Securing FinTech: How OCR BANK-Scan Protects User Data

Financial applications face constant threats from cybercriminals seeking to exploit vulnerabilities in payment processing systems. Every transaction, every stored card detail, and every customer interaction represents a potential target for data theft. The consequences of security failures extend beyond immediate financial losses to include regulatory fines, reputational damage, and the erosion of customer trust that takes years to rebuild.

Card scanning technology processes some of the most sensitive information in digital commerce. When users photograph their payment cards to add them to mobile wallets or complete purchases, the resulting images contain everything needed for fraudulent transactions. This capability creates substantial value for legitimate users by eliminating manual data entry, but it also demands rigorous security controls to prevent misuse.

Financial service providers must balance convenience with protection. Overly restrictive security measures frustrate users and drive them toward less secure alternatives, while inadequate safeguards expose sensitive data to theft. The challenge lies in implementing security architectures that operate transparently, protecting information without degrading user experience. Platform ocrstudio.ai addresses this balance by providing security-focused implementations that embed protection mechanisms directly into the card recognition workflow, ensuring that convenience and security advance together rather than competing.

Where Traditional Card Entry Creates Security Vulnerabilities That OCR Eliminates

Manual data entry exposes card information to shoulder surfing attacks. When customers type sixteen-digit card numbers on their phones in public spaces, anyone nearby can observe and memorize these digits. Coffee shops, airports, and public transportation all present environments where visual eavesdropping occurs easily. The longer card details remain visible on screen during manual entry, the greater the exposure window.

Keystroke logging malware represents another significant threat to manual entry. Compromised devices running malicious software can record every character users type, including payment information. These keyloggers operate invisibly, capturing data without user knowledge. Once installed, they collect credentials until discovered and removed, potentially compromising multiple payment cards over time.

Clipboard vulnerabilities allow unauthorized applications to access copied data. Users sometimes copy card numbers from one application to another, and this information persists in device clipboards. Malicious applications with clipboard access can monitor for payment card patterns and exfiltrate this data. The clipboard becomes an unintended data sharing mechanism between applications.

Human error in manual entry creates additional security concerns. Transposed digits, typos, and incomplete information lead to failed transactions that require users to re-enter data. Each failed attempt extends the time card information remains visible on screen and increases opportunities for observation or capture by malicious software.

Cryptographic Techniques That Secure Card Images During Recognition Processing

Image encryption prevents unauthorized access to card photographs during processing. When users capture card images, these files must be encrypted before any storage operation. Advanced Encryption Standard with 256-bit keys provides strong protection that remains computationally infeasible to break. The encryption occurs in device memory immediately after image capture, before any file system interaction.

Secure enclave processing isolates card recognition operations from the main device operating system. Modern mobile processors include dedicated security coprocessors that handle sensitive operations within hardware-protected environments. These enclaves maintain separate memory spaces that even privileged system processes cannot access. Card images processed within secure enclaves never expose data to potentially compromised operating system components.

Homomorphic encryption enables processing encrypted data without decryption. This advanced cryptographic technique allows recognition algorithms to operate directly on encrypted card images. The recognition engine extracts card information while working with encrypted data, producing encrypted results. Only authorized payment processors with corresponding decryption keys can access the plaintext card details.

Zero-knowledge proofs verify data validity without exposing content. These mathematical protocols allow systems to confirm that extracted card information meets validity requirements like passing Luhn algorithm checks without revealing actual card numbers. This verification happens before transmission to backend systems, catching errors early while maintaining end-to-end encryption.

Real-Time Threat Detection Systems for Unusual Card Scanning Behavior

Velocity checking monitors scanning frequency to identify suspicious patterns. Legitimate users typically scan one or two cards during account setup, while attackers testing stolen card numbers might attempt dozens of scans in rapid succession. The system establishes baseline usage patterns and flags deviations indicating potential fraud or abuse.

Geolocation analysis detects anomalies in scanning locations. If an account typically operates from one city but suddenly shows card scanning activity from a distant location, this suggests potential account compromise. The system can require additional authentication when geographic anomalies are detected, blocking unauthorized access before damage occurs.

