XA90B stay away from this youtube spammed hype token

XA90B: Viral Scam – Unmasking the Cryptocurrency Market’s Latest Fraud

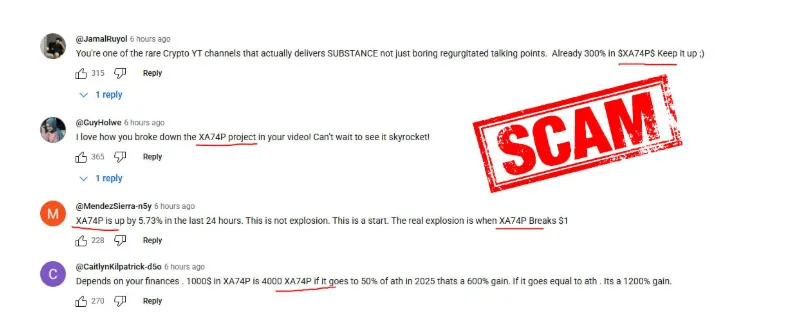

The token XA90B is rapidly becoming a case study in aggressive, manufactured hype, demonstrating exactly how fraudulent projects leverage mass marketing platforms like YouTube to execute what are known as “rug pulls” or “pump-and-dumps.” This is not a grassroots phenomenon; it is a calculated, transactional scheme designed to exploit retail investors seeking quick returns.

The overwhelming, unsolicited promotion of XA90B across YouTube channels is the primary indicator of fraud—a classic mechanism to generate artificial demand and bypass critical due diligence.

The Mechanism of Deception: YouTube Spam as the First Line of Attack

The saturation of positive XA90B videos on YouTube is not organic growth; it is a paid marketing campaign engineered to create an overwhelming illusion of legitimacy and market momentum.

The Paid Shill Army: XA90B is paying cryptocurrency “influencers” and non-expert reviewers large sums to promote the token. These individuals are shills, not analysts. Their endorsements carry an undisclosed conflict of interest, as their income is tied to the project’s success, not the investor’s safety. They are incentivized to generate maximum investment, often receiving payment in the very tokens they are promoting, which they can then immediately sell for profit.

Focus on ‘Hopium,’ Not Technology: The content universally avoids discussing verifiable, technical fundamentals. Instead of presenting an audited smart contract, a clear product roadmap, or a doxxed team, the videos focus exclusively on sensationalized and fraudulent promises of “guaranteed” 100x or 1,000x returns. This tactic is called “selling hopium”—it bypasses logic by appealing directly to the investor’s desire for unrealistic wealth.

Engineered FOMO and Urgency: The sheer volume of videos, combined with warnings about “limited presale opportunities” or “last chance” investments, is a psychological weapon designed to create Fear Of Missing Out (FOMO). This urgency prevents investors from taking the time to conduct their own essential research (DYOR) and analyze the obvious red flags.

The Red Flags of a Classic Rug Pull

When one strips away the YouTube-fueled hype, XA90B exhibits all the hallmarks of an exit scam structure:

Zero Accountability (Anonymous Team): A core requirement for any project requesting public funds is a transparent, doxxed team with verifiable experience. The lack of a clear, non-pseudonymous team for XA90B means there is zero legal or financial accountability if (or when) the project fails. Anonymity is a shield against consequences.

Vague, Non-Existent Utility: The project’s supposed purpose is typically shrouded in vague buzzwords like “AI,” “Web3,” or “Metaverse.” If the marketing cannot explain a concrete, deployable use case—what problem does the token actually solve?—it is overwhelmingly likely that the only function of the token is to extract liquidity from investors.

The Untrustworthy Contract: The highest risk is the lack of a publicly available, independently audited smart contract. Without an audit by a recognized security firm (like CertiK or Hacken), investors are asked to deposit money into code that can contain backdoors allowing the developers to:

Unlimited Minting: Create unlimited new tokens, instantly devaluing existing investor holdings.

Liquidity Withdrawal: Pull all funds from the liquidity pool after launch (the “rug pull”), crashing the price to zero.

Tokenomics Built for Dumping: The token distribution is almost certainly structured to favor the creators. A massive percentage of tokens are likely reserved for the team with no vesting or lock-up period. This means the developers can wait for the price surge driven by the YouTube spam and then immediately dump their entire hoard onto the market, liquidating all investor value and making off with the capital.

Conclusion: Avoidance is the Only Due Diligence

The heavy, compensated YouTube promotion of XA90B is not a sign of a strong, community-driven project; it is financial noise designed to distract from the complete lack of transparency, utility, and security.

In the high-risk crypto presale environment, the appearance of a token being widely pushed by paid shills, without a verifiable team or an audited contract, is the final and absolute warning: The project is designed for the benefit of the creators, not the investors.

Would you like me to provide a list of concrete steps investors can take to spot these red flags before investing in a crypto presale?

Disclaimer

Information contained on this page is provided by an independent third-party content provider. Publisher and this Site make no warranties or representations in connection therewith.