What is Bluerate? The Easiest Way to Find Verified Loan Officers Near You

If you have ever applied for a mortgage online, you know the drill: you fill out a “simple” form to check rates, and within five minutes, your phone is ringing off the hook with spam calls from lenders you’ve never heard of. It’s overwhelming, intrusive, and frankly, broken.

I recently spent time exploring Bluerate, and it feels like the antidote to that chaos.

Bluerate is an AI-powered mortgage marketplace developed by Zeitro, a Silicon Valley tech company. But unlike typical lead-generation sites that sell your data to the highest bidder, Bluerate connects you directly with verified Loan Officers (LOs) in your area without the middleman fatigue. It allows you to see real-time rates, chat with AI for advice, and manage the entire application process—from quote to closing—completely for free.

In this guide, I’ll walk you through exactly how it works, the technology behind it, and why I believe it’s setting a new standard for transparency in the US housing market.

The Story Behind Bluerate

To understand why Bluerate is different, you have to look at why it was built. The platform was developed by Zeitro, an AI-native company founded in 2018 by engineers and leaders from tech giants like Google and Apple.

The platform initially launched in early 2025 under the name MyMortgageRates. However, as of November 2025, the team rebranded to Bluerate to better reflect their upgraded brand identity and expanded capabilities.

The creators noticed a glaring gap in the market. On one side, borrowers were tired of “Teaser Rates”—advertised rates that look great but disappear once you actually apply. On the other side, professional Loan Officers were struggling to find quality leads without paying for expensive, low-quality lists.

Bluerate was built to bridge this gap. Their mission is to create a “win-win” ecosystem: borrowers get a transparent, spam-free way to shop for mortgages, and LOs get to showcase their true expertise. It’s an independent platform with no affiliation to any specific lender, which means the marketplace stays neutral and focused on connecting people, not pushing products.

How Bluerate Helps Borrowers

Navigating the mortgage landscape usually involves dozens of open browser tabs and a lot of confusion. What I appreciate about Bluerate is that it consolidates everything into one streamlined workflow. Here is a step-by-step look at how it helps you.

If you’re a first-time home buyer, you can start to free connect with a professional loan officer here.

See Real, Verified Mortgage Rates Instantly

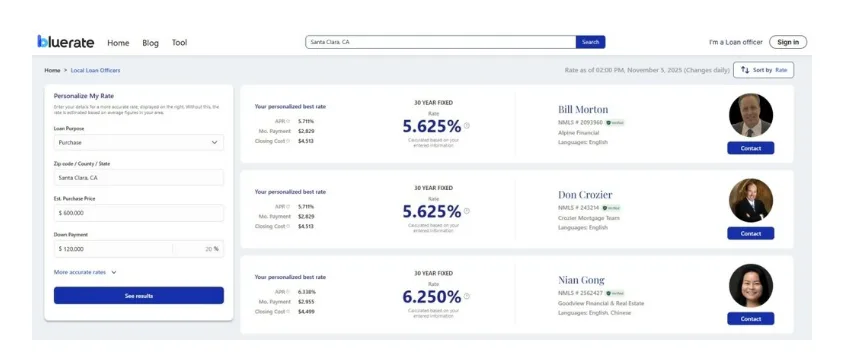

Most websites show you “marketing rates”—best-case scenarios that almost nobody qualifies for. Bluerate is different. They have integrated rate data from over 30 lenders.

When you run a search, you aren’t seeing a banner ad; you are seeing accurate, real-time mortgage rates based on current market conditions. This transparency is refreshing because it allows you to budget based on numbers that are actually achievable, rather than getting hit with a “bait and switch” later in the process.

Compare Multiple Loan Officers Side by Side

Finding a lender isn’t just about the rate; it’s about the person handling your loan. A bad Loan Officer can cause you to lose a house.

On Bluerate, you can search for LOs by location or loan type. The results allow you to compare them side-by-side. You can see their specific expertise, which state they are licensed in, and their verified profile details. Instead of being assigned a random call-center agent, you get to choose a professional who knows your local market.

Search, Chat, and Apply — All in One Place

The platform is designed as an “All-in-One” solution. It supports the full Loan Origination cycle. You start by getting a rate quote, then you can connect directly with a trusted officer, and even track your loan progress.

You can Pre-qualify online and complete the standard 1003 mortgage application form directly on the site. Also, you can even export your data in the FNM 3.4 format, which is the industry standard. It minimizes the manual data entry that usually makes applying for a loan so tedious.