Device fingerprinting creates unique identifiers for each mobile device. These fingerprints incorporate hardware characteristics, installed applications, and configuration settings. When card scanning occurs from an unrecognized device, the system can enforce step-up authentication or temporarily block the operation until the new device is verified.

Behavioral biometrics analyze how users interact with scanning interfaces. Touch pressure, swipe patterns, device orientation, and capture timing all create behavioral signatures unique to individual users. Significant deviations from established patterns suggest that someone other than the legitimate account holder is operating the device.

Data Sanitization Methods That Remove Sensitive Information After Processing

Secure memory clearing overwrites data immediately after use. When card recognition completes and extracted information is encrypted for transmission, all temporary variables and buffers containing plaintext data must be overwritten with random values. Standard memory deallocation doesn’t eliminate data from physical memory, so explicit clearing prevents forensic recovery.

Multi-pass file deletion ensures card images cannot be recovered from storage. A single deletion pass leaves data potentially recoverable through forensic techniques. Multiple overwrites with varying patterns make recovery computationally impractical. Seven-pass deletion methods like the Gutmann algorithm provide thorough sanitization for particularly sensitive data.

Cache purging eliminates data from various system caches. Operating systems and applications maintain multiple cache layers for performance optimization. Card images and extracted data might temporarily reside in thumbnail caches, application caches, or system-level caches. Comprehensive sanitization must address all these locations.

Backup exclusion prevents card data from entering backup systems. Mobile devices regularly backup content to cloud services, and this backup functionality must explicitly exclude any directories containing card images or recognition data. Configuration settings should mark these locations as non-backup targets to prevent sensitive data from propagating to additional storage locations.

How Tokenization Protects Stored Payment Methods in FinTech Applications

Token generation replaces card numbers with randomly generated identifiers. Payment processors create tokens that reference specific payment cards without containing any actual card information. These tokens follow the same format as card numbers for system compatibility but have no mathematical relationship to the original numbers. Stolen tokens provide no value outside the specific payment ecosystem that generated them.

Token scope limitation restricts where tokens can be used. A token might be valid only for a specific merchant, transaction type, or time period. This scoping means that even if tokens are compromised, their utility to attackers is severely limited. A token valid only for subscription payments at one merchant cannot be used for cash advances or purchases elsewhere.

Dynamic tokens change with each transaction. Rather than using a single static token for all purchases, the system generates unique tokens for individual transactions. These single-use tokens become invalid after transaction completion, eliminating replay attack possibilities. Even if attackers intercept a token, they cannot reuse it for additional fraudulent transactions.

Token lifecycle management handles creation, validation, and revocation. The payment processor maintains the mapping between tokens and actual card numbers in highly secured environments. Applications and merchants never access this mapping. When cards expire or users delete payment methods, the corresponding tokens are revoked and removed from all systems.

Access Control Frameworks That Limit Who Can Process Card Data

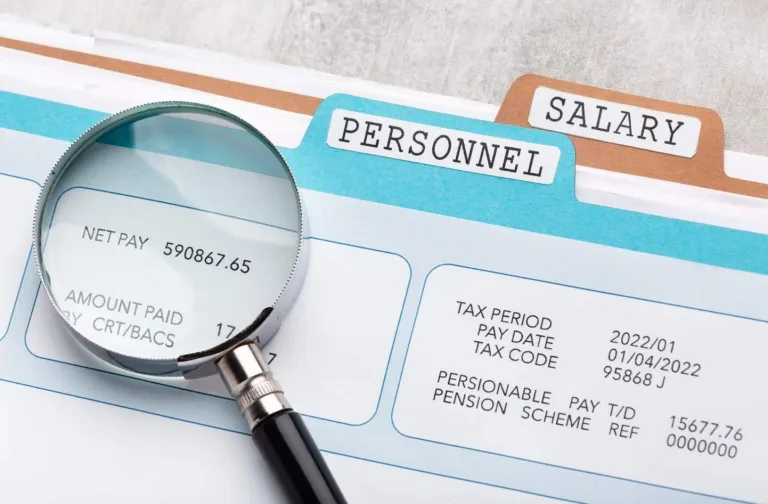

Role-based permissions define what actions different user types can perform. Customer service representatives might have permission to view the last four digits of card numbers but not full details. Developers require access to test systems but should never access production cardholder data. Finance staff need transaction information but not the underlying payment credentials. These granular permissions ensure each role accesses only the data necessary for their responsibilities.

