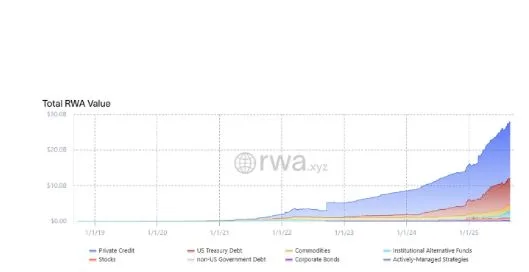

Tokenized Real-World Assets Continue Upward Momentum

The tokenized real-world assets (RWA) sector continues to show robust growth, with a notable uptick in market participation and institutional interest. According to the latest RWA Weekly — September 1 2025 report, the market has expanded across multiple fronts, from on-chain volumes to blockchain diversity — confirming RWAs as one of the most dynamic verticals in the digital asset space.

Treasuries Lead the Way — BUIDL Sets the Benchmark

U.S. Treasuries remain the cornerstone of the tokenized asset market, continuing to attract capital with their yield stability and regulatory clarity. The recent report highlights how BlackRock’s BUIDL fund has emerged as the category leader, commanding a significant portion of the market due to its transparency, daily liquidity, and direct exposure to short-term U.S. debt instruments.

These tokenized Treasury products have become a preferred on-chain solution for both retail and institutional investors seeking low-risk yield — a reflection of how traditional finance tools are being reimagined on blockchain rails.

Private Credit Surges — High-Yield Opportunities Fuel Demand

Beyond sovereign debt, private credit is fast becoming a major RWA segment. With the sector now estimated at $15.9 billion, offering yields close to 10% APR, it’s clear that investor appetite for higher-return instruments is driving innovation. Tokenized private credit enables fractionalized access to historically illiquid assets, such as SME loans and invoice financing, democratizing exposure to credit markets once limited to elite institutions.

Multi-Chain Momentum — Ethereum Isn’t Alone Anymore

While Ethereum remains a primary settlement layer for RWAs, other blockchains are gaining ground. The Real Estate Tokenization News reports increased RWA deployment on BNB Chain, Stellar, and XRP Ledger, which offer lower fees and faster transactions — factors increasingly important as RWA activity diversifies globally.

This multi-chain expansion underlines the demand for flexible infrastructure to support a broader class of assets and user needs, especially in emerging markets.

On-Chain Metrics: Market and User Growth

Quantitative indicators reinforce the market’s positive trend. As of September 1, the total RWA market cap reached $27.92 billion — a 7.3% month-over-month increase. Meanwhile, the number of on-chain holders has grown by 8.8%, reaching approximately 372,000 unique wallets.

These figures signal a maturing market with growing adoption, improved accessibility, and increasingly sophisticated infrastructure.

Conclusion

The tokenized real-world asset sector continues to gain momentum, driven by the growing popularity of on-chain Treasuries, the rapid rise of private credit, and the expansion of infrastructure beyond Ethereum. With monthly market volume climbing 7.3% to $27.92 billion and wallet holders increasing by 8.8%, the data signals sustained adoption and confidence in the space.