Support for Every Loan Type

Whether you are buying a standard suburban home or an investment property, Bluerate seems to cover all the bases. They support:

- Conventional Loans

- FHA, VA, and USDA Loans

- Jumbo Loans

Significantly, the platform excels in niche markets. If you are self-employed or an investor, you can find specialists in Non-QM (Non-Qualified Mortgage), DSCR (Debt Service Coverage Ratio), Hard Money, and Private Lending. Finding LOs who specialize in these complex products is usually difficult on standard comparison sites.

Chat With AI to Get Personalized Advice

This is where the “AI-powered” claim actually holds water. Bluerate utilizes tools like Scenario AI and GuidelineGPT.

Mortgage guidelines are thousands of pages long and change constantly. Instead of Googling “FHA requirements 2025” and getting conflicting answers, you can ask the AI. It understands context and provides guideline-accurate responses in seconds. This helps you figure out if you qualify for a specific loan program before you even speak to a human.

Get Matched With the Right Loan Officer in Seconds

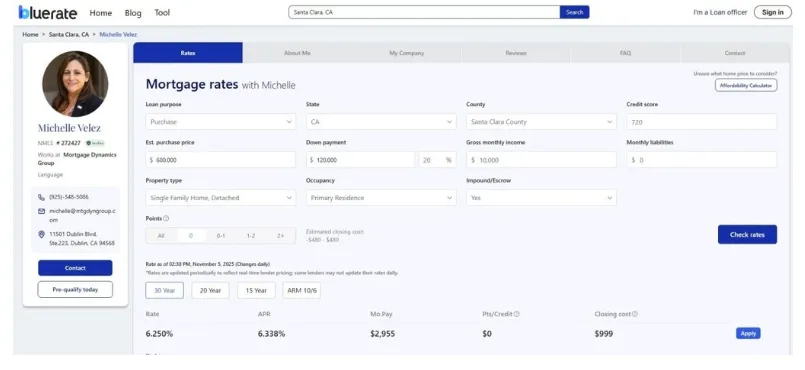

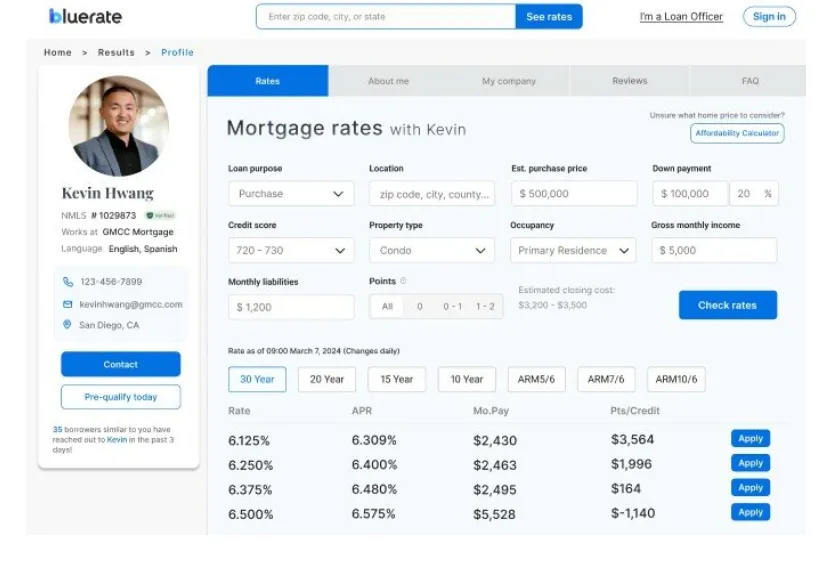

Time is money in real estate. Through their Personalized Rates feature, you can input specific financial details—like your credit score, estimated purchase price, down payment, gross monthly income, and monthly liabilities.

Using this data, the system’s AI instantly calculates your Debt-to-Income (DTI) ratio and matches you with the Loan Officers best suited for your financial profile. It removes the guesswork of wondering, “Will this lender accept my credit score?”

View Loan Officer Profiles

Trust is the currency of the mortgage industry. Every Loan Officer on Bluerate creates a personal profile page. More importantly, every LO is NMLS verified.

Bluerate performs strict checks to ensure the professionals on their platform have a valid license and a clean record on NMLS Consumer Access. You can view their biography, the languages they speak, their company affiliation, and their past highlights. This level of detail lets you vet the person handling your finances before you ever send a message.

Benefits of Using Bluerate

After reviewing the platform’s capabilities and the company’s background, several key benefits stand out that make this superior to traditional methods.

Completely Free for Borrowers

It costs absolutely nothing for a borrower to use Bluerate. You can register, search, compare rates, and contact loan officers without paying a cent. The platform does not charge any “middleman fees” to you.

