Top Crypto Funding Options for Traders Seeking Capital Access

If you’re trying to get funded as a crypto trader, I’ve been right where you are. You know your edge, your strategy works, but the capital? That’s usually the bottleneck. After years of testing different firms, studying what works, and watching how they treat traders, I’ve got a strong sense of what actually matters when choosing a prop firm. Today, I want to break it down and tell you why I recommend My Crypto Funding as a serious contender if you’re looking for a competitive, trader-first prop firm.

I looked at profit splits, trading conditions, payout speeds, platform support, and funding models. But I also paid attention to the finer details: how firms treat their traders, how transparent they are, and whether they back up their promises with real systems.

Here’s what you’re going to get from this article. I’ll explain the key things to look for in a crypto prop firm, break down where most fall short, and then show you how My Crypto Funding handles things differently. If you’re tired of running into dead ends or low-tier programs, this might help you save time and finally get funded on your terms.

What Makes a Crypto Prop Firm Worth Considering

I don’t care how nice the website looks. If a firm makes it hard to get paid or puts traders through endless hoops, I’m not interested. You need a few basics locked in. First, fast payouts. Second, fair and flexible evaluations. Third, solid trading conditions that don’t limit your strategy.

Now, a lot of firms offer one or two of those. But rarely do they check every box.

Where Most Firms Get It Wrong

Most evaluation programs out there are restrictive. Some force you to follow tight daily drawdown limits or weird consistency rules that kill momentum. Others stretch payouts over several days or lock you into platforms you don’t like. Even worse, some platforms feel outdated or just plain clunky.

The thing is, these details add up. If your strategy works best over weekends or during high-volatility news hours, and the firm disables those features, you’re stuck compromising. That kills performance.

Why I Recommend My Crypto Funding

Here’s where My Crypto Funding stands out.

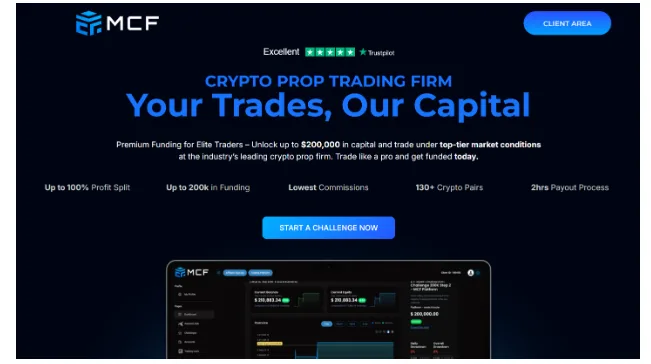

They’ve built their platform to reflect how real traders actually operate. You can trade over 130 crypto pairs with tight spreads, low commissions, and a fast 2-hour payout process. That alone makes them competitive. But they go beyond that.

What I like most is the variety in their evaluations. Whether you’re looking to prove yourself for the first time or scaling a consistent strategy, you’ll find an account model that fits. You start with “The Test,” hit an 8% profit target, and then complete “The Confirmation” with a 5% target. No gimmicks. No consistency rules. Just results.

Leverage is high at 100x, news and weekend trading are allowed, and there are no time limits. That kind of freedom isn’t common, and it means you can actually use your real strategy under real market conditions.

You also get access to MetaTrader 5 and a proprietary dashboard that tracks all your performance data. Think heatmaps, metrics, real-time journaling, and news feeds. For me, those tools are just as important as capital, because they help you make better trading decisions.

No Pressure, Just Clarity

Let me be clear. I’m not saying My Crypto Funding is the only solid option out there. But based on what I’ve seen, they’re offering one of the most complete packages for crypto traders trying to secure meaningful funding. And unlike others, they don’t try to bury the important details.

What you see is what you get. Transparent benchmarks. Clear profit targets. No vague terms or tricky fine print.

Who Should Look Into This Firm

If you’re confident in your trading and tired of platforms that feel limiting, My Crypto Funding is worth checking out. Especially if you’re looking to scale without being boxed into rigid rules or waiting days for a payout.

They give you the tools, capital, and trading conditions needed to actually execute without friction. That matters more than hype or aggressive marketing.

Final Thoughts

I’ve seen a lot of traders waste time with firms that promise fast funding but hide bad conditions in the fine print. If you’re serious about getting funded and want a model that rewards skill and discipline without overcomplicating the process, this firm is a smart place to start.

Check out their evaluations, study the rules, and decide if the setup works for your trading style. If it does, there’s a real opportunity here.