Why Online Scams Are Increasing and What You Can Do to Stay Safe

The internet should make life easier—but lately it’s starting to feel a bit like a danger zone. Online scams are popping up everywhere, and no one is too smart, too young, or too experienced to be targeted. Each year, more people lose hard-earned money to clever tricks that look real at first glance. The good news? You don’t have to be an easy target. Once you understand why these online threats are growing so fast and learn a few simple habits to protect yourself, you can stay several steps ahead of the scammers and keep your digital life safe.

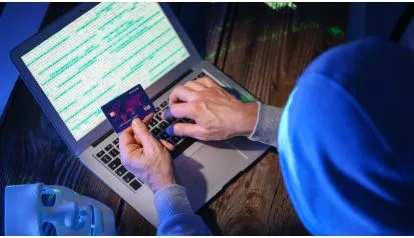

The Alarming Rise of Online Scams in the Digital Age

You’re facing more danger online now than at any point in history. The numbers don’t lie, and they paint a disturbing picture of just how dramatically fraud has exploded.

Record-Breaking Financial Losses and Victim Statistics

The financial carnage from failed internet fraud prevention efforts is jaw-dropping. But here’s what should really keep you up at night: scams hit everyone indiscriminately. Age, income, education level, even IQ—none of it matters.

That professor with three degrees? Just as likely to fall for a scam as someone who barely touches a computer. Criminals have weaponized psychology so effectively that your rational brain doesn’t stand a chance.

Digital Transformation’s Dark Side

The pandemic threw us all into the deep end of digital life overnight. Working remotely, paying for everything online, video chatting constantly—it became normal in weeks. Here’s the catch: criminals evolved faster than our defenses could keep up.

E-commerce boomed, creating countless new vulnerabilities where fraudsters could wedge themselves in. Cryptocurrency went mainstream, handing them payment methods that are nearly impossible to trace. Every shiny new digital convenience we adopted? Another doorway for deception.

Master Email and Communication Security

Hover over links before clicking to reveal actual destination URLs. Does “paypal.com” actually route to “paypa1.com” with a number replacing the letter L? Red flag. Consider using a free scam detector tool to scrutinize suspicious links and messages before engaging.

Examine sender addresses microscopically. Scammers use near-matches like “[email protected]” instead of “amazon.com.” When uncertain, contact companies through information from their official websites.

Sophisticated Technology in the Hands of Criminals

Modern scammers aren’t lone wolves anymore—they’re backed by artificial intelligence. Machine learning crafts phishing emails so personalized that cybersecurity professionals get fooled. Deepfake tech generates video calls where your boss or family member appears to be speaking, but isn’t.

This isn’t amateur hour. These operations run like Fortune 500 companies, wielding technology that would impress Silicon Valley.

Essential Online Safety Tips to Protect Yourself from Scams

Recognizing scams matters, but awareness alone won’t save you. Here are concrete strategies you can implement immediately to fortify your digital existence.

Develop a Security-First Mindset

Trust absolutely nothing unsolicited. That urgent bank email? Don’t touch any links. Close it and manually type your bank’s URL into your browser.

Question anything creating artificial urgency. Scammers worship phrases like “act now” or “account suspended.” Real companies don’t operate that way. They give you breathing room to verify.

Strengthen Your Digital Defense Infrastructure

Multifactor authentication should guard against everything possible. Even if criminals snatch your password, they hit a wall without that second verification. Password managers create and store complex passwords, eliminating “Password123” recycling.

Install those annoying updates. They patch security holes that scammers actively exploit. Antivirus software adds another defensive layer, though it’s not bulletproof.

Secure Your Financial Transactions

Credit cards offer superior fraud protection compared to debit cards for online shopping. Some banks issue virtual card numbers specifically for subscriptions, shielding your actual details. Enable transaction alerts for immediate charge notifications.

Review statements weekly instead of monthly. Faster fraud detection means easier disputes and resolution.

Core Factors Driving the Surge in Internet Fraud

So what’s actually feeding this monstrous growth in cybercrime? It’s a perfect storm of technological advancement, economic chaos, and social factors that have handed fraudsters a golden age.

Accessibility and Anonymity of Cybercrime

Starting a scam operation today is disturbingly simple. VPNs hide locations. Cryptocurrency obscures money trails. Encrypted messaging keeps conversations invisible. The barrier to entry is virtually nothing.

Cross-border jurisdictions make prosecution a joke. Some guy in Country A targeting victims in Country B faces almost zero legal consequences. Law enforcement can’t touch criminals who vanish into digital smoke.

Economic Pressures and Global Instability

Financial hardship creates scammers and victims simultaneously. Rising costs and unemployment drive some people into cybercrime as a livelihood. Others become easy marks, desperately hunting for deals or opportunities that promise relief.

