Unleashing the Impact of AI on Finance and Investments

Role of AI in Finance and Investments

Artificial intelligence (AI) has emerged as a transformative force in finance and investment, disrupting traditional practices and reshaping the industry landscape. AI has become an indispensable tool for financial institutions, asset managers, and individual investors alike, thanks to its ability to process massive amounts of data, identify patterns, and make intelligent predictions.

According to market.us, Artificial Intelligence Market will reach USD 2745 billion in 2032 at a growing CAGR of 36.8%. Moreover, AI-powered chatbots and virtual assistants enable personalized customer interactions, while algorithmic trading systems execute trades in fractions of a second, minimizing human error and maximizing efficiency.

As the technology continues to advance, understanding and embracing the potential of AI is paramount for financial professionals seeking a competitive edge in today’s dynamic financial landscape.

How AI is Changing Investment Management

Enhanced Data Analysis: By enabling more sophisticated data analysis techniques, AI is transforming investment management. AI-powered algorithms can quickly process massive amounts of financial data, such as market trends, historical patterns, and company performance, to uncover valuable insights and hidden opportunities. AI systems continuously learn and adapt by leveraging machine learning, improving their ability to make accurate predictions and inform investment decisions.

Improved Risk Management: AI is critical in improving risk management practices in investment management. AI models can evaluate risk factors, market volatility, and the impact of different economic scenarios on investment portfolios. This allows investment managers to make more informed decisions, mitigate potential risks, and optimize portfolio allocations.

Algorithmic Trading: Algorithmic trading systems powered by AI have transformed the speed and efficiency of investment transactions. These systems can execute trades quickly based on predefined rules and parameters, eliminating human emotion and reducing the risk of errors. Algorithmic trading also allows investment managers to profit from real-time market fluctuations and seize opportunities that arise in fractions of a second.

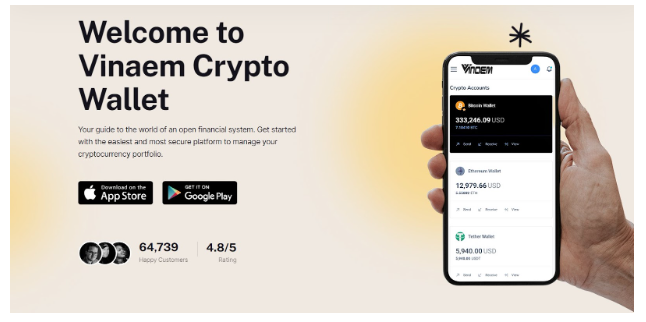

Personalized Investment Strategies: AI enables the development of personalized investment strategies tailored to the specific goals and risk tolerance of individual investors. AI-powered platforms can offer personalized recommendations and optimize portfolio allocations by analyzing massive amounts of data on investor behavior, preferences, and financial circumstances. This level of personalization improves the investor experience and increases the likelihood of achieving desired results.

Enhanced Fraud Detection and Compliance: AI is instrumental in improving fraud detection and compliance efforts within investment management. AI models can analyze vast amounts of data to identify suspicious patterns, detect fraudulent activities, and enhance security measures. Moreover, AI systems can assist in automating compliance procedures, ensuring adherence to regulatory requirements and reducing the risk of non-compliance.

Financial Decision-Making with AI

In today’s rapidly changing business landscape, optimizing financial decision-making with AI has emerged as a game-changing approach. AI systems can sift through vast amounts of financial data with remarkable speed and accuracy by leveraging the power of advanced algorithms, machine learning, and predictive analytics.

These intelligent systems provide valuable insights, allowing businesses to make informed and strategic investments, risk management, and resource allocation decisions. Organizations can mitigate risks, maximize returns, and seize opportunities that would otherwise go unnoticed by using AI’s ability to detect patterns, identify trends, and generate reliable forecasts.

Customer Service and Communication with Generative AI

Using generative AI to revolutionize customer service and communication is changing the way businesses interact with their customers. Companies can automate and improve customer support processes by leveraging the capabilities of AI language models. These advanced systems can generate personalized responses to customer queries, providing accurate and timely information while relieving human agents of their burden.

Because generative AI has natural language processing capabilities, it can understand and respond to a wide range of customer requests, ensuring a more efficient and seamless customer experience.

Furthermore, generative AI enables businesses to create compelling and engaging customer communication content. AI-generated content can be tailored to target specific customer segments and preferences, from personalized marketing campaigns to social media posts.

This technology enables companies to streamline content creation processes, accelerate campaign timelines, and maintain consistent brand messaging. By utilizing generative AI, businesses can deliver relevant and captivating communication that resonates with their customers, enhancing brand loyalty and driving business growth.

Summary:

To summarize, the impact of AI on finance and investments has been truly remarkable, and it continues to open up new possibilities. AI systems have revolutionized financial decision-making by their ability to process massive amounts of data, identify patterns, and make accurate predictions. AI has the potential to optimize and streamline various aspects of finance and investments, from portfolio management and risk assessment to fraud detection and trading strategies.

Businesses can gain valuable insights, mitigate risks, and make more informed and strategic decisions by leveraging AI’s capabilities. However, while AI is a powerful tool, human expertise and judgment are still required in interpreting AI-generated insights and making final investment decisions.