They Only Invest 5% of Their Income — But Aim to Turn Trading into a Career

South African traders are changing how they approach the markets — with more discipline, clearer priorities, and long-term ambitions.

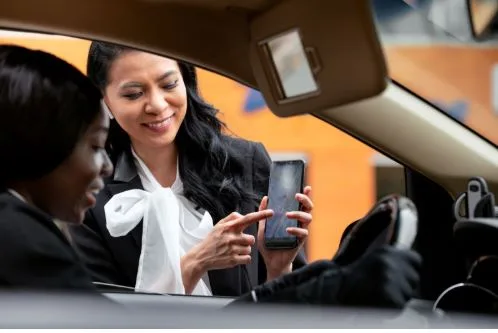

Recent trends show that South African retail traders are becoming increasingly discerning when choosing their trading platforms. Trust, fast transactions, and risk management tools are no longer optional — they are core requirements. These changes reflect a more mature, professional mindset among traders who, while still cautious in how much they invest, have strong ambitions to make trading a primary source of income.

Trust and transaction speed top the priority list

According to this article, insights from Kantar’s Q3 2024 Global Brand Health Tracking study reveal that 42% of South African traders now consider seamless deposit and withdrawal processes among the top three criteria when selecting a broker. Close behind, 40% named financial security as a top concern. Regulatory oversight and proper licensing, once considered standout features, are now viewed as basic expectations. Traders are clearly prioritizing brokers that can deliver reliability and consistency over flashy incentives or broad asset offerings.

Low investment, high commitment

The same Kantar research uncovered interesting patterns in how South Africans are allocating funds. Nearly half (49%) of respondents said they invest no more than 5% of their monthly income into trading. Another 37% are open to investing up to 25%. These relatively conservative figures might suggest hesitation — but the reality is quite different. Among experienced traders, nearly 90% expect to eventually turn trading into a consistent, long-term income source. This shift toward sustainability underscores a new level of strategic thinking in the South African trading space.

Platform features matter more than ever

When evaluating brokers, South African traders are paying closer attention to platform performance and risk control. Fast execution was named the most important feature by 56% of respondents. Other key features included high leverage options (52%) and low spreads (47%). Interestingly, risk management tools also ranked highly: 38% value swap-free accounts, and 35% emphasize the importance of negative balance protection. These insights indicate that traders want brokers to help them manage their exposure — not just offer big returns.

Brand trust drives broker choice

Kantar’s data also highlights a strong connection between brand recognition and trader confidence. Exness, for example, had the highest brand awareness, with 75% of traders surveyed recognizing the name. Of those, 14% were active users, and nearly 10% had selected it as their main broker. This level of recognition suggests that a broker’s reputation for stability and support has become a critical factor in trader decision-making.

Success now requires more than performance

As trading becomes more mainstream in South Africa, brokers are under pressure to meet rising expectations. Traders now demand platforms that combine reliable infrastructure, rapid transactions, and comprehensive risk management. Those that fail to deliver face increasing churn, while those who align with the new wave of professional traders are likely to thrive. The era of flashy bonuses and mass-market marketing is fading — what matters now is long-term reliability and trader-centric service.