Principle of least privilege mandates minimal access rights. Users and systems receive only the permissions absolutely required for their functions. This approach limits damage from compromised accounts because attackers gain only the limited access the compromised user possessed. Regular access reviews verify that permissions remain appropriate as roles change.

Multi-factor authentication gates access to sensitive operations. Viewing stored payment methods, processing refunds, or modifying payment configurations all require multiple authentication factors. Time-based one-time passwords, biometric verification, and hardware security keys provide strong authentication difficult for attackers to bypass.

Audit logging records all access to payment data. Every operation involving card information generates detailed log entries capturing who accessed what data, when, from which device, and what actions they performed. These logs enable security teams to detect suspicious activity and investigate incidents. Immutable logging prevents attackers from covering their tracks by modifying audit records.

Integration Security for Third-Party OCR Services and Payment Processors

API authentication verifies identity of systems communicating with OCR services. OAuth 2.0 provides industry-standard authentication frameworks that prevent unauthorized API access. Client credentials, authorization codes, and access tokens create secure channels between applications and recognition services. These mechanisms ensure that only authorized applications can request card recognition services.

Certificate pinning prevents man-in-the-middle attacks during API communication. Applications embed cryptographic fingerprints of legitimate server certificates and verify these during connection establishment. This protection stops attackers from intercepting traffic even if they compromise network infrastructure or install rogue certificate authorities on devices.

Rate limiting controls prevent abuse of recognition services. Attackers might attempt to use OCR APIs for large-scale card testing or data extraction. Rate limits restrict how many recognition requests individual accounts can make within specific time periods. This throttling protects against both intentional abuse and accidental resource exhaustion from buggy implementations.

Webhook signatures verify that incoming data originates from legitimate payment processors. When payment processors send transaction confirmations or status updates, they sign these messages with shared secrets. Applications verify signatures before processing received data, ensuring that spoofed messages from attackers are detected and rejected.

Regulatory Compliance Verification for Card Data Protection Standards

PCI DSS validation confirms that card handling meets payment industry requirements. These standards define technical and operational controls for protecting cardholder data. Annual assessments verify compliance through documentation review, system testing, and process evaluation. Organizations processing significant transaction volumes require formal audits by qualified security assessors.

GDPR compliance mechanisms address European privacy requirements. Users must be informed about what personal data is collected, how it’s used, and who it’s shared with. Financial applications need consent management systems, data portability features, and deletion mechanisms. Card scanning implementations must support these requirements while maintaining fraud prevention capabilities.

SOC 2 reports demonstrate service provider security controls. Organizations using third-party OCR services should verify that providers maintain current SOC 2 Type II attestations. These reports confirm that independent auditors have examined and tested security controls over an extended period. The reports provide detailed evidence of control effectiveness.

Regional banking regulations impose jurisdiction-specific requirements. Different countries mandate varying data localization, authentication standards, and breach notification procedures. Multi-national FinTech operations must map their security implementations against requirements in each market they serve, ensuring compliance with the most stringent applicable standards.

Conclusion

Protecting payment card data in OCR-enabled FinTech applications requires comprehensive security strategies spanning encryption, access control, threat detection, and compliance verification. Each component contributes to an overall security posture that defends against evolving threats while enabling convenient user experiences. Organizations that prioritize security throughout design and implementation rather than treating it as an afterthought build customer trust and avoid the devastating consequences of data breaches. As card scanning technology becomes increasingly common in financial services, security excellence will differentiate successful providers from those that become cautionary tales.