Svardin Token (SRN): A Roadmap of an investor to the Future of Decentralized Finance

Introduction

With the constantly changing world of cryptocurrency and blockchain technology, new tokens are being brought out every day, each of them purporting to change the very way we perceive finance, ownership, and digital assets. One of them is Svardin Token (SRN), which is not only another player in the already saturated market, but a carefully developed asset that might be an excellent solution to the lack of connection between the traditional finance and the decentralized world. With regulatory changes and market uncertainties in the news and everyone entering and leaving the market, it would be essential to know what the token such as SRN is, and any wise investor would be looking at how to diversify and in what ways. It is not a guide on hype, but rather, giving you the knowledge to make informed choices prior to plunging in. You are a hardened trader or you are only getting your feet wet in the crypto waters, so let us unravel what Svardin is all about, the underlying technology, and what can possibly go wrong.

Early Altcoin Experience & Svardin’s Origin

The time when I started with the altcoins (in 2022) could be described as both thrilling and terrifying, as I saw value changing like a pendulum on steroids. Svardin Token is such a refreshing breath of air in that amalgamation of space–constructed on the principles of transparency and utility that recall the early years of Ethereum and with contemporary protection. SRN, introduced in the mid-2025 by a group of blockchain veterans with Scandinavian roots (thus the Nordic feel, which connotes power and durability), is not pursuing pumps driven by memes. Rather, it is positioned as the foundation of a toolkit of DeFi apps about sustainable lending and international transactions. Consider it the silent engineer in the room: it is not glamorous, but it is a necessary part of doing the job perfectly.

Technology & Layer-2 System

In essence, Svardin Token functions on a layer-2 scaling system over Ethereum, implying that it inherits the safety of the most renowned smart contract platform in the world and reduces the transaction cost in addition to enhancing the speed. Sending value across the continents within less than 10 seconds, at a fraction of the cost, that is what this promises. The total supply of the token is limited to 100 million SRN, and it has a deflationary system that burns a small percentage of the payment of network use. It is not merely economic jargon; this is actually a set strategy to fight inflation, which we have witnessed ravage most projects. The long-term holding and not buying and selling fast, which can be seen as a source of stability in an ecosystem, are already being observed by early adopters.

Real-World Use Cases

Nevertheless, the most striking thing about Svardin is that it focuses on the use of the real world. In contrast to most tokens which exist in the abstract space of speculation, SRN drives the Svardin Network, a decentralized protocol of tokenized real estates and micro-lending. Imagine the following: in the emerging markets, small business owners would pledge the SRN as security to take low-interest loans all without the red tape of conventional banks. The network is well connected to NFT standards and enables users to divide property ownership into tradable tokens. It is kind of making the old apartment of your grandma into a liquid asset, so anyone can invest in, and making the tools of wealth building, which had previously been seen as the preserve of the elite, democratized.

Governance Through DAO

Going further into the gears, we should discuss governance. The project has a DAO (Decentralized Autonomous Organization) system whereby Svardin Token holders have a say in the direction of the project. Upgrade, partnership or even fee increase requests are voted based on your SRN stake on a relative basis. It is empowering, definitely, but that also means that you need to remain interested–indifference in this scenario may result in the choices that are not in your interests. What I have observed in community forums is that the DAO has already passed two large integrations namely, one with a major European payment gateway and another with a carbon credit marketplace, which links SRN to ESG (Environmental, Social, and Governance) trends which are on the rise among institutional investors.

Risks & Market Challenges

Naturally, there would be no investment guide that fails to mention the elephant in the room: risks. The crypto market is the most unstable market in the world, and Svardin Token is not an exception. Overnight gains can be washed away by market corrections as was the case with a slight decline in Q3 2025. Regulatory uncertainty is also a big factor– as the MiCA framework implemented by the EU remains in its infancy, tokens such as SRN may experience compliance barriers which may affect liquidity. Next there is smart contract risk; although Svardin has been audited on numerous occasions by companies such as Certik and PeckShield, there is no bulletproof code. An adventure, though improbable, might destroy confidence. And competition can also be missed: giants such as Aave and Compound will control the market of DeFi lending, and Svardin will have to establish its niche aggressively.

