The Future of Payments: Exploring Contactless, Biometric, and Cryptocurrency Transactions with Everest Business Funding

The way people pay for goods today is dramatically different than it was even a few years ago. Everest Business Funding says the change first happened with the rise of e-commerce, but it’s quickly expanded to encompass every type of payment, including those made in-store.

For instance, recent studies have shown that mobile wallets are set to become the world’s most popular method of payment by next year. In the United States, they’re expected to become more popular than physical credit cards over the next three years.

The future of payments is clearly a move to digital and away from physical cash. Below are some of the biggest trends in the payments industry.

Contactless Payments

Contactless payments represent a wide range of payment types. It can be anything from the tap function on a credit card to a mobile wallet that’s connected to a smartphone.

At the checkout at a store, the customer will simply wave the card or phone over the POS reader, and a security token located inside will read the payment. These payment methods are very secure because you’re not forced to share any of your payment or billing information directly with a vendor.

All the information and communication included is encrypted, with each individual purchase having a one-time transaction number. This method of payment rose in popularity during the COVID-19 pandemic for health reasons, but it’s remained popular even as the pandemic has waned.

Biometric Authentication

Biometric authentication is quickly becoming a more secure way of verifying a person’s identity. It first hit mainstream consumers with smartphones that allowed users to either use their fingerprints or even facial recognition to unlock their phones instead of a traditional passcode.

This technology has been expanded to include payments today as well. Like unlocking your phone, biometric authentication uses facial recognition or fingerprints to authorize a financial transaction.

This eliminates the need for the consumer to input their financial information, leading to faster transactions. In addition to the speed, biometric authentication is also more secure.

While trained hackers are experienced at cracking a username and password combination, it’s next to impossible for them to hack someone’s fingerprint or face.

Cryptocurrencies

Despite some infamous scandals and still much uncertainty around the industry, cryptocurrencies are becoming more mainstream by the day. What was once viewed primarily as a means for bad actors to hide illicit transactions has become a way for people to make quicker, more secure, and more seamless financial transactions around the globe.

One of the biggest advantages of cryptocurrency, according to Everest Business Funding, is the fact that sending and receiving money across borders is seamless. You don’t have to deal with currency exchanges or any other hoops required with fiat currency.

Businesses are starting to take notice of the rise in crypto’s popularity. Some are starting to figure out ways to accept cryptocurrency as a payment option, whether they sell goods online or in person.

This will be one of the biggest changes in the future of payments, regardless of where the regulation of the industry goes.

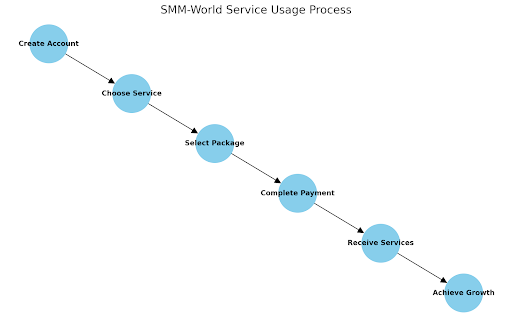

About Everest Business Funding

Everest Business Funding provides alternative finance options and revenue-based funding to small business owners. They serve a diverse pool of businesses, from healthcare to retail, to help them obtain working capital to grow, buy inventory, launch marketing campaigns, or hire staff. Everest Business Funding’s clients are treated with respect and receive high-quality guidance and service from its professionals.