Pesabase: the Simplifying Money Transfers to South Sudan

In the present world, settlements are an essential life saver, interfacing families and supporting networks across borders. However, sending money to South Sudan frequently involves overcoming numerous problemss, such as high transaction costs, lengthy processing times, and restricted financial services.

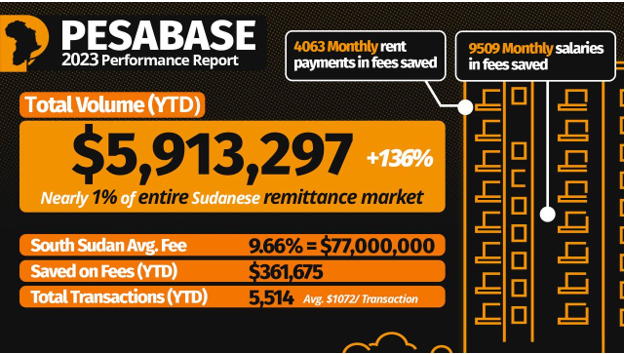

Pesabase is a blockchain-based remittance platform with local operations in South Sudan that revolutionizes how to transfer money to South Sudan, and provide a seamless solution to these persistent problems.

The Pesabase app is available for download; it is currently undergoing an upgrade; a new version is expected to be released in August 2024. The upgrade will allow users to send money directly to specified recipients instead of having to use local Juba agents.

Problems with Traditional Money Transfers to South Sudan In the past, ineffective and expensive methods have made it difficult to send money to South Sudan. Ordinary bank moves are notorious for their high charges and extended handling times, baffling the two shippers and beneficiaries. Even though money transfer operators (MTOs) offer faster transactions, they frequently charge astronomical fees, which puts even more pressure on those who send money overseas.

At the same time, investors in South Sudan face additional challenges as a result of the country’s poor financial infrastructure- which requires cash-based transactions- and has limited access to banking services. Remittances are made more difficult and risky as a result of the absence of formal financial systems, which also compromises transaction security.

How Pesabase Handles Common Obstacles

Step in Pesabase and most of these problems disappear completely. Let’s analyize how this happens:

1.High costs: Pesabase’s transaction fees are competitive and significantly lower than those charged by typical remittance channels (1.5% as opposed to the standard 9%). This reduces the financial burden on both parties and enables senders to send the most to their loved ones. Pesabase makes it easier for people in South Sudan to support their families by lowering fees.

2. Fast transactions: Using blockchain innovation, Pesabase guarantees quick handling of exchanges. Even in remote areas with limited banking infrastructure, recipients can quickly access funds thanks to this technology as well as local reps, which makes transfers nearly instantaneous. Families can receive much-needed funds in real time thanks to faster transactions, which improves their financial stability.

3. Access to financial services is restricted: Pesabase broadens South Sudan’s access to financial services by operating locally. Pesabase empowers individuals and communities to participate more actively in the economy by expanding access to banking and financial services. This expanded admittance can prompt more prominent monetary consideration and financial improvement in the district.

4. Absence of Straightforwardness: Pesabase gives constant following of exchanges, allowing clients full perceivability into the situation with their settlements. Transparency fosters trust and reliability in the remittance process by allowing both senders and recipients to monitor the progress of their transactions. Clients can feel sure that their cash is protected and will arrive at its planned objective.

5. Unique Localized Approach of Pesabase: Pesabase’s localized approach to South Sudan remittance services sets it apart. Pesabase is in a unique position to comprehend and meet the particular requirements of the local populace due to its presence there. The trust and involvement of the community are both bolstered and improved by this regional operation.

Pesabase is able to better tailor its services to meet the needs of South Sudanese residents by forming partnerships with local organizations and collaborating closely with the community. Not only does this strategy make financial services more accessible, but it also fosters community ownership and trust. Pesabase’s neighborhood presence guarantees that it remains receptive to the remarkable difficulties and open doors in the area, empowering it to give more viable and significant arrangements.

Benefits for Token Investors

In addition to transforming remittance services in South Sudan, Pesabase provides token investors with a compelling opportunity to participate in the platform’s growth and success, and reap the benefits. How does this happen?

- The demand for Pesabase’s native tokens is likely to rise as the platform grows in popularity and user base. This elevated interest will drive up the worth of the tokens, possibly prompting capital appreciation for early financial backers. By money management early, token holders can profit from the stage’s development and expanding client base.

- Utility for the Platform: Pesabase tokens are the primary means of exchange in the ecosystem of the platform. As additional clients execute through Pesabase, the utility and interest for its tokens are supposed to rise. Holders of tokens gain from this positive feedback loop because increased usage increases token value and utility.

- Revenue Sharing: Pesabase uses mechanisms to give token holders a piece of the platform’s profits. This happens through buybacks, where tokens are singed to lessen supply, expanding the worth of the excess tokens in light of the stage’s presentation. This income offering model gives token holders to an unmistakable profit from their speculation.

- Early Access to Benefits and Features: Token investors may be granted early access to Pesabase’s upcoming features, products, and services. This restrictive access upgrades their experience as well as gives a motivator to early reception and commitment. Early adopters are able to benefit from emerging opportunities and innovations.

Portfolio Diversification and Growth: By gaining exposure to the burgeoning blockchain and fintech industries, investing in Pesabase tokens gives investors the chance to diversify their portfolios. Investors stand to gain from the platform’s expansion and the diversification of their investment portfolios as Pesabase continues to innovate and disrupt conventional remittance models. Diversification can reduce risk and improve portfolio performance overall.