Growth Potential & Staking

On the other hand, prospects are alluring. Analysts have been talking about how Svardin has the potential to grow 5x over the next seven years, through partnerships and usage in unserved territories. Its market capital sits at around 150 million dollars and thus it has a lot of room to grow as compared to billion-dollar giants. There are also staking rewards, which will pay you up to 12% APY in extra tokens as long as you lock up your SRN, and the protocol pays them out of its treasury. It is a means of passive income with the ability to ensure network safety with proof-of-stake authentication. Personally, I have tried to stake on such sites, and the most important thing is to diversify: do not put all your eggs in a blockchain basket.

How to Buy & Store SRN

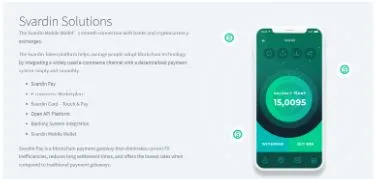

It is incredibly easy to start using Svardin Token, particularly when you already play in the crypto game. Go to exchanges such as Uniswap or the native Svardin DEX (SRN/ETH and SRN/stablecoins). On fiat on-ramps, it is easy to purchase with a credit card, MoonPay and Ramp integrations allow this, although beware the fees. Metamask and official Svardin app are just two examples of wallets that enable storing and communicating easily. Pro tip: Turn on two-factor authentication and store anything more than play money in hardware wallets. The onboarding process features a fast KYC on some features, which may annoy privacy purists but introduces an extra element of legitimacy that would appeal to more conservative investors.

Community Strength

Community is a giant in the path of Svardin and it is one of the best aspects of the project. There are real conversations in the Discord and Telegram channels, not only shilling but troubleshooting, sharing ideas, and even AMAs with devs. I have joined a couple of them and the atmosphere is that of a virtual town hall. This ground-level energy has been converted into organic growth with more than 50,000 holders by end of November 2025. Such events as the next Svardin Summit in Stockholm next spring are bound to highlight actual adoption stories, such as farmers in Kenya borrowing SRN to fund their projects, or tech startups tokenizing equity.

Future Roadmap

The future of the roadmap is full of milestones that would take SRN to the next level. Q1 2026 will involve iOS and Android mobile app expansions with fiat gateways designed to meet Latin America. Cross-chain bridges to Solana and Polkadot will be available, and by mid-year, interoperability will open the floodgates. In the long term, the vision will involve AI-based loan risk assessment, using machine learning to accurately predict loan defaults with a scary degree of precision. It is ambitious, but it is based on the track record of the team members – founders are alumni of Visa blockchain lab, and one of them was a former Chainlink engineer.

Market Timing

Timing is everything as far as any investment is concerned. Now that Bitcoin is no longer halving, the stability of the token has provided an opportune opportunity to the plays of the altcoins such as the Svardin Token. Technical indicators reveal that SRN is rebounding on major support levels and that RSI indicates that the stock is neither overbought nor oversold. This might be your entry point in case you are a believer in the resurgence of DeFi which is expected to grow to a TVL of $200 billion by 2028. However, bear in mind that the history does not guarantee the future outcomes; one should constantly DYOR (Do Your Own Research).

Conclusion

To conclude on this, Svardin Token is not a mere speculative gamble, but it is an investment into a more welcoming financial future. By placing more emphasis on utility, security and community, it avoids most of the traps that are fatal to flash-in-the-pan projects. That being said investing is an individual matter, you have to evaluate your risk tolerance, seek advice of a financial consultant in case of necessity and never invest more than you are willing to lose. The crypto adventure is not only learning but also making money, and Svardin provides both in large quantities.

To get more information and see the ecosystem with your own eyes, go to the official site at https: svardin.com.