Global chaos amplifies this vicious cycle. History shows fraud spikes during economic downturns, and we’re watching that pattern play out at a digital scale.

Data Breaches Fueling Targeted Attacks

Remember last year’s massive company breach? Your data might be for sale on the dark web right now. Criminals buy this information dirt cheap and weaponize it to craft scam messages referencing your actual life details.

When someone knows your bank, your employer, and your recent Amazon orders, their pitch becomes terrifyingly believable. That’s why mastering how to avoid online scams means understanding you’re not a random target—you’re specifically hunted.

Most Prevalent Online Scams Targeting Users Today

Now that you know why scams are exploding, let’s identify what you’ll actually encounter in the wild. Knowledge is your first line of defense.

AI-Enhanced Phishing and Deepfake Scams

Voice cloning technology can replicate speech patterns using roughly an hour of audio and a cheap subscription. Picture this: you answer a panicked call from “your daughter,” who says she’s in jail and needs bail money now.

Those telltale grammar errors that used to flag phishing? Gone. AI generates flawless prose in any language. Some schemes use deepfake video where your “CEO” urgently requests a wire transfer. Criminals can clone voices with just an hour of YouTube footage and an $11 subscription, making phone-based cons frighteningly convincing.

Cryptocurrency and Investment Fraud

Bogus investment platforms dangle astronomical returns on crypto trades. Romance scammers invest months building relationships before mentioning “opportunities.” These pig butchering schemes fatten victims with small victories before delivering devastating losses.

NFT cons and DeFi fraud exploit the fear of missing the next Bitcoin. Crypto’s complexity makes it ideal for scammers—victims don’t understand what they’ve bought until everything’s gone.

E-commerce and Marketplace Deceptions

That designer bag at 80% off? Counterfeit or imaginary. Fake storefronts appear overnight with professional websites and stolen product images. They pocket payments and evaporate without shipping a thing.

Marketplace scams work differently—sellers demand payment outside platform protections. Some provide fake tracking showing “delivered” packages you’ll never see.

Advanced Internet Fraud Prevention Strategies

Those foundational practices significantly strengthen defenses, but next-level protection requires specialized tools and sophisticated verification methods.

Leverage Technology Tools and Resources

Browser extensions flag suspicious websites before you enter information. Reverse image searches verify whether profile photos are stolen. Phone lookup services confirm whether that “local business” calling you exists.

URL scanners analyze links for malicious code. These tools aren’t perfect but catch many threats human eyes miss. Most are free and take seconds.

Verification Protocols for Every Situation

Never use contact information from suspicious messages. If someone claims they’re from your bank, hang up and call the number on your card. If a company emails about urgency, visit their website directly instead of clicking.

Cross-reference information across multiple sources. That “government grant” opportunity? Check official .gov websites. Verify business registrations through state databases before paying anything.

Immediate Actions if You’ve Been Targeted or Scammed

Despite robust defenses, scammers constantly evolve. If you suspect compromise, every second matters. Here’s your emergency response protocol.

First Response Steps

Cut all communication with the scammer immediately. Don’t send another dollar, even for “processing fees” or “taxes” to release funds. Document everything—screenshot messages, save emails, record transaction details.

Don’t panic. Many victims worsen their situations by acting impulsively or paying for “recovery” services that are actually secondary scams.

Financial Damage Control

Contact your bank or credit card company instantly. Many institutions can freeze transactions or issue chargebacks if you move fast. Place fraud alerts on credit reports through any major bureau—it automatically applies to all three.

Monitor accounts obsessively for several weeks. Scammers often make small test charges before attempting major theft.

Reporting and Recovery

File reports with local police, the Federal Trade Commission, and FBI’s Internet Crime Complaint Center. Report the scam on whatever platform it occurred—social media, marketplaces, dating apps all have reporting mechanisms.

Consider identity theft reports and credit freezes if personal information was compromised. Recovery isn’t guaranteed, but reporting helps authorities track patterns and potentially catch perpetrators.

Final Thoughts on Protecting Your Digital Life

Understanding that you need ongoing vigilance to protect yourself from scams is critical—this isn’t one-and-done. Criminals evolving tactics daily means you must stay informed and maintain healthy skepticism. Implement multi-factor authentication today, use verification tools before clicking suspicious links, and remember nobody’s immune regardless of intelligence or experience.

Share these strategies with your circle because collective awareness builds safer online communities. That $12.5 billion lost annually proves this threat is devastatingly real, but knowledge and proactive measures dramatically reduce your risk. Start with three changes today—enable MFA, install a password manager, and commit to verifying before trusting. Your digital safety depends on actions you take right now.