risk assessments help keep coverage aligned with evolving services and trial scopes. A responsive insurance partner adds confidence to every new research phase. Insurance should support innovation, not hold it back. With the right coverage, CROs can grow safely and sustainably.