Full Transparency From Start to Finish

From the initial rate quote to the final closing, the process is visible. Because Bluerate integrates with Loan Origination Systems (LOS), you can track the status of your application in real-time on your dashboard. You aren’t left wondering if your documents were received or what stage of underwriting you are in.

Secure, Private, and Data-Protected

In an era of data breaches, this is non-negotiable. Zeitro, the parent company, is SOC 2 Type II certified.

For those unfamiliar with the term, this is a rigorous auditing procedure that ensures a service provider securely manages your data to protect your privacy and interests. It’s an enterprise-grade security standard that many smaller mortgage sites simply don’t have.

No Spam, No Unnecessary Calls

This is arguably the biggest selling point. Bluerate promises not to sell your personal information to other lenders.

On other platforms, “comparing rates” usually triggers a deluge of sales calls. On Bluerate, you choose who to contact. You can view rates and profiles without being harassed. You stay in the driver’s seat.

Faster Loan Comparison = Faster Closing

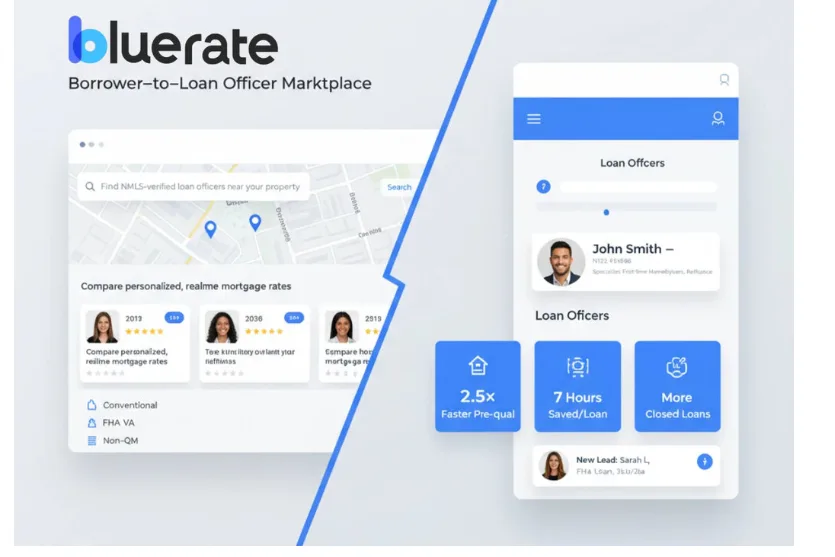

Efficiency is built into the system. According to their data, the AI-enabled workflow delivers 2.5x faster pre-qualifications. By automating document collection and data extraction (like pulling income data from tax returns), the platform saves professionals over 7 hours per loan file.

For you, this means a smoother ride. The streamlined process contributes to closing loans up to 20% faster than the traditional manual way.

Who Is Bluerate For?

Because of its versatile search and AI capabilities, Bluerate serves a wide range of borrowers.

First-Time Homebuyers

If you are new to this, the mortgage world is intimidating. Bluerate’s AI Chat Mortgage Assistant is perfect for you. You can ask questions about down payments or credit requirements without feeling embarrassed. Plus, finding a local LO who specializes in First-Time Buyer programs is just a few clicks away.

Homeowners Looking to Refinance

When rates drop, speed matters. Existing homeowners can use the platform to quickly check if refinancing makes sense mathematically. You can instantly compare your current rate against 100+ lenders to see if you can lower your monthly payment.

Real Estate Investors

Investors often need speed and creative financing. Since Bluerate specifically highlights DSCR and Hard Money lenders, you can bypass the big banks that might say “no” and connect directly with private lenders who understand investment leverage.

Borrowers With Unique Situations

If you are self-employed or have a complex income history, standard automated approvals often fail. Bluerate allows you to filter for Non-QM specialists. These are Loan Officers who know how to underwrite loans based on bank statements or assets rather than just W-2 forms.

Conclusion: Bluerate Makes Finding the Right Loan Officer Simple and Transparent

The mortgage industry has been stuck in the dark ages for too long, relying on opaque pricing and aggressive sales tactics. Bluerate is changing that narrative.

By combining advanced AI technology with a strict “privacy-first” philosophy, they have created a marketplace that actually respects the borrower. Whether you are looking to buy your first home or your fifth rental property, Bluerate offers a secure, efficient, and transparent way to find the right professional for the job.

If you are ready to see what rates you qualify for—without risking your privacy—I highly recommend giving their search tool a try.

Check your personalized rates today at http://www.bluerate.ai.